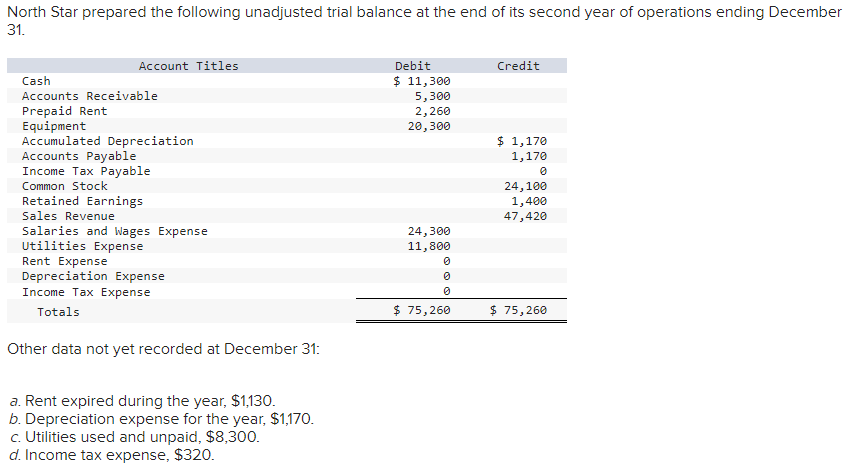

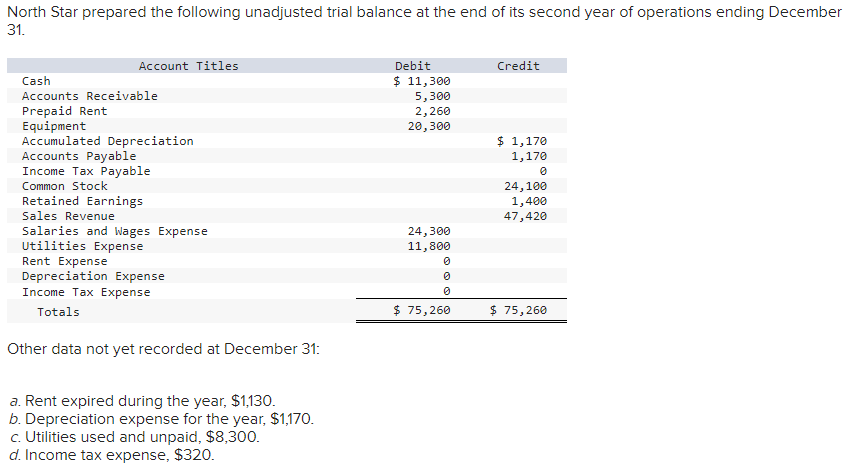

Please explain the errors if possible (including what's highlighted in yellow)

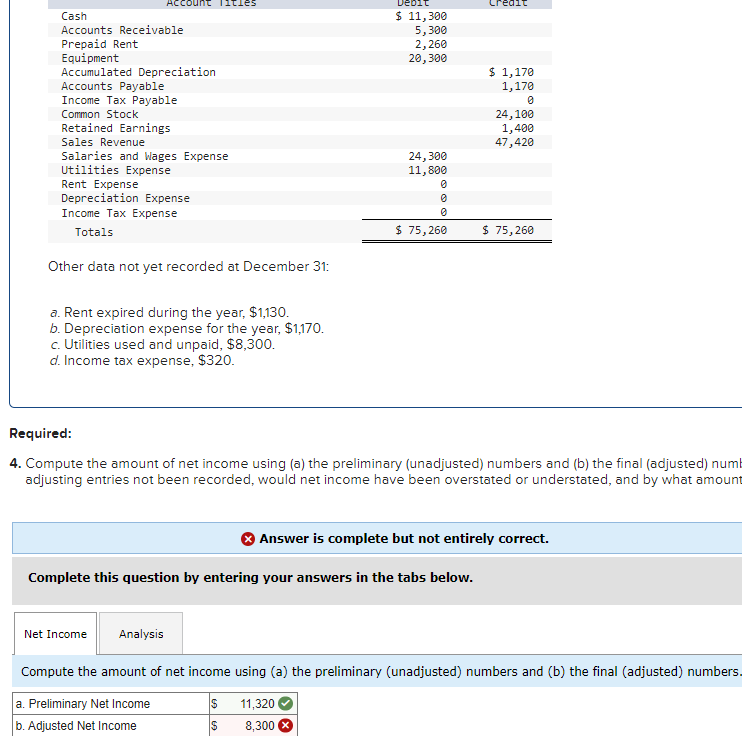

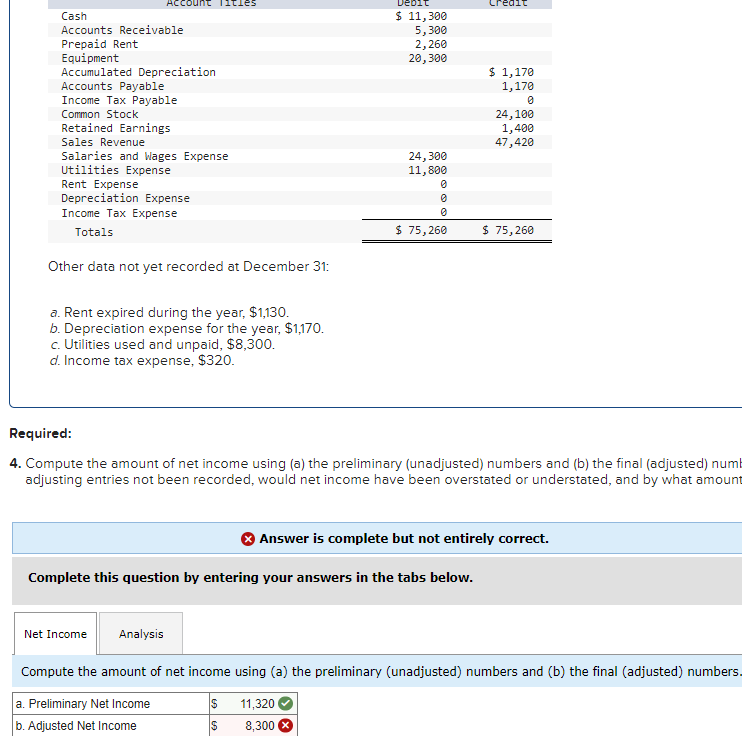

Please explain the errors if possible (including what's highlighted in yellow)

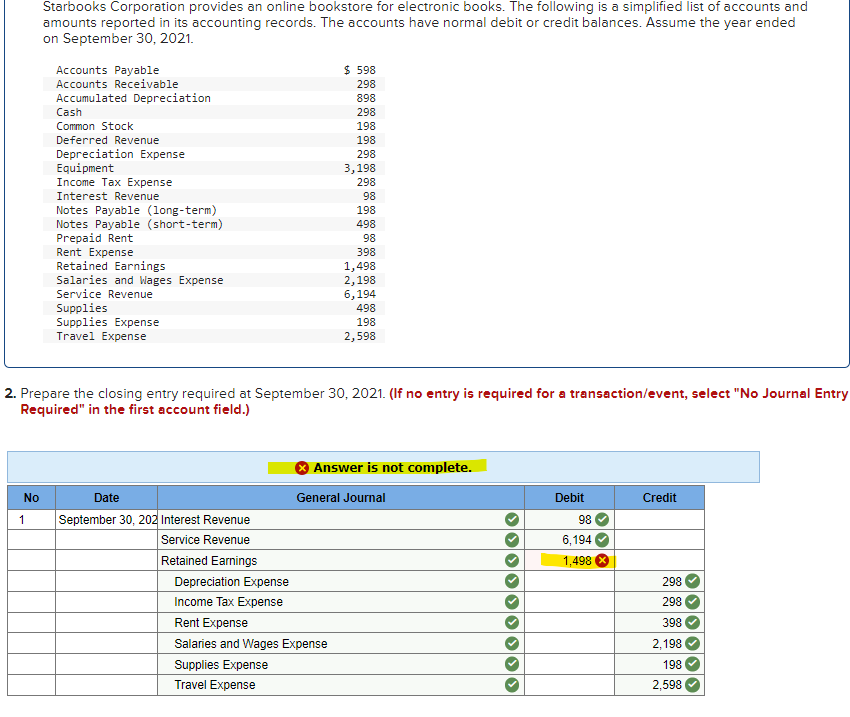

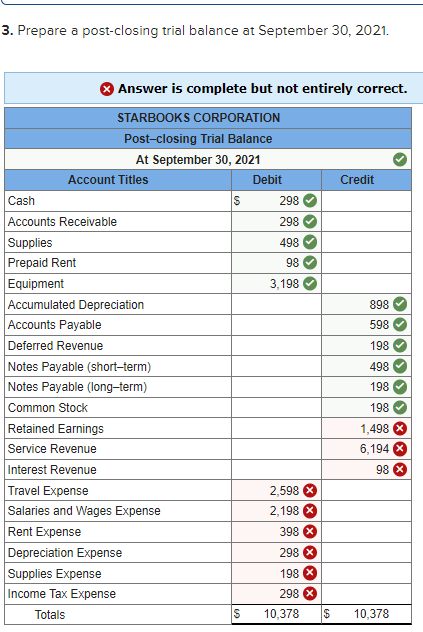

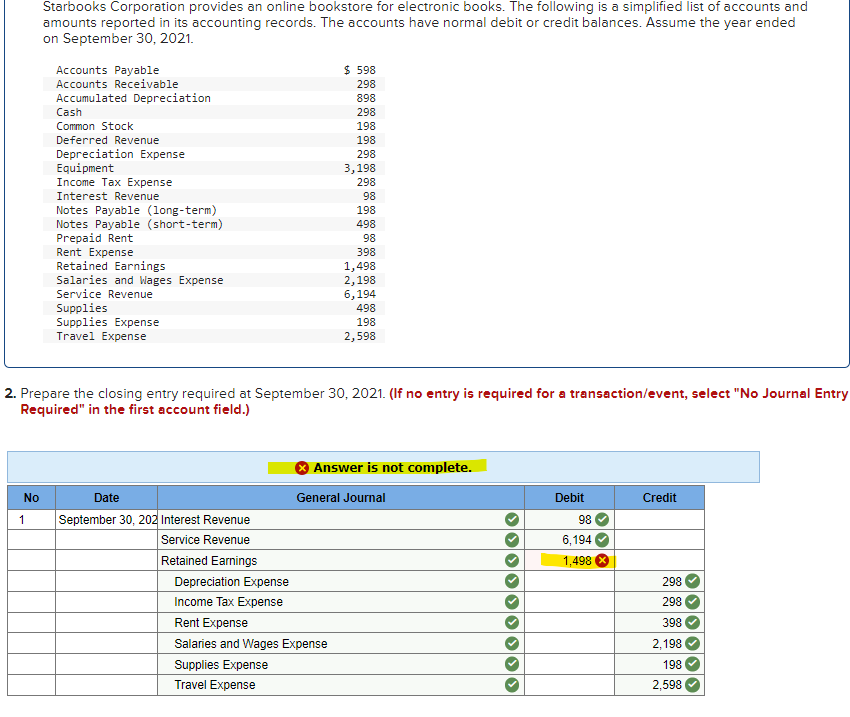

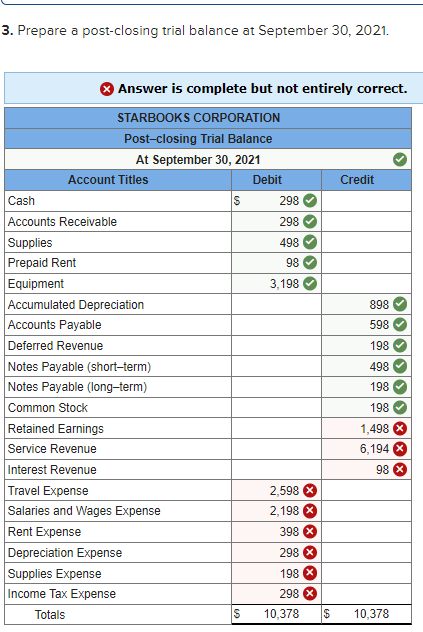

Account Titles Debit Credit $ 11,300 5,300 2,260 20,300 Cash Accounts Receivable Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Income Tax Payable Common Stock Retained Earnings Sales Revenue Salaries and Wages Expense Utilities Expense Rent Expense Depreciation Expense Income Tax Expense Totals $ 1,170 1,170 @ 24,100 1,400 47,420 24,300 11,800 0 $ 75,260 $ 75,260 Other data not yet recorded at December 31: a. Rent expired during the year, $1,130. b. Depreciation expense for the year, $1,170. c. Utilities used and unpaid, $8,300. d. Income tax expense, $320. Required: 4. Compute the amount of net income using (a) the preliminary (unadjusted) numbers and (b) the final (adjusted) num adjusting entries not been recorded, would net income have been overstated or understated, and by what amount Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Net Income Analysis Compute the amount of net income using (a) the preliminary (unadjusted) numbers and (b) the final (adjusted) numbers. S a. Preliminary Net Income b. Adjusted Net Income 11,320 8,300 S Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debit or credit balances. Assume the year ended on September 30, 2021. Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Deferred Revenue Depreciation Expense Equipment Income Tax Expense Interest Revenue Notes Payable (long-term) Notes Payable (short-term) Prepaid Rent Rent Expense Retained Earnings Salaries and Wages Expense Service Revenue Supplies Supplies Expense Travel Expense $ 598 298 898 298 198 198 298 3,198 298 98 198 498 98 398 1,498 2,198 6,194 498 198 2,598 2. Prepare the closing entry required at September 30, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No Debit Credit 1 98 6,194 1,498 298 Date General Journal September 30, 202 Interest Revenue Service Revenue Retained Earnings Depreciation Expense Income Tax Expense Rent Expense Salaries and Wages Expense Supplies Expense Travel Expense 298 > 398 2,198 198 2,598 OO

Please explain the errors if possible (including what's highlighted in yellow)

Please explain the errors if possible (including what's highlighted in yellow)