Answered step by step

Verified Expert Solution

Question

1 Approved Answer

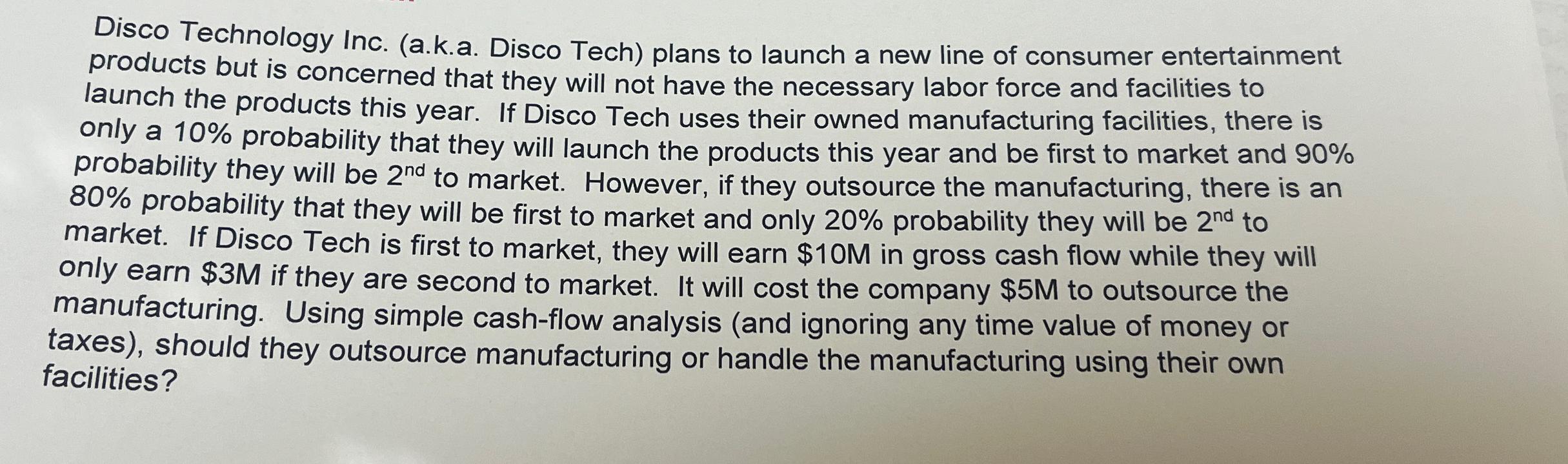

Disco Technology Inc. ( a . k . a . Disco Tech ) plans to launch a new line of consumer entertainment products but is

Disco Technology Inc. aka Disco Tech plans to launch a new line of consumer entertainment products but is concerned that they will not have the necessary labor force and facilities to launch the products this year. If Disco Tech uses their owned manufacturing facilities, there is only a probability that they will launch the products this year and be first to market and probability they will be to market. However, if they outsource the manufacturing, there is an probability that they will be first to market and only probability they will be to market. If Disco Tech is first to market, they will earn $ in gross cash flow while they will only earn $ if they are second to market. It will cost the company $ to outsource the manufacturing. Using simple cashflow analysis and ignoring any time value of money or taxes should they outsource manufacturing or handle the manufacturing using their own facilities?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started