Answered step by step

Verified Expert Solution

Question

1 Approved Answer

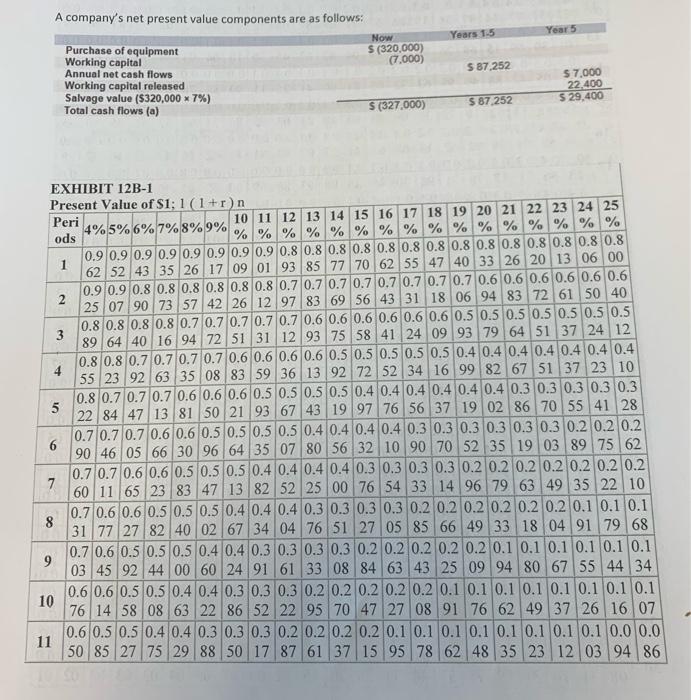

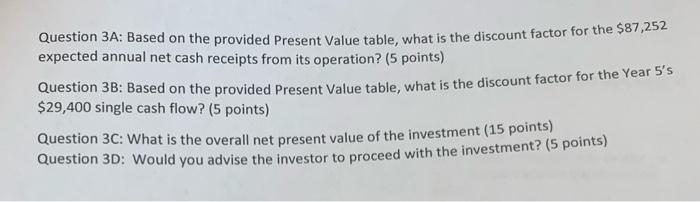

Discount rate 11% expected rate of return 11% Years 1.5 Year 5 A company's net present value components are as follows: Now Purchase of equipment

Discount rate 11%

expected rate of return 11%

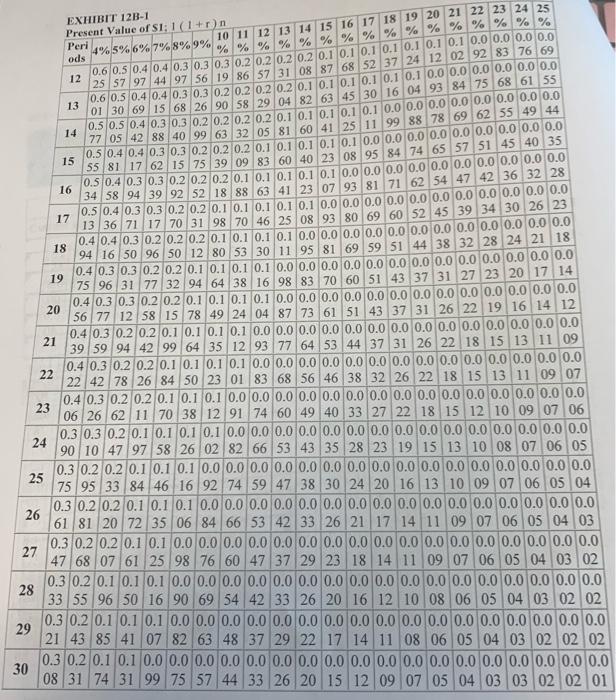

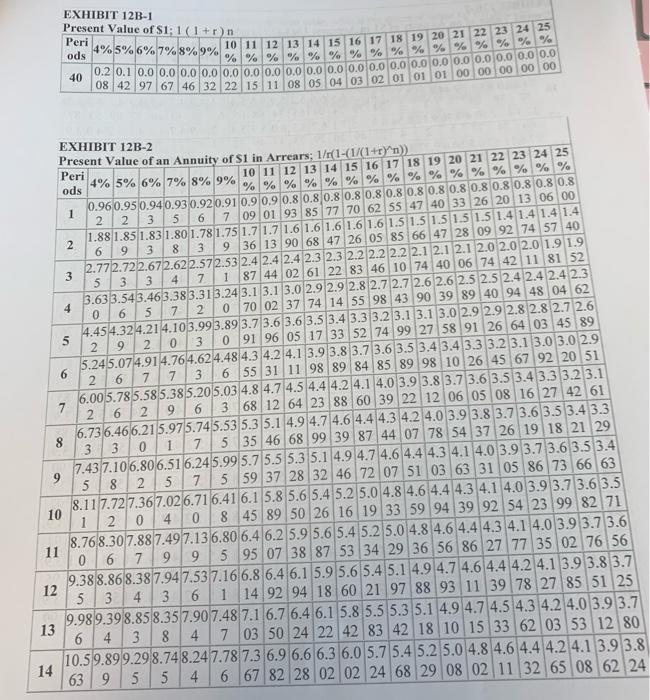

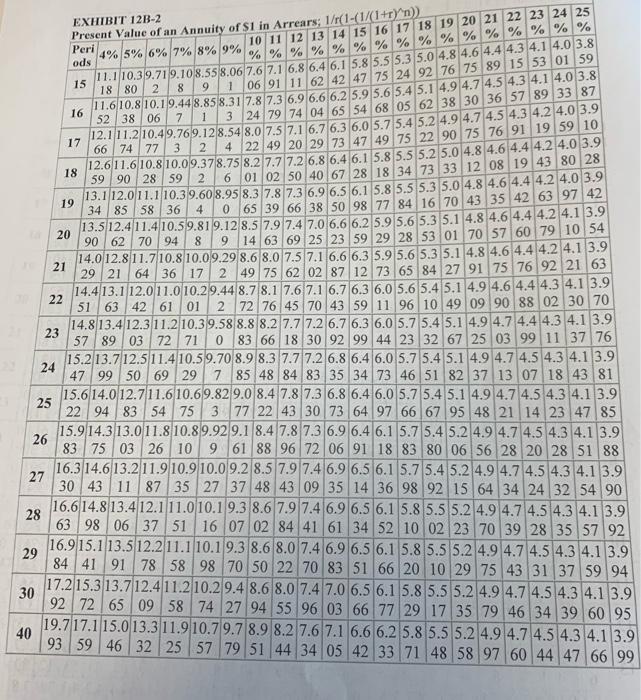

Years 1.5 Year 5 A company's net present value components are as follows: Now Purchase of equipment S (320,000) Working capital (7.000) Annual net cash flows Working capital released Salvage value ($320,000 7%) Total cash flows (a) S (327.000) 5 87.252 $ 7.000 22.400 529,400 S 87 252 EXHIBIT 12B-1 Present Value of S1;1(1+r)n Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 1 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 62 52 43 35 26 17 09 01 93 85 77 70 62 55 47 40 33 26 20 13 06 00 0.9 0.9 0.8 0.8 0.8 0.8 0.8 0.8 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.6 0.6 2 25 07 90 73 57 42 26 12 97 83 69 56 43 31 18 06 94 83 72 61 50 40 0.8 0.8 0.8 0.8 0.7 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.5 0.5 0.5 3 89 64 40 16 94 72 51 31 12 93 75 58 41 24 09 93 79 64 51 37 24 12 0.8 0.8 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.4 0.4 0.4 4 55 23 92 63 35 08 83 59 36 13 92 72 52 34 16 99 82 67 51 37 23 10 0.8 0.7 0.7 0.7 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.3 5 22 84 47 13 81 5021 93 67 43 19 97 76 56 37 19 02 86 70 55 41 28 0.7 0.7 0.7 0.6 0.6 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.3 0.3 0.2 0.2 0.2 6 90 46 05 66 30 96 64 35 07 80 56 32 10 90 70 52 35 19 03 89 75 62 0.7 0.7 0.6 0.6 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.2 0.2 7 60 11 65 23 83 47 13 82 52 25 00 76 54 33 14 96 79 63 49 35 22 10 0.7 0.6 0.6 0.5 0.5 0.5 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.2 0.1 0.1 0.1 8 31 77 27 82 40 02 67 34 04 76 51 27 05 85 66 49 33 18 04 91 79 68 0.7 0.6 0.5 0.5 0.5 0.4 0.4 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 9 03 45 92 44 00 60 24 91 61 33 08 84 63 43 25 09 94 80 67 55 44 34 0.6 0.6 0.5 0.5 0.4 0.4 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 10 76 14 58 08 63 22 86 52 22 95 70 47 27 08 91 76 62 49 37 26 16 07 0.6 0.5 0.5 0.4 0.4 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 11 50 85 27 75 29 88 50 17 87 61 37 15 95 78 62 48 35 23 12 03 94 86 8 EXHIBIT 12B-1 Present Value of SI: 1 (1+r) n Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 0.6 0.5 0.4 0.4 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 12 25 57 97 44 97 56 19 86 57 31 08 87 68 52 37 24 12 02 92 83 76 69 13 10.6 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 01 3069 15 68 26 90 58 29 04 82 63 45 30 16 04 93 84 75 68 61 55 14 0.5 0.5 0.4 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 7705 42 88 40 99 63 32 05 81 60 41 25 11 99 88 78 69 62 55 49 44 15 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 55 81 17 62 15 75 39 09 83 60 40 23 08 95 84 74 65 57 51 45 40 35 16 0.5 0.4 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 3458 94 39 92 52 18 88 63 41 23 07 93 81 71 62 54 47 42 36 32 28 17 0.5 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 13 36 71 17 70/31 98 70 46 25 08 93 80 69 60 52 45 39 34 30 26 23 18 0.4 0.4 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 94 16 50 96 50 12 80 53 30 11 95 81 69 59 51 44 38 32 28 24 21 18 19 0.40.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 75 96 31 7732 94 64 38 16 98 83 70 60 51 43 37 31 27 23 20 17 14 20 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 56 77 12 58 15 78 49 24 04 87 73 61 51 43 37 31 26 22 19 16 14 12 21 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 39 59 94 42 99 64 35 12 93 77 64 53 44 37 31 26 22 18 15 13 11 09 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 22 22 42 78 26 84 50 23 01 83 68 56 46 38 32 26 22 18 15 13 11 09 07 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 23 06 26 62 11 70 38 12 91 74 60 49 40 33 27 22 18 15 12 10 09 07 06 0.3 0.3 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 24 90 10 47 97 58 26 02 82 66 53 43 35 28 23 19 15 13 10 08 07 06 05 0.3 0.2 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 25 75 95 33 84 46 16 92 74 59 47 38 30 24 20 16 13 10 09 07 06 05 04 26 0.3 0.2 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 61 81 20 72 35 06 84 66 53 42 33 26 21 17 14 11 09 07 06 05 04 03 27 0.3 0.2 0.2 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 47 68 0761 25 98 76 60 47 37 29 23 18 14 11 09 07 06 05 04 03 02 0.3 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 28 33 55 96 50 16 90 69 54 42 33 26 20 16 12 10 08 06 05 04 03 02 02 0.3 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 29 (21 43 85 41 07 82 63 48 37 29 22 17 14 11 08 06 05 04 03 02 02 02 0.3 0.2 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 30 08 31 74 31 99 75 57 44 33 26 20 15 12 09 07 05 04 03 03 02 02 01 EXHIBIT 12B-1 Present Value of S1: 1 (1+r)n Peri ods 4% 5% 6% 7% 8% 9% 40 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 % % % % % % % % % % % % % % % % 0.2 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 | 08 42 97 67 46 32 22 15 11 08 OS 04 03 02 01 01 01 00 00 00 00 00 2 6 o 5 9 6 2 EXHIBIT 12B-2 Present Value of an Annuity of S1 in Arrears: 1/6(1-(1/(1+r)^n)) Peri 4% 5% 6% 7% 8% 9% 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 ods % % % % % % % % % % % % % % % % 0.96 0.950.940.93 0.92 0.91 0.9 0.910.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 1 2 2 3 5 6 7 09 01 93 85 77 706255 47 40 33 26 20 13 06 00 2 1.88 1.85 1.83 1.80 1.781.75 1.7 1.7 1.6 1.6 1.6 1.6 1.6 1.5 1.5 1.5 1.5 1.5 1.4 1.4 1.4 1.4 6 9 3 8 3 9 36 13 90 68 47 26 OS 85 66 47 28 09 92 74 57 40 2.77 2.722.672.622.572.53 2.4 2.4 2.4 2.3 2.3 2.2 2.2 2.2 2.1 2.1 2.1 2.0 2.0 2.0 1.9 1.9 3 5 3 3 4 7 187 44 02 61 22 83 46 10 74 40 06 74 42 11 81 52 3.633.543.463.383.313.24 3.1 3.1 3.0 2.9 2.9 2.8 2.7 2.7 2.6 2.6 2.5 2.5 2.4 2.4 2.4 2.3 4 0 6 5 7 2 0 70 02 37 74 14 55 98 43 90 39 89 40 94 48 04 62 4.45 4.324.214.103.99 3.89 3.7 3.6 3.6 3.5 3.4 3.3 3.2 3.1 3.1 3.0 2.9 2.9 2.8 2.8 2.7 2.6 2 2 0 3 0 91 96 05 17 33 52 74 99 27 58 91 26 6403 45 89 5.245.074.914.76 4.62 4.48 4.3 4.2 4.1 3.9 3.8 3.7 3.6 3.5 3.4 3.4 3.3 3.2 3.1 3.0 3.0 2.9 6 2 6 7 73 6 55 31 11 98 89 84 85 89 98 10 26 45 67 92 20 51 6.005.785.585.38 5.20 5.03 4.8 4.7 4.5 4.4 4.2 4.1 4.0 3.9 3.8 3.7 3.6 3.5 3.4 3.3 3.2 3.1 7 2 6 29 6 3 68 12 64 23 88 60 39 22 12 06 05 08 16 27 42 61 6.73 6.466.215.975.745.53 5.3 5.1 4.9 4.7 4.6 4.4 4.3 4.2 4.0 3.9 3.8 3.7 3.6 3.5 3.4 3.3 33 01 75 35 46 68 99 39 87 44 07 78 54 37 26 19 18 21 29 7.43 7.106.806.516.245.99 5.7 5.5 5.3 5.1 4.9 4.7 4.6 4.4 4.3 4.1 4.0 3.9 3.7 3.6 3.5 3.4 9 5 82 5 75 59 37 28 32 46 72 07 51 03 63 31 05 86 73 66 63 8.11 7.72 7.36 7.026.716.41 6.1 5.8 5.6 5.4 5.2 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.9 3.7 3.6 3.5 1 2 0 4 0 8 45 89 50 26 16 19 33 59 94 39 92 54 23 99 82 71 8.76 8.30 7.88 7.49 7.136.80 6.4 6.2 5.9 5.6 5.4 5.2 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.9 3.7 3.6 11 0 6 7 9 9 5 95 07 38 87 53 34 29 36 56 86 27 77 35 02 76 56 9.38 8.86 8.38 7.94 7.537.16 6.8 6.4 6.1 5.9 5.6 5.4 5.1 4.9 4.7 4.6 4.4 4.2 4.1 3.9 3.8 3.7 12 5 3 4 6 1 14 92 94 18 60 21 97 88 93 11 39 78 27 85 51 25 9.989.398.85 8.35 7.90 7.48 7.1 6.7 6.4 6.1 5.8 5.5 5.3 5.1 4.9 4.7 4.5 4.3 4.2 4.0 3.9 3.7 13 6 4 3 8 4 7 03 50 24 22 42 83 42 18 10 15 33 62 03 53 12 80 10.59.89 9.298.74 8.247.78 7.3 6.9 6.6 6.3 6.0 5.7 5.4 5.2 5.0 4.8 4.6 4.4 4.2 4.1 3.9 3.8 14 63 9 5 5 4 6 67 82 28 02 02 24 68 29 08 02 11 32 65 08 62 24 8 5 10 2 EXHIBIT 12B-2 Present Value of an Annuity of S1 in Arrears; 1/(1-(1/(1+ryn)) Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 15 11.1 10.3 9.71 9.108.55 8.06 7.6 7.16.8 6.4 6.1 5.8 5.5 5.3 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.8 18 80 2 89 1 06 91 11 62 42 47 75 24 92 76 75 89 15 53 01 59 16 11.6 10.8 10.19.448.85 8.31 7.8 7.3 69 6.662 5.9 5.6 5.4 5.1 4.9 4.7 4.5 4.3 4.1 4.0 3.8 52 38 06 7 1 3 24 79 74 04 65 5468 05 62 38 30 36 57 89 33 87 17 12.111.2 10.4 9.769.128.54 8.0 7.5 7.16.7 6.3 6.0 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.2 4.0 3.9 66 7477 3 2 4 22 49 20 29 73 47 49 75 22 90 75 76 91 19 59 10 18 12.611.6 10.8 10.09.378.75 8.2 7.7 7.21686.4 6.1 5.8 5.5 5.2 5.0 4.8 4.6 4.4 4.2 4.0 3.9 5990 28 59 2 6 01 02 50 40 67 28 18 34 73 33 12 08 19 43 80 28 19 13.1 12.011.1 10.39.60 8.95 8.3 7.8 7.3 696.5 6.1 5.8 5.5 5.3 5.0 4.8 4.6 4.4 4.2 4.0 3.9 34 85 58 36 4 0 65 39 66 38 50 98 77 84 16 70 43 35 42 63 97 42 20 13.5 12.411.410.59.819.12 8.5 7.9 7.4 7.0 6.6 6.2 5.9 5.6 5.3 5.1 4.8 4.6 4.4 4.2 4.1 3.9 90 62 7094 8 9 14 63 69 25 23 59 29 28 53 01 70 57 60 79 1054 14.0 12.8 11.7 10.8 10.09.29 8.6 8.0 7.5 7.1 6.6 6.3 5.9 5.6 5.3 5.1 4.8 4.6 4.4 4.2 4.1 3.9 21 29 21 64 36 17 2 49 75 62 02 87 12 73 65 84 27 91 75 76 92 21 63 14.413.1 12.0 11.0 10.29.44 8.7 8.1 7.6 7.1 6.7 6.3 6.0 5.6 5.4 5.1 4.9 4.6 4.4 4.3 4.1 3.9 22 51 63 42 61 01 2 72 76 45 70 43 59 11 96 10 49 09 90 88 02 30 70 14.8 13.412.3 11.2 10.39.58 8.8 8.2 7.7 7.2 6.7 6.3 6.0 5.7 5.4 5.1 4.9 4.7 4.4 4.3 4.1 3.9 23 57 89 03 72 71 08366 18 30 92 99 44 23 32 67 25 03 99 11 37 76 15.2 13.712.5 11.410.5 9.70 8.9 8.3 7.7 7.2 6.8 6.4 6.0 5.7 5.4 5.1 4.9 4.7 4.5 4.3 4.1 3.9 24 47 99 50 69 297 85 48 84 83 35 34 73 46 51 82 37 13 07 18 43 81 15.6 14.0 12.711.610.69.82 9.0 8.4 7.8 7.36.8 6.4 6.0 5.7 5.4 5.1 4.9 4.7 4.5 4.3 4.1 3.9 25 22 94 83 54 753 77 22 43 30 73 64 97 66 67 95 48 21 14 23 47 85 15.914.3 13.0 11.8 10.8 9.92 9.1 8.4 7.8 7.3 6.9 6.4 6.1 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.1 3.9 26 83 75 03 26 10 9 61 88 96 72 06 91 18 83 80 06 56 28 20 28 51 88 27 16.3 14.613.2 11.910.9 10.09.2 8.5 7.9 7.4 6.9 6.5 6.1 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.1 3.9 30 43 11 87 35 27 37 48 43 09 35 14 36 98 92 15 64 34 24 32 54 90 28 16.6 14.8 13.4 12.1 11.0 10.1 9.3 8.6 7.9 7.4 6.9 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 63 98 06 37 51 16 07 02 84 41 61 34 52 10 02 23 70 39 28 35 57 92 16.9 15.1 13.5 12.2 11.1 10.1 9.3 8.6 8.0 7.4 6.9 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 29 84 41 91 78 58 98 70 50 22 70 83 51 66 20 10 29 75 43 31 37 59 94 30 17.2 15.3 13.712.411.210.2 9.4 8.6 8.0 7.4 7.0 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 92 72 65 09 58 74 27 94 55 96 03 66 77 29 17 35 79 46 34 39 60 95 19.717.1 15.0 13.3 11.910.79.7 8.9 8.2 7.6 7.1 6.6 6.2 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 40 93 59 46 32 25 57 79 51 44 34 05 42 33 71 48 58 97 60 44 47 66 99 Question 3A: Based on the provided Present Value table, what is the discount factor for the $87,252 expected annual net cash receipts from its operation? (5 points) Question 3B: Based on the provided Present Value table, what is the discount factor for the Year 5's $29,400 single cash flow? (5 points) Question 3C: What is the overall net present value of the investment (15 points) Question 3D: Would you advise the investor to proceed with the investment? (5 points) Question 3A: Based on the provided Present Value table, what is the discount factor for the $87,252 expected annual net cash receipts from its operation? (5 points) Question 3B: Based on the provided Present Value table, what is the discount factor for the Year 5's $29,400 single cash flow? (5 points) Question 30: What is the overall net present value of the investment (15 points) Question 3D: Would you advise the investor to proceed with the investment? (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started