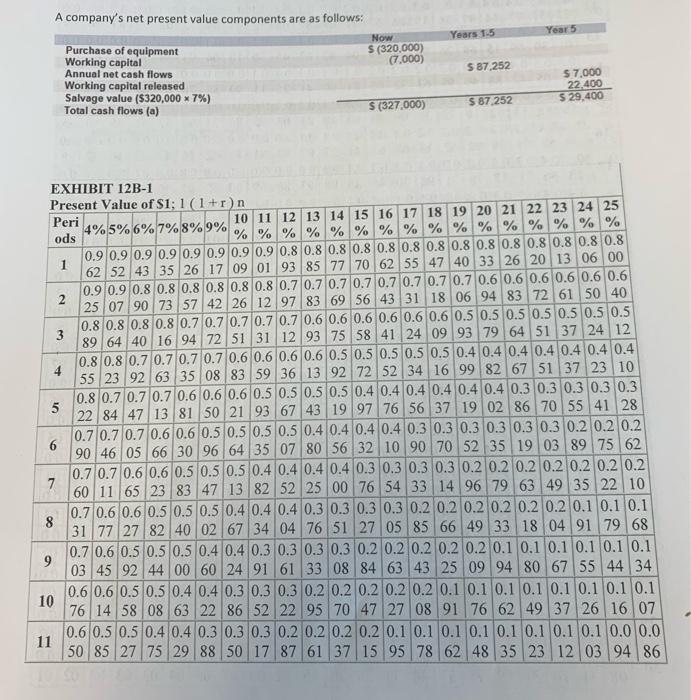

discount rate 11%

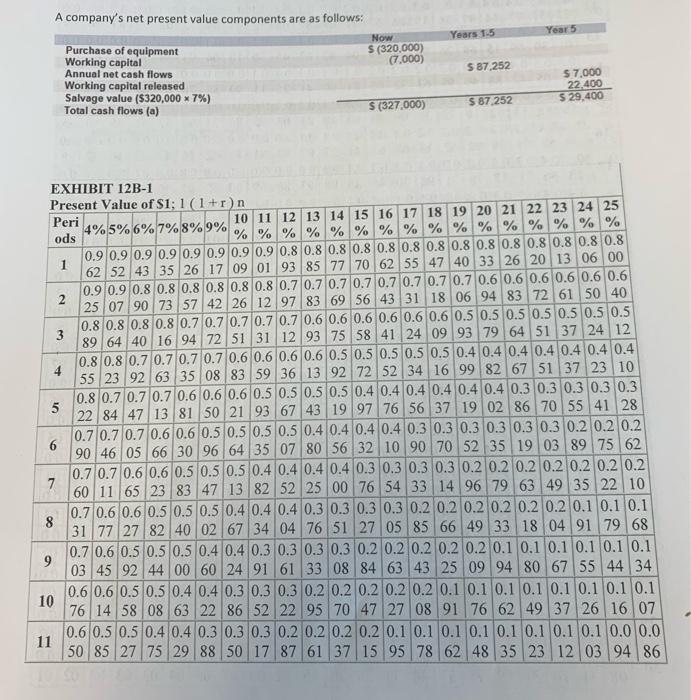

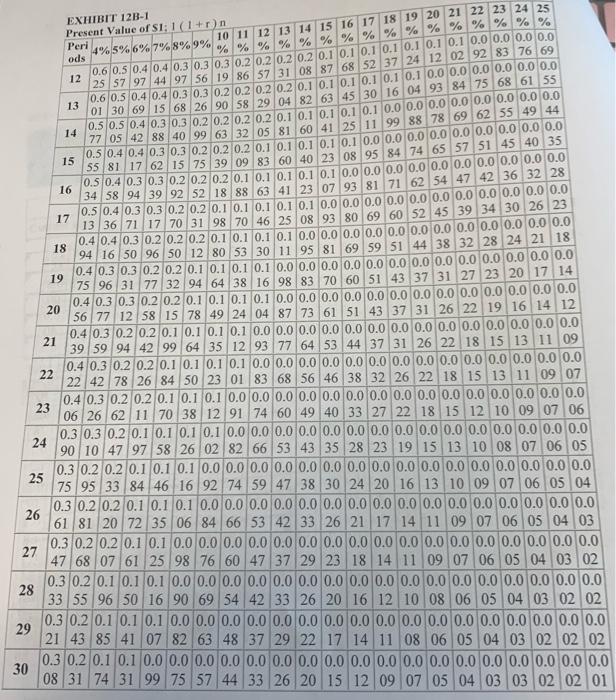

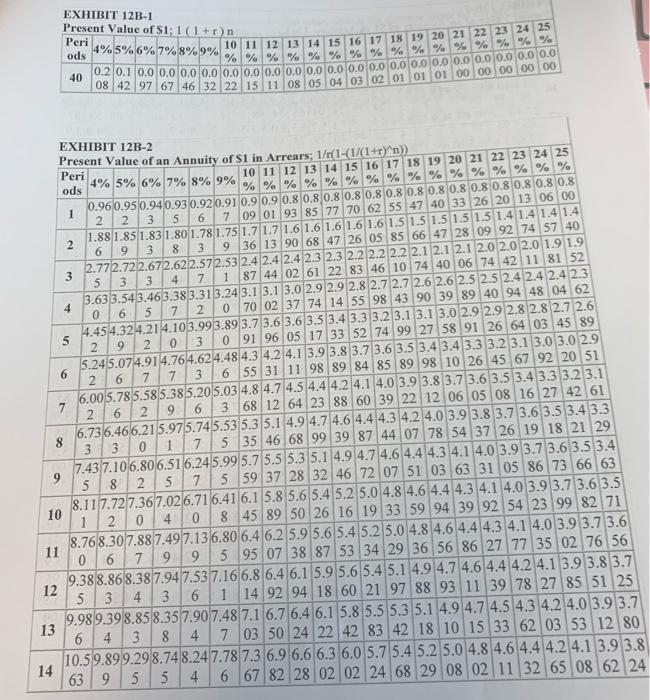

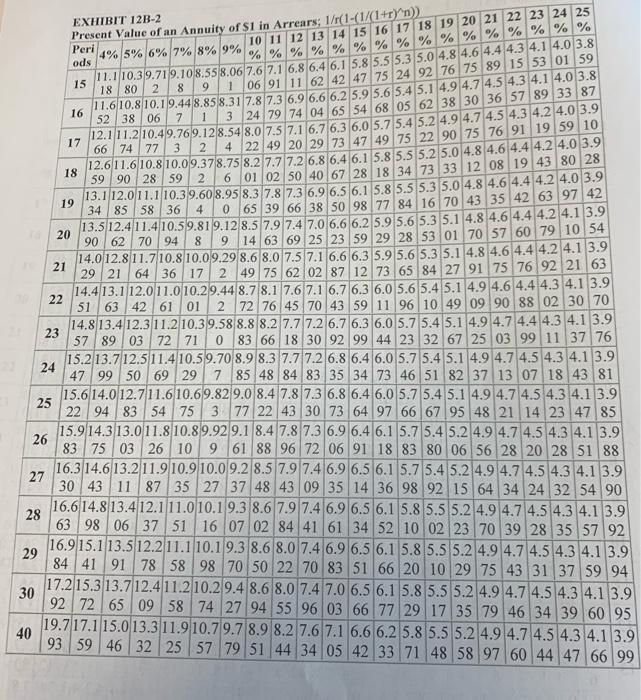

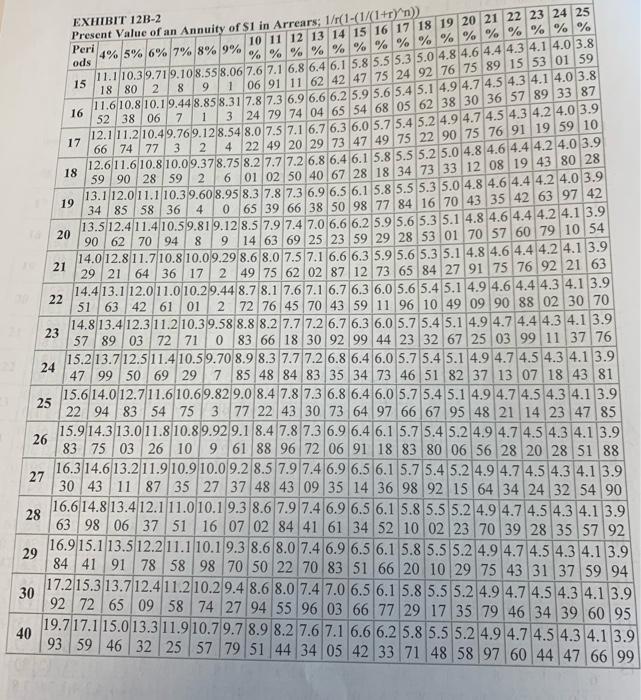

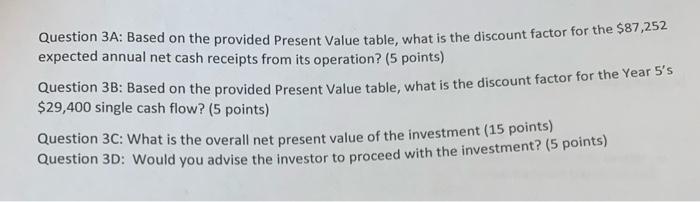

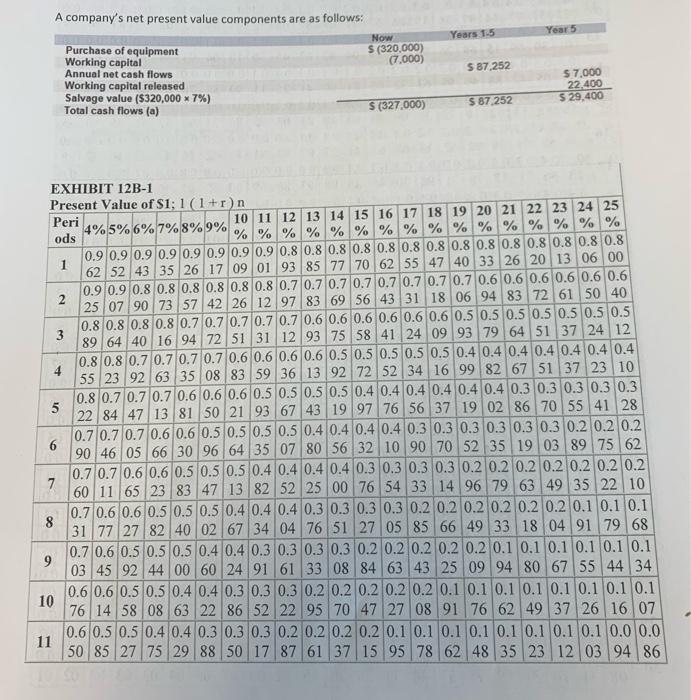

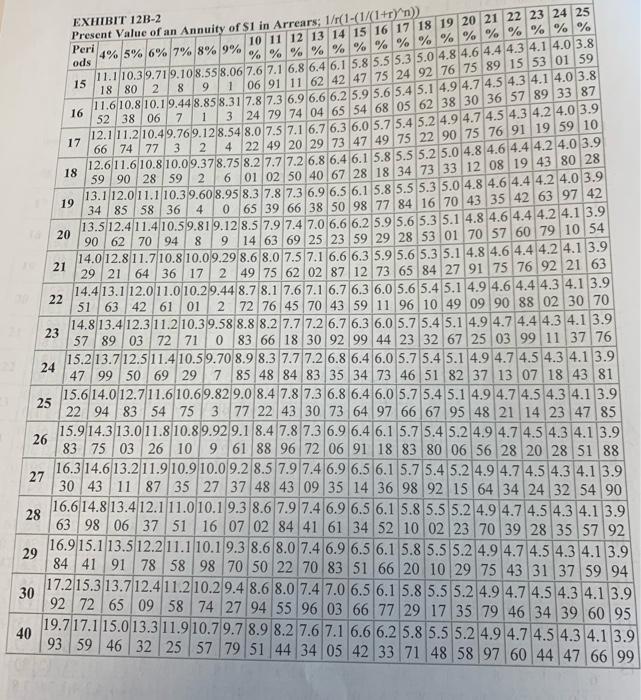

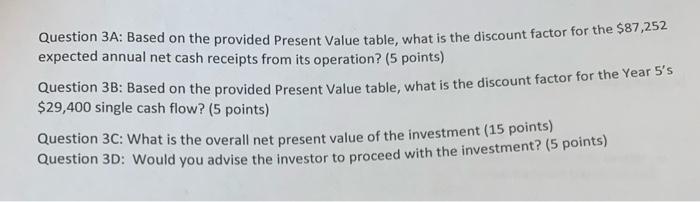

Years 1.5 Year 5 A company's net present value components are as follows: Now Purchase of equipment S (320,000) Working capital (7.000) Annual net cash flows Working capital released Salvage value ($320,000 7%) Total cash flows (a) S (327.000) 5 87.252 $ 7.000 22.400 529,400 S 87 252 EXHIBIT 12B-1 Present Value of S1;1(1+r)n Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 1 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.9 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 62 52 43 35 26 17 09 01 93 85 77 70 62 55 47 40 33 26 20 13 06 00 0.9 0.9 0.8 0.8 0.8 0.8 0.8 0.8 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.6 0.6 2 25 07 90 73 57 42 26 12 97 83 69 56 43 31 18 06 94 83 72 61 50 40 0.8 0.8 0.8 0.8 0.7 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.5 0.5 0.5 3 89 64 40 16 94 72 51 31 12 93 75 58 41 24 09 93 79 64 51 37 24 12 0.8 0.8 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.4 0.4 0.4 4 55 23 92 63 35 08 83 59 36 13 92 72 52 34 16 99 82 67 51 37 23 10 0.8 0.7 0.7 0.7 0.6 0.6 0.6 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.3 5 22 84 47 13 81 5021 93 67 43 19 97 76 56 37 19 02 86 70 55 41 28 0.7 0.7 0.7 0.6 0.6 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.3 0.3 0.2 0.2 0.2 6 90 46 05 66 30 96 64 35 07 80 56 32 10 90 70 52 35 19 03 89 75 62 0.7 0.7 0.6 0.6 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.2 0.2 7 60 11 65 23 83 47 13 82 52 25 00 76 54 33 14 96 79 63 49 35 22 10 0.7 0.6 0.6 0.5 0.5 0.5 0.4 0.4 0.4 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.2 0.1 0.1 0.1 8 31 77 27 82 40 02 67 34 04 76 51 27 05 85 66 49 33 18 04 91 79 68 0.7 0.6 0.5 0.5 0.5 0.4 0.4 0.3 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 9 03 45 92 44 00 60 24 91 61 33 08 84 63 43 25 09 94 80 67 55 44 34 0.6 0.6 0.5 0.5 0.4 0.4 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 10 76 14 58 08 63 22 86 52 22 95 70 47 27 08 91 76 62 49 37 26 16 07 0.6 0.5 0.5 0.4 0.4 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 11 50 85 27 75 29 88 50 17 87 61 37 15 95 78 62 48 35 23 12 03 94 86 8 EXHIBIT 12B-1 Present Value of SI: 1 (1+r) n Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 0.6 0.5 0.4 0.4 0.3 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 12 25 57 97 44 97 56 19 86 57 31 08 87 68 52 37 24 12 02 92 83 76 69 13 10.6 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 01 3069 15 68 26 90 58 29 04 82 63 45 30 16 04 93 84 75 68 61 55 14 0.5 0.5 0.4 0.3 0.3 0.2 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 7705 42 88 40 99 63 32 05 81 60 41 25 11 99 88 78 69 62 55 49 44 15 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 55 81 17 62 15 75 39 09 83 60 40 23 08 95 84 74 65 57 51 45 40 35 16 0.5 0.4 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 3458 94 39 92 52 18 88 63 41 23 07 93 81 71 62 54 47 42 36 32 28 17 0.5 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 13 36 71 17 70/31 98 70 46 25 08 93 80 69 60 52 45 39 34 30 26 23 18 0.4 0.4 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 94 16 50 96 50 12 80 53 30 11 95 81 69 59 51 44 38 32 28 24 21 18 19 0.40.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 75 96 31 7732 94 64 38 16 98 83 70 60 51 43 37 31 27 23 20 17 14 20 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 56 77 12 58 15 78 49 24 04 87 73 61 51 43 37 31 26 22 19 16 14 12 21 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 39 59 94 42 99 64 35 12 93 77 64 53 44 37 31 26 22 18 15 13 11 09 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 22 22 42 78 26 84 50 23 01 83 68 56 46 38 32 26 22 18 15 13 11 09 07 0.4 0.3 0.2 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 23 06 26 62 11 70 38 12 91 74 60 49 40 33 27 22 18 15 12 10 09 07 06 0.3 0.3 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 24 90 10 47 97 58 26 02 82 66 53 43 35 28 23 19 15 13 10 08 07 06 05 0.3 0.2 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 25 75 95 33 84 46 16 92 74 59 47 38 30 24 20 16 13 10 09 07 06 05 04 26 0.3 0.2 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 61 81 20 72 35 06 84 66 53 42 33 26 21 17 14 11 09 07 06 05 04 03 27 0.3 0.2 0.2 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 47 68 0761 25 98 76 60 47 37 29 23 18 14 11 09 07 06 05 04 03 02 0.3 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 28 33 55 96 50 16 90 69 54 42 33 26 20 16 12 10 08 06 05 04 03 02 02 0.3 0.2 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 29 (21 43 85 41 07 82 63 48 37 29 22 17 14 11 08 06 05 04 03 02 02 02 0.3 0.2 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 30 08 31 74 31 99 75 57 44 33 26 20 15 12 09 07 05 04 03 03 02 02 01 EXHIBIT 12B-1 Present Value of S1: 1 (1 + r) n Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 40 0:2 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 108 42 97 67 46 32 22 15 11 08 05 04 03 02 01 01 01 00 00 00 00 00 6 5 6 EXHIBIT 12B-2 Present Value of an Annuity of $1 in Arrears: 1/6(1-(1/(1+r)^n)) Peri 4% 5% 6% 7% 8% 9% 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 ods % % % % % % % % % % % % % % % % 1 0.96 0.950.940.93 0.920.91 0.9 0.910.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 0.8 2 2 3 5 6 7 09 01 93 85 77 70 6255 47 40 33 26 20 13 06 00 2 1.88 1.85 1.83 1.80 1.781.75 1.7 1.7 1.6 1.6 1.6 1.6 1.6 1.5 1.5 1.5 1.5 1.5 1.4 1.4 1.4 1.4 6 9 3 8 3 9 36 13 90 68 47 26 OS 85 66 47 28 09 92 74 57 40 2.77 2.722.672.622.572.53 2.4 2.4 2.4 2.3 2.3 2.2 2.2 2.2 2.1 2.1 2.1 2.0 2.0 2.0 1.9 1.9 3 5 3 3 4 7 187 44 02 61 22 83 46 10 74 40 06 74 42 11 81 52 3.633.54 3.46 3.383.31 3.24 3.1 3.1 3.0 2.9 2.9 2.8 2.7 2.7 2.6 2.6 2.5 2.5 2.4 2.4 2.4 2.3 4 0 6 5 7 2 0 70 02 37 74 14 55 98 43 90 39 89 40 94 48 04 62 4.45 4.324.214.10 3.99 3.89 3.7 3.6 3.6 3.5 3.4 3.3 3.2 3.1 3.1 3.0 2.9 2.9 2.8 2.8 2.7 2.6 2 9 20 3 0 91 96 05 17 33 52 7499 27 58 91 26 6403 45 89 5.245.074.914.76 4.62 4.48 4.3 4.2 4.1 3.9 3.8 3.7 3.6 3.5 3.4 3.4 3.3 3.2 3.1 3.0 3.0 2.9 6 2 6 7 73 6 55 31 11 98 89 84 85 89 98 10 26 45 67 92 20 51 6.005.785.585.38 5.20 5.03 4.8 4.7 4.5 4.4 4.2 4.1 4.0 3.9 3.8 3.7 3.6 3.5 3.4 3.3 3.2 3.1 7 2 6 2 9 6 3 68 12 64 23 88 60 39 22 12 06 05 08 16 27 42 61 6.736.466.215.975.745.53 5.3 5.1 4.9 4.7 4.6 4.4 4.3 4.2 4.0 3.9 3.8 3.7 3.6 3.5 3.4 3.3 33 01 75 35 46 68 99 39 87 44 07 78 54 37 26 19 18 21 29 7.43 7.106.806.516.245.99 5.7 5.5 5.3 5.1 4.9 4.7 4.6 4.4 4.3 4.1 4.0 3.9 3.7 3.6 3.5 3.4 9 5 8 2 5 75 59 37 28 32 46 72 07 51 03 63 31 05 86 73 66 63 8.11 7.72 7.36 7.026.716.41 6.1 5.8 5.6 5.4 5.2 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.9 3.7 3.6 3.5 10 120 408 45 89 50 26 16 19 33 59 94 39 92 54 23 99 82 71 8.76 8.30 7.88 7.49 7.136.806.4 6.2 5.9 5.6 5.4 5.2 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.9 3.7 3.6 11 0 6 7 9 9 5 95 07 38 87 53 34 29 36 56 86 27 77 35 02 76 56 9.38 8.86 8.38 7.947.537.16 6.8 6.4 6.1 5.9 5.6 5.4 5.1 4.9 4.7 4.6 4.4 4.2 4.1 3.9 3.8 3.7 12 5 3 4 3 6 1 14 92 94 18 60 21 97 88 93 11 39 78 27 85 51 25 19.989.398.85 8.35 7.90 7.48 7.1 6.7 6.4 6.1 5.8 5.5 5.3 5.1 4.9 4.7 4.5 4.3 4.2 4.0 3.9 3.7 13 6 4 3 8 4 7 03 50 24 22 42 83 42 18 10 15 33 62 03 53 12 80 10.5 9.89 9.29 8.748.247.78 7.3 6.9 6.6 6.3 6.0 5.7 5.4 5.2 5.0 4.8 4.6 4.4 4.2 4.1 3.9 3.8 14 63 9 5 5 4 6 67 82 28 02 02 24 68 29 08 02 11 32 65 08 62 24 2 8 9 2 9 EXHIBIT 12B-2 Present Value of an Annuity of $1 in Arrears: 1/(1-(1/(1+r)^n)) Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 15 11.1 10.3 9.71 9.108.55 8.06 7.6 7.1 6.8 6.4 6.1 5.8 5.5 5.3 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.8 18 80 28 1 06 91 11 62 42 47 75 24 92 76 75 89 15 53 01 59 16 11.610.8 10.19.448.85 8.31 7.8 7.3 69 6.662 5.9 5.6 5.4 5.1 4.9 4.7 4.5 4.3 4.1 4.0 3.8 5238 06 7 1 3 24 79 74 04 65 5468 05 62 38 30 36 57 89 33 87 17 12.111.2 10.49.769.128.54 8.0 7.5 7.16.7.6.3 6.0 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.2 4.0 3.9 66 7477 3 2 4 22 49 20 29 73 47 49 75 22 90 75 76 91 19 59 10 12.611.610.8 10.09.378.75 8.2 7.7 7.2 6.8 6.4 6.1 5.8 5.5 5.2 5.0 4.8 4.6 4.4 4.2 4.0 3.9 18 5990 28 59 2 6 01 02 50 40 67 28 18 34 73 33 12 08 19 43 80 28 19 13.1 12.011.1 10.39.60 8.95 8.3 7.8 7.3 696.5 6.1 5.8 5.5 5.3 5.0 4.8 4.6 4.4 4.2 4.0 3.9 34 85 58 36 4 065 39 66 38 50 98 77 84 16 70 43 35 42 63 97 42 13.5 12.4 11.410.59.819.12 8.5 7.9 7.4 7.0 6.6 6.2 5.9 5.6 5.3 5.1 4.8 4.6 4.4 4.2 4.1 3.9 20 90 62 7094 8 9 14 63 69 25 23 59 29 28 53 01 70 57 60 79 10 54 14.0 12.811.7 10.8 10.09.29 8.6 8.0 7.5 7.1 6.6 6.3 5.9 5.6 5.3 5.1 4.8 4.6 4.4 4.2 4.1 3.9 21 29 21 64 36 17 2 49 75 62 02 87 12 73 65 84 27 91 75 76 92 21 63 14.413.112.0 11.0 10.29.44 8.7 8.1 7.6 7.1 6.7 6.3 6.0 5.6 5.4 5.1 4.9 4.6 4.4 4.3 4.1 3.9 22 51 63 42 61 01 2 72 76 45 70 43 59 11 96 10 49 09 90 88 02 30 70 14.8 13.412.3 11.2 10.39.58 8.8 8.2 7.7 7.2 6.7 6.3 6.0 5.7 5.4 5.1 4.9 4.7 4.4 4.3 4.1 3.9 23 57 89 03 72 71 0 83 66 18 30 92 99 44 23 32 67 25 03 99 11 3776 15.2 13.712.511.410.5 9.70 8.9 8.3 7.7 7.2 6.8 6.4 6.0 5.7 5.4 5.1 4.9 4.7 4.5 4.3 4.1 3.9 24 47 99 50 69 297 85 48 84 83 35 34 73 46 51 82 37 13 07 18 43 81 15.6 14.0 12.7 11.610.69.82 9.0 8.4 7.8 7.3 6.8 6.4 6.0 5.7 5.4 5.1 4.9 4.7 4.5 4.3 4.1 3.9 25 22 94 83 54 753 77 22 43 30 73 64 97 66 67 95 48 21 14 23 47 85 15.914.3 13.0 11.8 10.8 9.92 9.1 8.4 7.8 7.3 6.9 6.4 6.1 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.1 3.9 26 83 75 03 26 10 9 61 88 96 72 06 91 18 83 80 06 56 28 20 28 51 88 27 16.3 14.6 13.211.910.9 10.09.2 8.5 7.9 7.4 6.9 6.5 6.1 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.1 3.9 3043 11 87 35 27 37 48 43 09 35 14 36 98 92 15 64 34 24 32 54 90 16.614.8 13.4 12.1 11.010.1 9.3 8.6 7.9 7.4 6.9 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 28 63 98 06 37 51 16 07 02 84 41 61 34 52 10 02 23 70 39 28 35 57 92 16.9 15.1 13.5 12.2 11.1 10.1 9.3 8.6 8.0 7.4 6.9 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 29 84 41 91 78 58 98 70 50 22 70 83 51 66 20 10 29 75 43 31 37 59 94 30 17.2 15.3 13.712.4 11.2 10.2 9.4 8.6 8.0 7.4 7.0 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 92 72 65 09 58 74 27 94 55 96 03 66 77 29 17 35 79 46 34 39 60 95 19.717.1 15.0 13.3 11.910.79.7 8.9 8.2 7.6 7.1 6.6 6.2 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 40 93 59 46 32 25 57 79 51 44 34 05 42 33 71 48 58 97 60 44 47 66 99 9 EXHIBIT 12B-2 Present Value of an Annuity of $1 in Arrears: 1/(1-(1/(1+r)^n)) Peri 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 4% 5% 6% 7% 8% 9% ods % % % % % % % % % % % % % % % % 15 11.1 10.3 9.71 9.108.55 8.06 7.6 7.1 6.8 6.4 6.1 5.8 5.5 5.3 5.0 4.8 4.6 4.4 4.3 4.1 4.0 3.8 18 80 28 1 06 91 11 62 42 47 75 24 92 76 75 89 15 53 01 59 16 11.610.8 10.19.448.85 8.31 7.8 7.3 69 6.662 5.9 5.6 5.4 5.1 4.9 4.7 4.5 4.3 4.1 4.0 3.8 5238 06 7 1 3 24 79 74 04 65 5468 05 62 38 30 36 57 89 33 87 17 12.111.2 10.49.769.128.54 8.0 7.5 7.16.7.6.3 6.0 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.2 4.0 3.9 66 7477 3 2 4 22 49 20 29 73 47 49 75 22 90 75 76 91 19 59 10 12.611.610.8 10.09.378.75 8.2 7.7 7.2 6.8 6.4 6.1 5.8 5.5 5.2 5.0 4.8 4.6 4.4 4.2 4.0 3.9 18 5990 28 59 2 6 01 02 50 40 67 28 18 34 73 33 12 08 19 43 80 28 19 13.1 12.011.1 10.39.60 8.95 8.3 7.8 7.3 696.5 6.1 5.8 5.5 5.3 5.0 4.8 4.6 4.4 4.2 4.0 3.9 34 85 58 36 4 065 39 66 38 50 98 77 84 16 70 43 35 42 63 97 42 13.5 12.4 11.410.59.819.12 8.5 7.9 7.4 7.0 6.6 6.2 5.9 5.6 5.3 5.1 4.8 4.6 4.4 4.2 4.1 3.9 20 90 62 7094 8 9 14 63 69 25 23 59 29 28 53 01 70 57 60 79 10 54 14.0 12.811.7 10.8 10.09.29 8.6 8.0 7.5 7.1 6.6 6.3 5.9 5.6 5.3 5.1 4.8 4.6 4.4 4.2 4.1 3.9 21 29 21 64 36 17 2 49 75 62 02 87 12 73 65 84 27 91 75 76 92 21 63 14.413.112.0 11.0 10.29.44 8.7 8.1 7.6 7.1 6.7 6.3 6.0 5.6 5.4 5.1 4.9 4.6 4.4 4.3 4.1 3.9 22 51 63 42 61 01 2 72 76 45 70 43 59 11 96 10 49 09 90 88 02 30 70 14.8 13.412.3 11.2 10.39.58 8.8 8.2 7.7 7.2 6.7 6.3 6.0 5.7 5.4 5.1 4.9 4.7 4.4 4.3 4.1 3.9 23 57 89 03 72 71 0 83 66 18 30 92 99 44 23 32 67 25 03 99 11 3776 15.2 13.712.511.410.5 9.70 8.9 8.3 7.7 7.2 6.8 6.4 6.0 5.7 5.4 5.1 4.9 4.7 4.5 4.3 4.1 3.9 24 47 99 50 69 297 85 48 84 83 35 34 73 46 51 82 37 13 07 18 43 81 15.6 14.0 12.7 11.610.69.82 9.0 8.4 7.8 7.3 6.8 6.4 6.0 5.7 5.4 5.1 4.9 4.7 4.5 4.3 4.1 3.9 25 22 94 83 54 753 77 22 43 30 73 64 97 66 67 95 48 21 14 23 47 85 15.914.3 13.0 11.8 10.8 9.92 9.1 8.4 7.8 7.3 6.9 6.4 6.1 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.1 3.9 26 83 75 03 26 10 9 61 88 96 72 06 91 18 83 80 06 56 28 20 28 51 88 27 16.3 14.6 13.211.910.9 10.09.2 8.5 7.9 7.4 6.9 6.5 6.1 5.7 5.4 5.2 4.9 4.7 4.5 4.3 4.1 3.9 3043 11 87 35 27 37 48 43 09 35 14 36 98 92 15 64 34 24 32 54 90 16.614.8 13.4 12.1 11.010.1 9.3 8.6 7.9 7.4 6.9 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 28 63 98 06 37 51 16 07 02 84 41 61 34 52 10 02 23 70 39 28 35 57 92 16.9 15.1 13.5 12.2 11.1 10.1 9.3 8.6 8.0 7.4 6.9 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 29 84 41 91 78 58 98 70 50 22 70 83 51 66 20 10 29 75 43 31 37 59 94 30 17.2 15.3 13.712.4 11.2 10.2 9.4 8.6 8.0 7.4 7.0 6.5 6.1 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 92 72 65 09 58 74 27 94 55 96 03 66 77 29 17 35 79 46 34 39 60 95 19.717.1 15.0 13.3 11.910.79.7 8.9 8.2 7.6 7.1 6.6 6.2 5.8 5.5 5.2 4.9 4.7 4.5 4.3 4.1 3.9 40 93 59 46 32 25 57 79 51 44 34 05 42 33 71 48 58 97 60 44 47 66 99 Question 3A: Based on the provided Present Value table, what is the discount factor for the $87,252 expected annual net cash receipts from its operation? (5 points) Question 3B: Based on the provided Present Value table, what is the discount factor for the Year 5's $29,400 single cash flow? (5 points) Question 3C: What is the overall net present value of the investment (15 points) Question 3D: Would you advise the investor to proceed with the investment? (5 points)