Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discount rate - 12% Settlement price of defined benefit obligation - Php 80,000 Present value of defined benefit obligation settled - Php 30,000 Required:

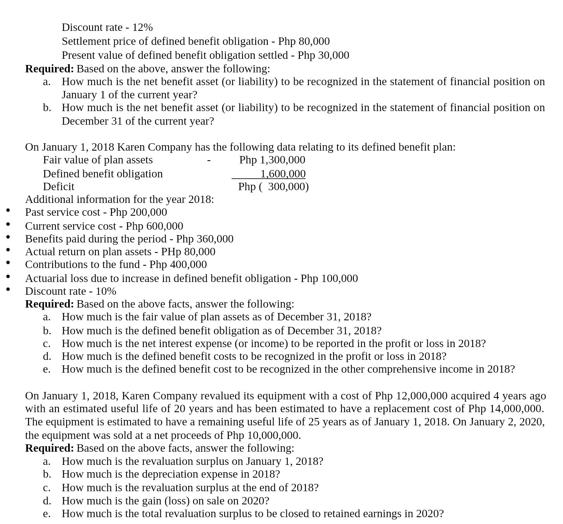

Discount rate - 12% Settlement price of defined benefit obligation - Php 80,000 Present value of defined benefit obligation settled - Php 30,000 Required: Based on the above, answer the following: a. How much is the net benefit asset (or liability) to be recognized in the statement of financial position on January 1 of the current year? b. How much is the net benefit asset (or liability) to be recognized in the statement of financial position on December 31 of the current year? On January 1, 2018 Karen Company has the following data relating to its defined benefit plan: Php 1,300,000 Fair value of plan assets Defined benefit obligation Deficit Additional information for the year 2018: Past service cost - Php 200,000 Current service cost - Php 600,000 Benefits paid during the period - Php 360,000 Actual return on plan assets - PHp 80,000 Contributions to the fund - Php 400,000 1,600,000 Php ( 300,000) Actuarial loss due to increase in defined benefit obligation - Php 100,000 Discount rate - 10% Required: Based on the above facts, answer the following: a. How much is the fair value of plan assets as of December 31, 2018? b. How much is the defined benefit obligation as of December 31, 2018? How much is the net interest expense (or income) to be reported in the profit or loss in 2018? c. d. How much is the defined benefit costs to be recognized in the profit or loss in 2018? e. How much is the defined benefit cost to be recognized in the other comprehensive income in 2018? On January 1, 2018, Karen Company revalued its equipment with a cost of Php 12,000,000 acquired 4 years ago with an estimated useful life of 20 years and has been estimated to have a replacement cost of Php 14,000,000. The equipment is estimated to have a remaining useful life of 25 years as of January 1, 2018. On January 2, 2020, the equipment was sold at a net proceeds of Php 10,000,000. Required: Based on the above facts, answer the following: a. How much is the revaluation surplus on January 1, 2018? b. How much is the depreciation expense in 2018? c. How much is the revaluation surplus at the end of 2018? d. How much is the gain (loss) on sale on 2020? e. How much is the total revaluation surplus to be closed to retained earnings in 2020?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

aSettlement gain or loss PHP 80000 PHP 30000 Settlement gain or loss PHP 50000 If the settlement gain or loss is positive it is a gain and if it is negative it is a loss In this case we have a positiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started