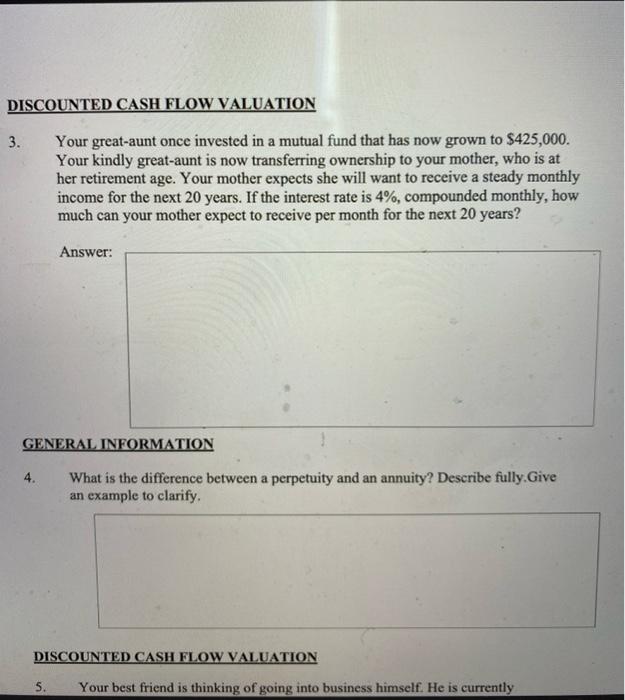

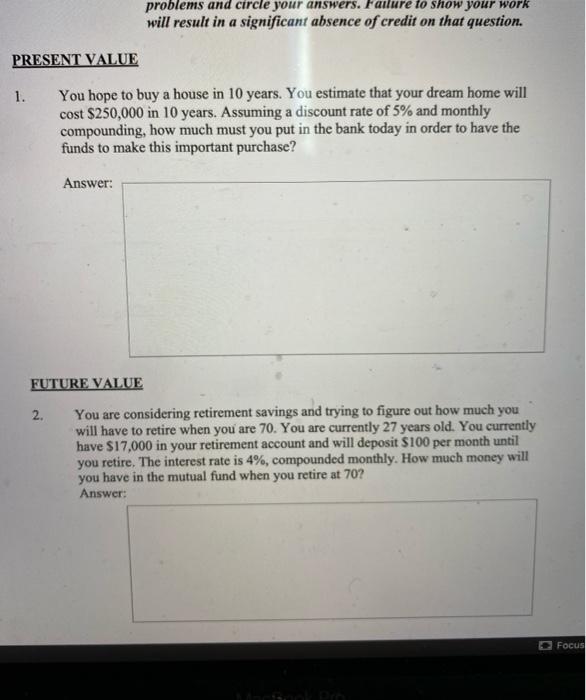

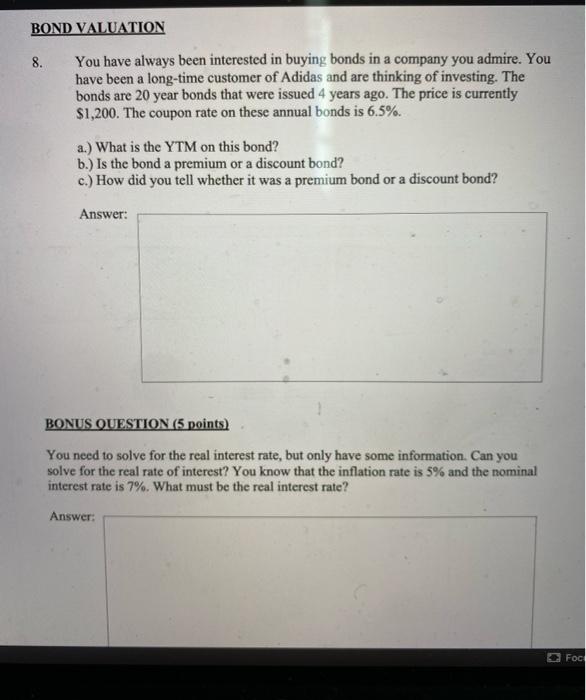

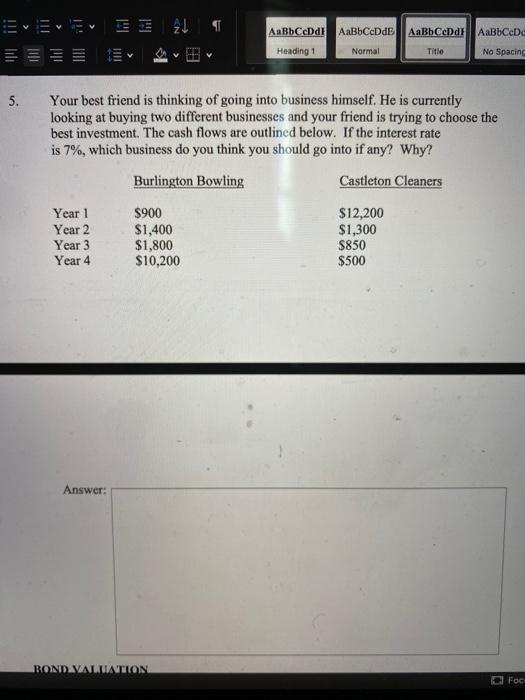

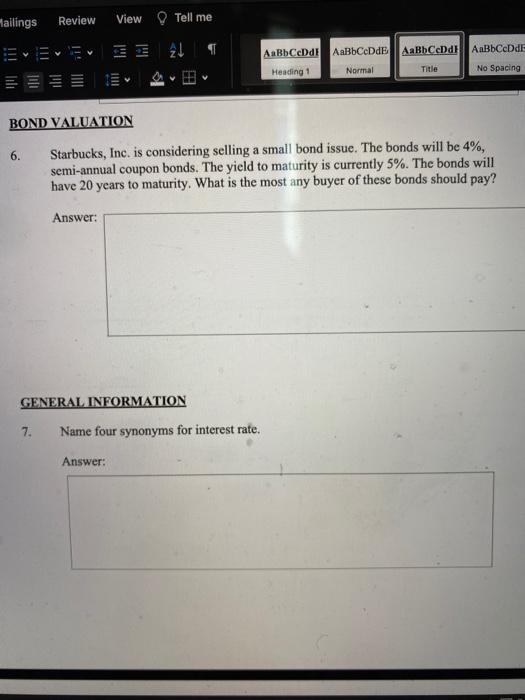

DISCOUNTED CASH FLOW VALUATION 3. Your great-aunt once invested in a mutual fund that has now grown to $425,000. Your kindly great-aunt is now transferring ownership to your mother, who is at her retirement age. Your mother expects she will want to receive a steady monthly income for the next 20 years. If the interest rate is 4%, compounded monthly, how much can your mother expect to receive per month for the next 20 years? Answer: GENERAL INFORMATION 4. What is the difference between a perpetuity and an annuity? Describe fully. Give an example to clarify. DISCOUNTED CASH FLOW VALUATION S. Your best friend is thinking of going into business himself. He is currently problems and circle your answers. Failure to show your work will result in a significant absence of credit on that question. PRESENT VALUE 1. You hope to buy a house in 10 years. You estimate that your dream home will cost $250,000 in 10 years. Assuming a discount rate of 5% and monthly compounding, how much must you put in the bank today in order to have the funds to make this important purchase? Answer: FUTURE VALUE 2. You are considering retirement savings and trying to figure out how much you will have to retire when you are 70. You are currently 27 years old. You currently have $17,000 in your retirement account and will deposit $100 per month until you retire. The interest rate is 4%, compounded monthly. How much money will you have in the mutual fund when you retire at 70? Answer: Focus BOND VALUATION 8. You have always been interested in buying bonds in a company you admire. You have been a long-time customer of Adidas and are thinking of investing. The bonds are 20 year bonds that were issued 4 years ago. The price is currently $1,200. The coupon rate on these annual bonds is 6,5%. a.) What is the YTM on this bond? b.) Is the bond a premium or a discount bond? c.) How did you tell whether it was a premium bond or a discount bond? Answer: BONUS QUESTION (5 points) You need to solve for the real interest rate, but only have some information. Can you solve for the real rate of interest? You know that the inflation rate is 5% and the nominal interest rate is 7%. What must be the real interest rate? Answer: Foc 3321 AaBbccbat AaBbCcDdE AaBbCeDo AaBbCcDdi Title Heading 1 Normal No Spacing 5. Your best friend is thinking of going into business himself. He is currently looking at buying two different businesses and your friend is trying to choose the best investment. The cash flows are outlined below. If the interest rate is 7%, which business do you think you should go into if any? Why? Burlington Bowling Castleton Cleaners Year 1 Year 2 Year 3 Year 4 $900 $1,400 $1,800 $10,200 $12,200 $1,300 $850 $500 Answer: BOND VALTATION O FOC failings Review View Tell me AaBbCeDdE AaBbCcDdE Heading 1 AaBhCcDd! Title AaBbCcDdE No Spacing Normal lili BOND VALUATION 6. Starbucks, Inc. is considering selling a small bond issue. The bonds will be 4%, semi-annual coupon bonds. The yield to maturity is currently 5%. The bonds will have 20 years to maturity. What is the most any buyer of these bonds should pay? Answer: GENERAL INFORMATION 7. Name four synonyms for interest rate