Answered step by step

Verified Expert Solution

Question

1 Approved Answer

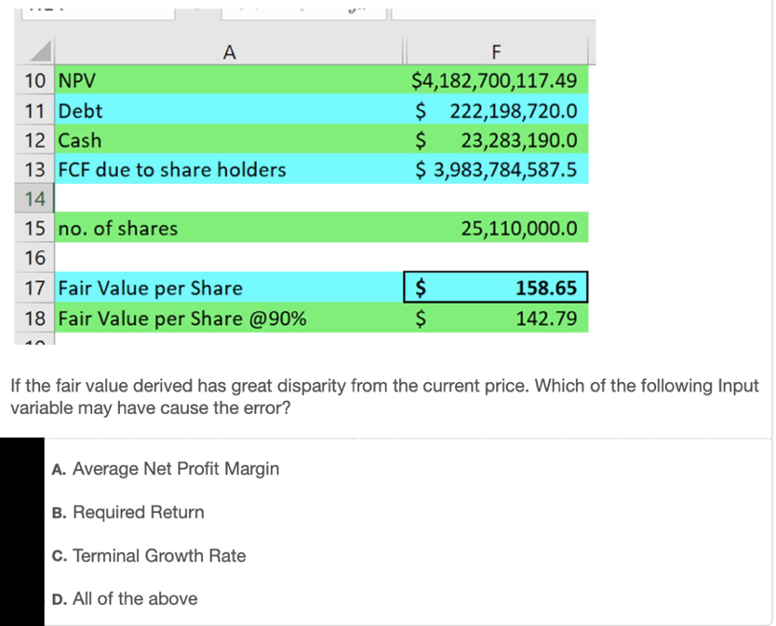

Discounted CashFlow - Output F $4,182,700,117.49 $ 222,198,720.0 $ 23,283,190.0 $ 3,983,784,587.5 A 10 NPV 11 Debt 12 Cash 13 FCF due to share holders

Discounted CashFlow - Output

F $4,182,700,117.49 $ 222,198,720.0 $ 23,283,190.0 $ 3,983,784,587.5 A 10 NPV 11 Debt 12 Cash 13 FCF due to share holders 14 15 no. of shares 16 17 Fair Value per Share 18 Fair Value per Share @90% 25,110,000.0 $ $ 158.65 142.79 If the fair value derived has great disparity from the current price. Which of the following Input variable may have cause the error? A. Average Net Profit Margin B. Required Return C. Terminal Growth Rate D. All of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started