Question

Discounted payback period . Becker, Inc. uses the discounted payback period for projects costing less than $25,000 and has a cutoff period of four years

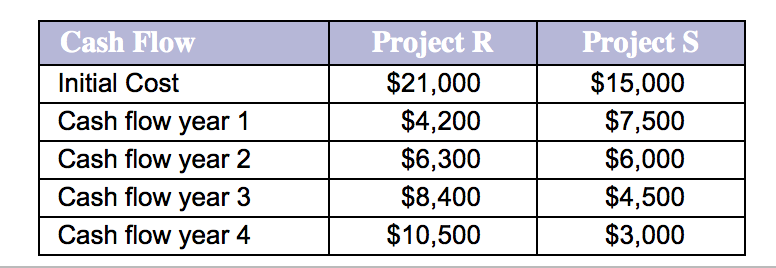

Discounted payback period. Becker, Inc. uses the discounted payback period for projects costing less than $25,000 and has a cutoff period of four years for these small-value projects. Two projects, R and S, in the following table, 1, are under consideration. Their anticipated cash flows are listed in the following table. If Becker uses a discount rate of 4% on these projects, are they accepted or rejected? If it uses a discount rate of 12%? A discount rate of 18%? Why is it necessary to look at only the first four years of the projects' cash flows?

With a discount rate of 4%, the cash outflow for project R is: (Select the best response.)

A.

fully recovered in 3 years comma so reject.

fully recovered in 3 years, so reject.

B.

fully recovered in 4 years comma so accept.

fully recovered in 4 years, so accept.

C.

not fully recovered in four years, so reject.

D.

fully recovered in 5 years, so accept.

With a discount rate of 12%, the cash outflow for project R is:(Select the best response.)

A.

fully recovered in 3 years comma so reject.

fully recovered in 3 years, so reject.

B.

not fully recovered in four years, so reject.

C.

fully recovered in 4 years comma so accept.

fully recovered in 4 years, so accept.

D.

fully recovered in 5 years, so accept.

With a discount rate of 18%, the cash outflow for project R is: (Select the best response.)

A.

not fully recovered in 4 years comma so reject.

not fully recovered in 4 years, so reject.

B.

not fully recovered in four years, so accept.

C.

fully recovered in 4 years comma so accept.

fully recovered in 4 years, so accept.

D.

fully recovered in 3 years, so accept.

With a discount rate of 4%, the cash outflow for project S is: (Select the best response.)

A.fully recovered in 3 years comma so accept.

fully recovered in 3 years, so accept.

B.not fully recovered in 4 years comma so accept.

not fully recovered in 4 years, so accept.

C.fully recovered in 4 years, so reject.

D. fully recovered in 3 years, so reject.

With a discount rate of 12%, the cash outflow for project S is: (Select the best response.)

A.fully recovered in 3 years, so reject.

B.fully recovered in 4 years, so reject.

C. not fully recovered in 4 years comma so reject.

not fully recovered in 4 years, so reject.

D. fully recoved in 4 years comma so accept.

fully recoved in 4 years, so accept.

With a discount rate of 18%, the cash outflow for project S is: (Select the best response.)

A.

fully recovered in 4 years, so accept.

B.

fully recovered in 5 years comma so accept.

fully recovered in 5 years, so accept.

C.

never fully recovered in 4 years comma so reject.

never fully recovered in 4 years, so reject.

D.

fully recovered in 3 years, so accept.

Because Becker, Inc. is using a (1) -year cut-off period; only the first (2) years of cash flow matter. If the first (3) years of anticipated cash flows are insufficient to cover the initial outlay of cash, the project is (4) regardless of the cash flows in years (5) and forward.(Select from the drop-down menus.)

((1)three/four/five

(2) four/five/three

(3) four/three/five

(4)rejected/accepted

(5)three five four)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started