Discuss accounting and Tax treatment of R&D under GAAP & ITAA? Please provide it in the form of table (like in given image) as well

Discuss accounting and Tax treatment of R&D under GAAP & ITAA?

Please provide it in the form of table (like in given image) as well as explanation.

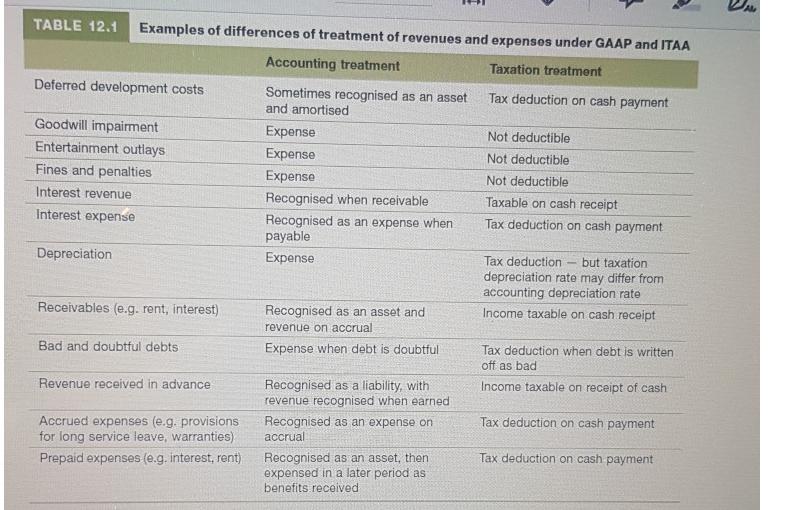

It should be noted, looking at table 12.1, that the different treatment of some revenues and expenses for taxation and accounting give rise to two categories of differences between taxable and accounting profit.

Permanent differences that will never reverse Some revenues may never be taxed (e.g, government grant). Some expenses may never be allowed as a deduction (e.g. entertainment expenses, fines. goodwill impairment)

TABLE 12.1 Examples of differences of treatment of revenues and expenses under GAAP and ITAA Accounting treatment Taxation treatment Deferred development costs Sometimes recognised as an asset and amortised Tax deduction on cash payment Goodwill impairment Expense Not deductible Entertainment outlays Expense Not deductible Fines and penalties Expense Not deductible Interest revenue Recognised when receivable Taxable on cash receipt Interest expense Recognised as an expense when payable Tax deduction on cash payment Depreciation Expense Tax deduction but taxation depreciation rate may differ from accounting depreciation rate Income taxable on cash receipt Receivables (e.g. rent, interest) Recognised as an asset and revenue on accrual Bad and doubtful debts Expense when debt is doubtful Tax deduction when debt is written off as bad Revenue received in advance Recognised as a liability, with revenue recognised when earned Income taxable on receipt of cash Accrued expenses (e.g. provisions for long service leave, warranties) Recognised as an expense on Tax deduction on cash payment accrual Tax deduction on cash payment Recognised as an asset, then expensed in a later period as Prepaid expenses (e.g. interest, rent) benefits received

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

GAAP Accounting Treatment Taxation Treatment Tax Deduction on cash p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started