Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss and calculate based on forward, futures, options and swaps (if applicable) to mitigate the foreign exchange exposure UK company contracted to buy 20,000 litres

Discuss and calculate based on forward, futures, options and swaps (if applicable) to mitigate the foreign exchange exposure

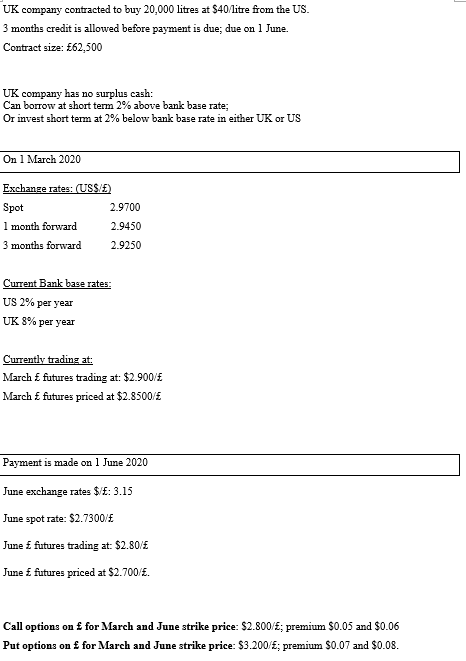

UK company contracted to buy 20,000 litres at $40/litre from the US. 3 months credit is allowed before payment is due; due on 1 June. Contract size: 62,500 UK company has no surplus cash: Can borrow at short term 2% above bank base rate; Or invest short term at 2% below bank base rate in either UK or US On 1 March 2020 Spot Exchange rates: (US$) 2.9700 1 month forward 2.9450 3 months forward 2.9250 Current Bank base rates: US 2% per year UK 8% per year Currently trading at: March futures trading at: $2.900/. March futures priced at $2.8500/ Payment is made on 1 June 2020 June exchange rates $: 3.15 June spot rate: $2.7300/ June futures trading at: $2.80/ June futures priced at $2.700 . Call options on for March and June strike price: $2.800/; premium $0.05 and $0.06 Put options on for March and June strike price: $3.200 ; premium $0.07 and $0.08. UK company contracted to buy 20,000 litres at $40/litre from the US. 3 months credit is allowed before payment is due; due on 1 June. Contract size: 62,500 UK company has no surplus cash: Can borrow at short term 2% above bank base rate; Or invest short term at 2% below bank base rate in either UK or US On 1 March 2020 Spot Exchange rates: (US$) 2.9700 1 month forward 2.9450 3 months forward 2.9250 Current Bank base rates: US 2% per year UK 8% per year Currently trading at: March futures trading at: $2.900/. March futures priced at $2.8500/ Payment is made on 1 June 2020 June exchange rates $: 3.15 June spot rate: $2.7300/ June futures trading at: $2.80/ June futures priced at $2.700 . Call options on for March and June strike price: $2.800/; premium $0.05 and $0.06 Put options on for March and June strike price: $3.200 ; premium $0.07 and $0.08Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started