Question

Identify if the scenario is a fraud risk factor relating to misstatements arising from fraudulent financial reporting or fraud risk factors relating to misstatements arising

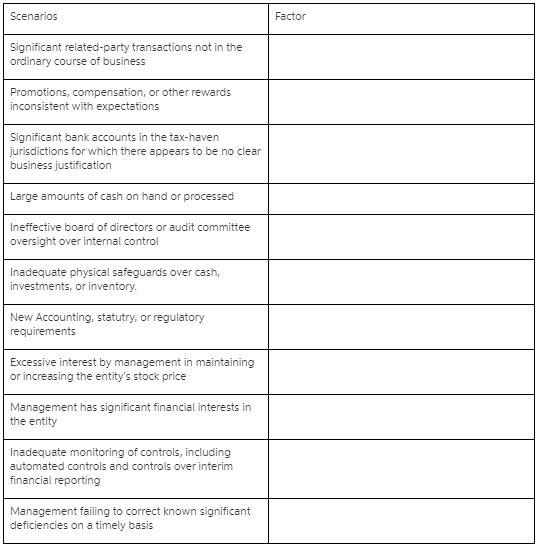

Identify if the scenario is a fraud risk factor relating to misstatements arising from fraudulent financial reporting or fraud risk factors relating to misstatements arising from misappropriation of assets and the associated condition generally present when fraud occurs.

For each of the scenarios in the table below, double-click on each of the associated shaded cells and select from the list provided the appropriate risk factor. Each selection may be used once, more than once, or not at all.

Factors include:

Attitudes/rationalizations Misstatements arising from misappropriation of assets

Attitudes/rationalizations Misstatements from fraudulent financial reporting.

Incentives/pressure Misstatements arising from misappropriation of assets

Incentives/pressures Misstatements from fraudulent financial reporting

Opportunities Misstatements arising from misappropriation of assets

Opportunities Misstatements from fraudulent financial reporting

Does not Apply

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started