Answered step by step

Verified Expert Solution

Question

1 Approved Answer

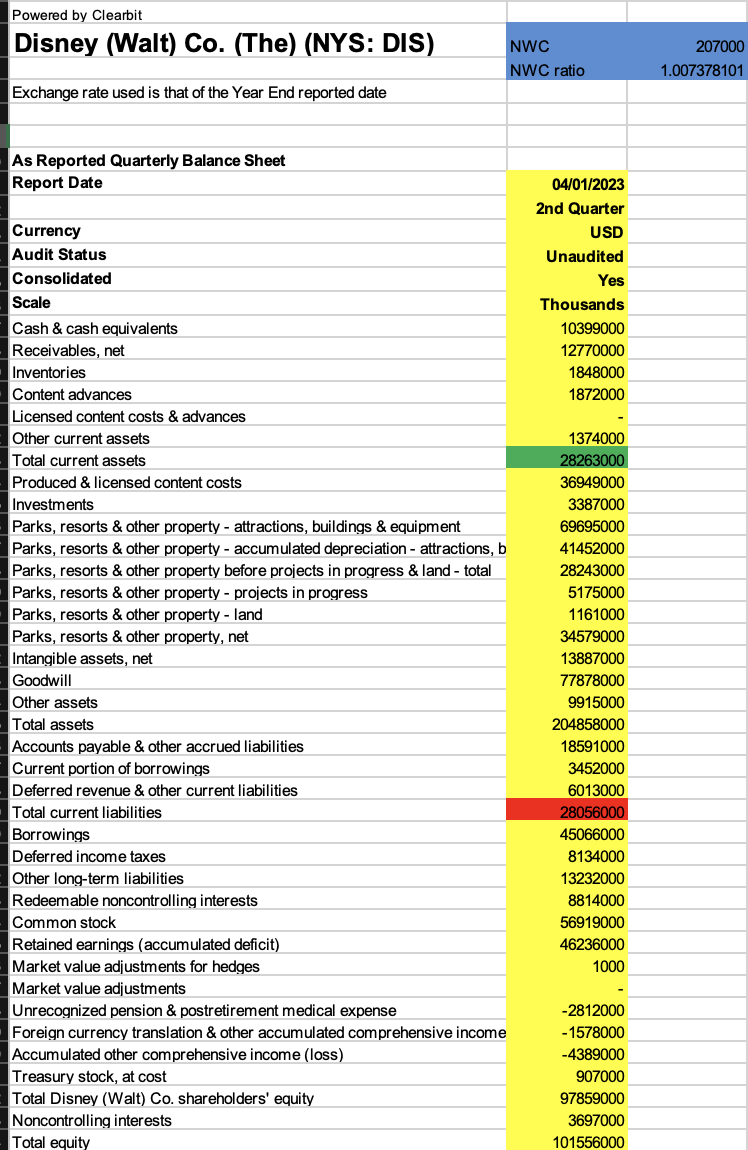

Discuss how businesses that manage their working capital well stay healthy. Use the correct formula to calculate working capital. Then discuss the business's current financial

Discuss how businesses that manage their working capital well stay healthy.

- Use the correct formula to calculate working capital. Then discuss the business's current financial liquidity position.

- For example, does the business have enough working capital ready to address bills to suppliers? Will there be potential cash inflow at the end of the year?

Powered by Clearbit Disney (Walt) Co. (The) (NYS: DIS) Exchange rate used is that of the Year End reported date NWC NWC ratio As Reported Quarterly Balance Sheet Report Date Currency Audit Status Consolidated Scale Cash & cash equivalents Receivables, net Inventories Content advances Licensed content costs & advances Other current assets 04/01/2023 2nd Quarter USD Unaudited Yes Thousands 10399000 12770000 1848000 1872000 1374000 Total current assets 28263000 Produced & licensed content costs 36949000 Investments 3387000 Parks, resorts & other property - attractions, buildings & equipment Parks, resorts & other property - accumulated depreciation - attractions, b 69695000 41452000 Parks, resorts & other property before projects in progress & land - total Parks, resorts & other property - projects in progress 28243000 5175000 Parks, resorts & other property - land 1161000 Parks, resorts & other property, net 34579000 Intangible assets, net 13887000 Goodwill 77878000 Other assets 9915000 Total assets 204858000 Accounts payable & other accrued liabilities 18591000 Current portion of borrowings 3452000 Deferred revenue & other current liabilities 6013000 Total current liabilities 28056000 Borrowings 45066000 Deferred income taxes 8134000 Other long-term liabilities Redeemable noncontrolling interests Common stock Retained earnings (accumulated deficit) Market value adjustments for hedges 13232000 8814000 56919000 46236000 1000 Market value adjustments Unrecognized pension & postretirement medical expense -2812000 Foreign currency translation & other accumulated comprehensive income -1578000 Accumulated other comprehensive income (loss) -4389000 Treasury stock, at cost 907000 Total Disney (Walt) Co. shareholders' equity Noncontrolling interests Total equity 97859000 3697000 101556000 207000 1.007378101

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started