Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss in Detail these questions after looking at the solved questions above: 1- Which one of these problems was the most difficult? What made the

Discuss in Detail these questions after looking at the solved questions above: 1- Which one of these problems was the most difficult? What made the problem difficult?

2- Perhaps you had issues with the same problem? What helped you?

3-What suggestions do you have for the problem they had an issue with? Can you explain it to them?

4- What questions do you have for your professor and classmates regarding this problem set?

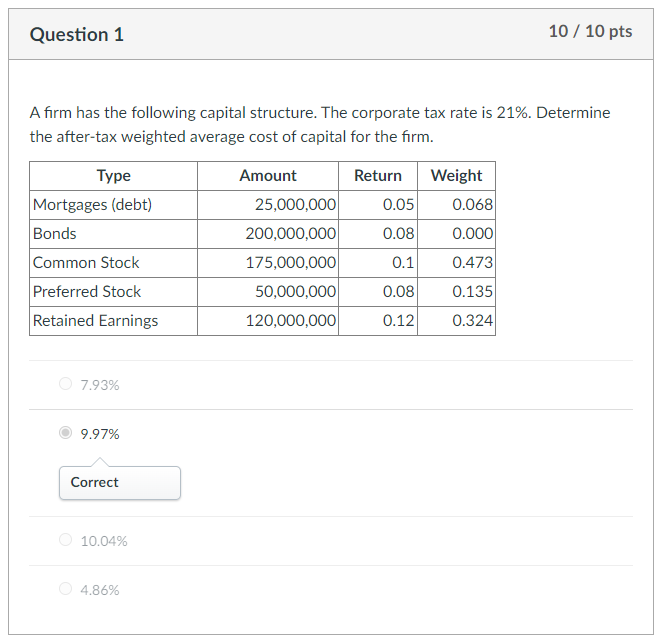

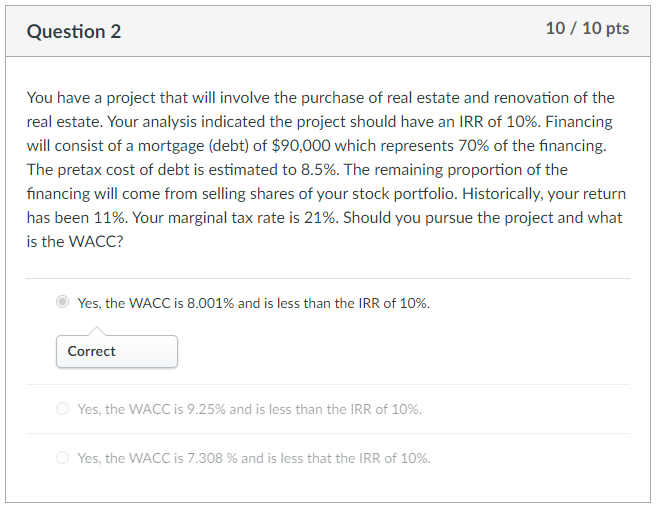

A firm has the following capital structure. The corporate tax rate is 21%. Determine the after-tax weighted average cost of capital for the firm. 7.93% 9.97% 10.04% 4.86% You have a project that will involve the purchase of real estate and renovation of the real estate. Your analysis indicated the project should have an IRR of 10%. Financing will consist of a mortgage (debt) of $90,000 which represents 70% of the financing. The pretax cost of debt is estimated to 8.5%. The remaining proportion of the financing will come from selling shares of your stock portfolio. Historically, your return has been 11%. Your marginal tax rate is 21%. Should you pursue the project and what is the WACC? Yes, the WACC is 8.001% and is less than the IRR of 10%. Yes, the WACC is 9.25% and is less than the IRR of 10%. Yes, the WACC is 7.308% and is less that the IRR of 10%

A firm has the following capital structure. The corporate tax rate is 21%. Determine the after-tax weighted average cost of capital for the firm. 7.93% 9.97% 10.04% 4.86% You have a project that will involve the purchase of real estate and renovation of the real estate. Your analysis indicated the project should have an IRR of 10%. Financing will consist of a mortgage (debt) of $90,000 which represents 70% of the financing. The pretax cost of debt is estimated to 8.5%. The remaining proportion of the financing will come from selling shares of your stock portfolio. Historically, your return has been 11%. Your marginal tax rate is 21%. Should you pursue the project and what is the WACC? Yes, the WACC is 8.001% and is less than the IRR of 10%. Yes, the WACC is 9.25% and is less than the IRR of 10%. Yes, the WACC is 7.308% and is less that the IRR of 10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started