Question

Discuss the $31 and $56 IPO prices for Wok Yow within the context of comparable firms and their multiples. You can use some outside reference

Discuss the $31 and $56 IPO prices for Wok Yow within the context of comparable firms and their multiples. You can use some outside reference materials from companies in similar industries for comparison purposes. Then take a position on whether you would recommend the $31 or $56 IPO. Which one is more feasible? Take a position on which of the two business plans you would invest in as an investor, which financial instrument of the company you would want to invest in and what kind of a return you would expect on your money.

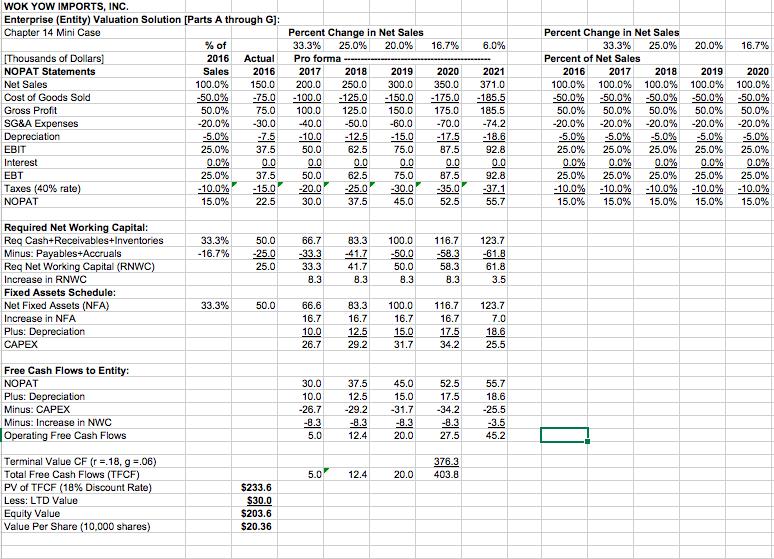

WOK YOW IMPORTS, INC. Enterprise (Entity) Valuation Solution [Parts A through G]: Chapter 14 Mini Case Percent Change in Net Sales 25.0% Percent Change in Net Sales 33.3% % of 33.3% 20.0% 16.7% 6.0% 25.0% 20.0% 16.7% Thousands of Dollars)] 2016 Actual Pro forma Percent of Net Sales NOPAT Statements Sales 2016 2017 2018 2019 2020 2021 2016 2017 2018 2019 2020 Net Sales 100.0% 150.0 200.0 250.0 300.0 350.0 371.0 100.0% 100.0% 100.0% 100.0% 100.0% Cost of Goods Sold -75.0 -50.0% 50.0% -125.0 125.0 -50.0% 50.0% -50.0% 50.0% -100.0 -150.0 -175.0 -185.5 -50.0% 50.0% -50.0% 50.0% -50.0% 50.0% Gross Profit 75.0 100.0 150.0 175.0 185.5 SG&A Expenses -20.0% -30.0 -40.0 -50.0 -60.0 -70.0 -74.2 -20.0% -20.0% -20.0% -20.0% -20.0% Depreciation -5.0% 25.0% -17.5 -5.0% 25.0% -7.5 -10.0 -12.5 -15.0 -18.6 -5.0% -5.0% 25.0% -5.0% -5.0% EBIT 37.5 50.0 62.5 75.0 87.5 92.8 25.0% 25.0% 25.0% Interest 0.0 0.0% 25.0% 0.0% 25.0% 0.0% 0.0 0.0 0.0 0.0 0.0 92.8 0.0% 25.0% 0.0% 25.0% 0.0% 25.0% EBT 37.5 50.0 62.5 75.0 87.5 25.0% Taxes (40% rate) -10.0% 15.0% -20.0 30.0 -10.0% 15.0% -15.0 -25.0 -30.0 -35.0 -37.1 -10.0% -10.0% -10.0% 15.0% -10.0% 15.0% NOPAT 22.5 37.5 45.0 52.5 55.7 15.0% 15.0% Required Net Working Capital: Req Cash+Receivables+Inventories Minus: Payables+Accruals Req Net Working Capital (RNWC) Increase in RNWC 33.3% 50.0 66.7 83.3 100.0 116.7 123.7 -16.7% -25.0 -33.3 41.7 -50.0 50.0 -58.3 -61.8 25.0 33.3 41.7 58.3 61.8 8.3 8.3 8.3 8.3 3.5 Fixed Assets Schedule: Net Fixed Assets (NFA) 33.3% 50.0 66.6 83.3 100.0 116.7 123.7 Increase in NFA 16.7 16.7 16.7 16.7 7.0 Plus: Depreciation E 10.0 12.5 15.0 17.5 18.6 26.7 29.2 31.7 34.2 25.5 Free Cash Flows to Entity: NOPAT 30.0 37.5 45.0 52.5 55.7 Plus: Depreciation 10.0 12.5 15.0 17.5 18.6 Minus: CAPEX -26.7 -29.2 -31.7 -34.2 -25.5 Minus: Increase in NWC -8.3 -8.3 -8.3 20.0 -8.3 -3.5 Operating Free Cash Flows 5.0 12.4 27.5 45.2 Terminal Value CF (r =.18, g =.06) Total Free Cash Flows (TFCF) PV of TFCF (18% Discount Rate) 376.3 5.0 12.4 20.0 403.8 $233.6 $30.0 $203.6 Less: LTD Value Equity Value Value Per Share (10,000 shares) $20.36

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

WOK YOW IMPORTS INC Question 3 31 vs 56share Discussion Prompt Discuss the 31 and 556 IPO prices for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started