Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss the challenges/differences that the Chinese market presented to Amazon. What did Amazon do to try to adapt and succeed in China. How did they

- Discuss the challenges/differences that the Chinese market presented to Amazon. What did Amazon do to try to adapt and succeed in China. How did they adapt to the market. Be as comprehensive as possible.

- What are their biggest problems moving forward. Discuss which of these you think Amazon should deal with and how they might deal with it.

3.Cite a concept/idea/data from the chapter we are covering this week to support your answer. Include the page number in parenthesis and make sure it is clearly explained what you are referring to within the text.

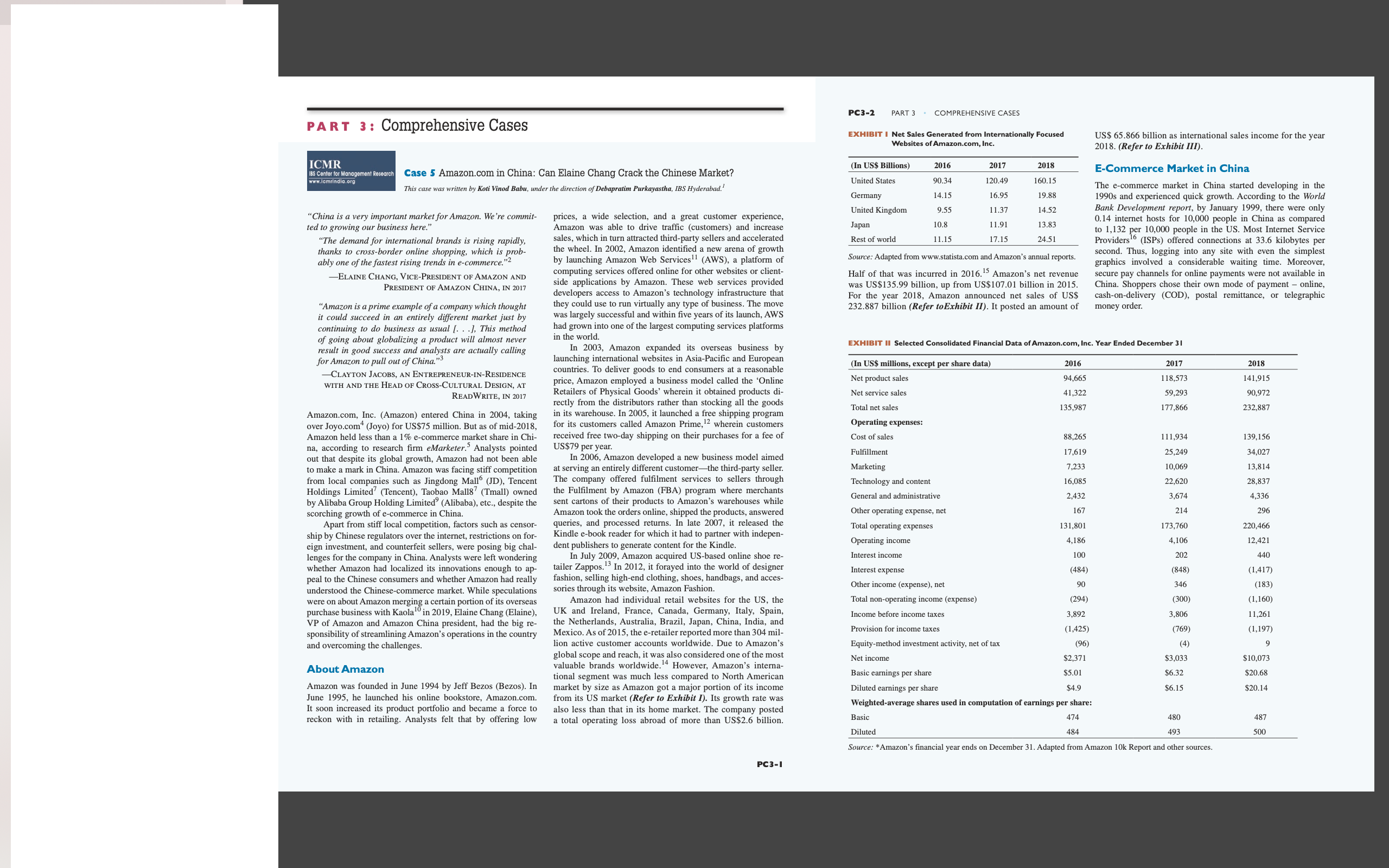

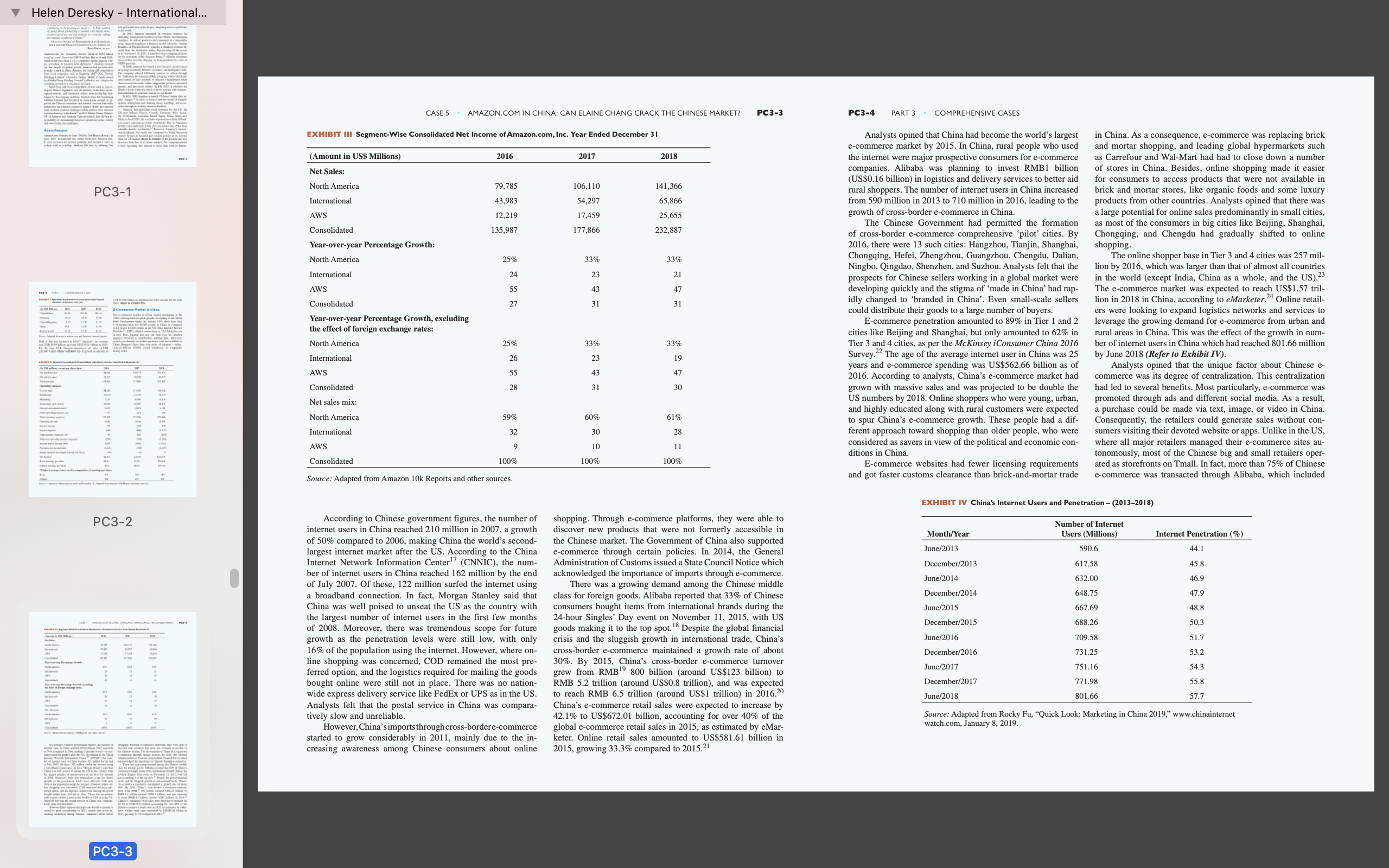

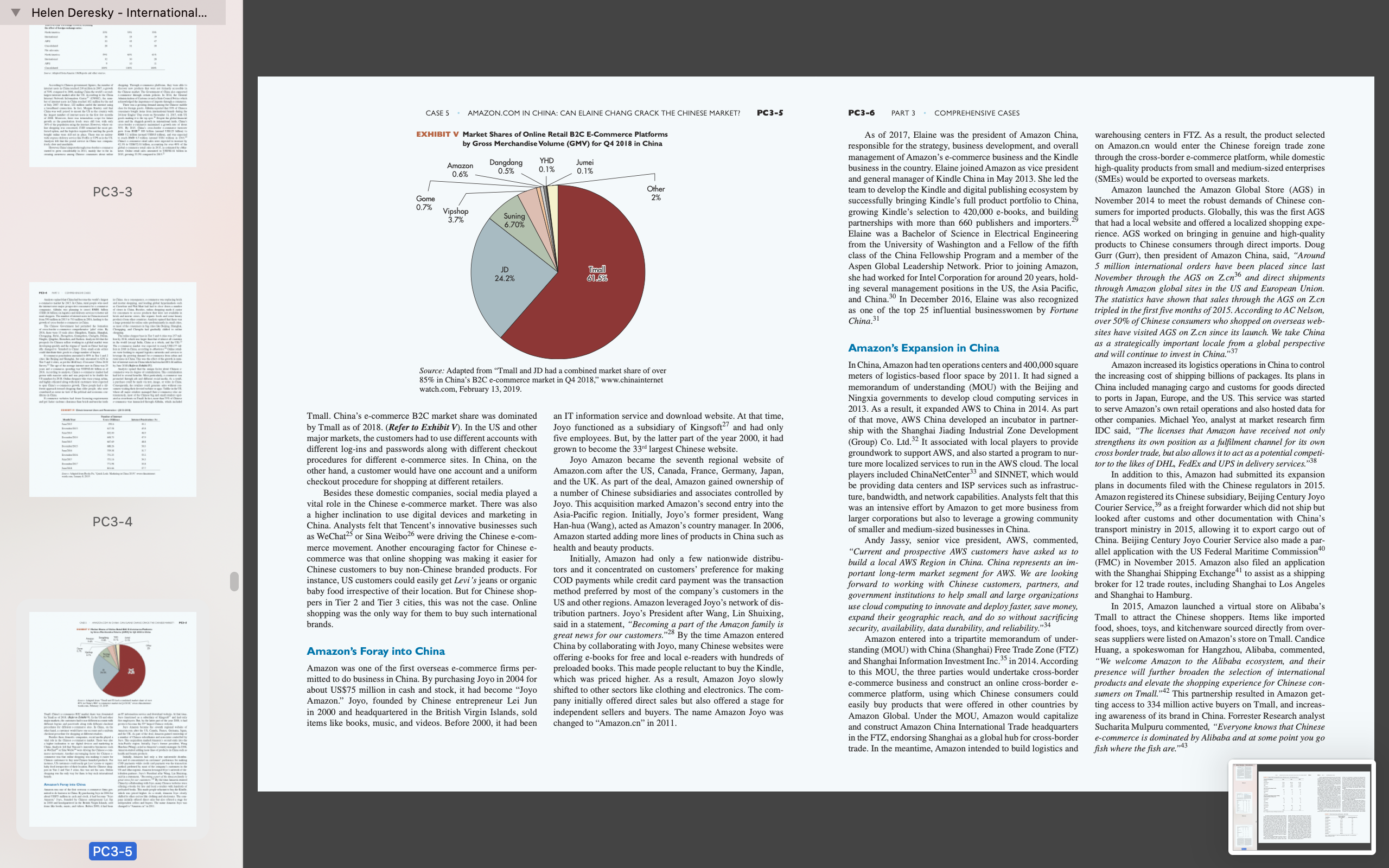

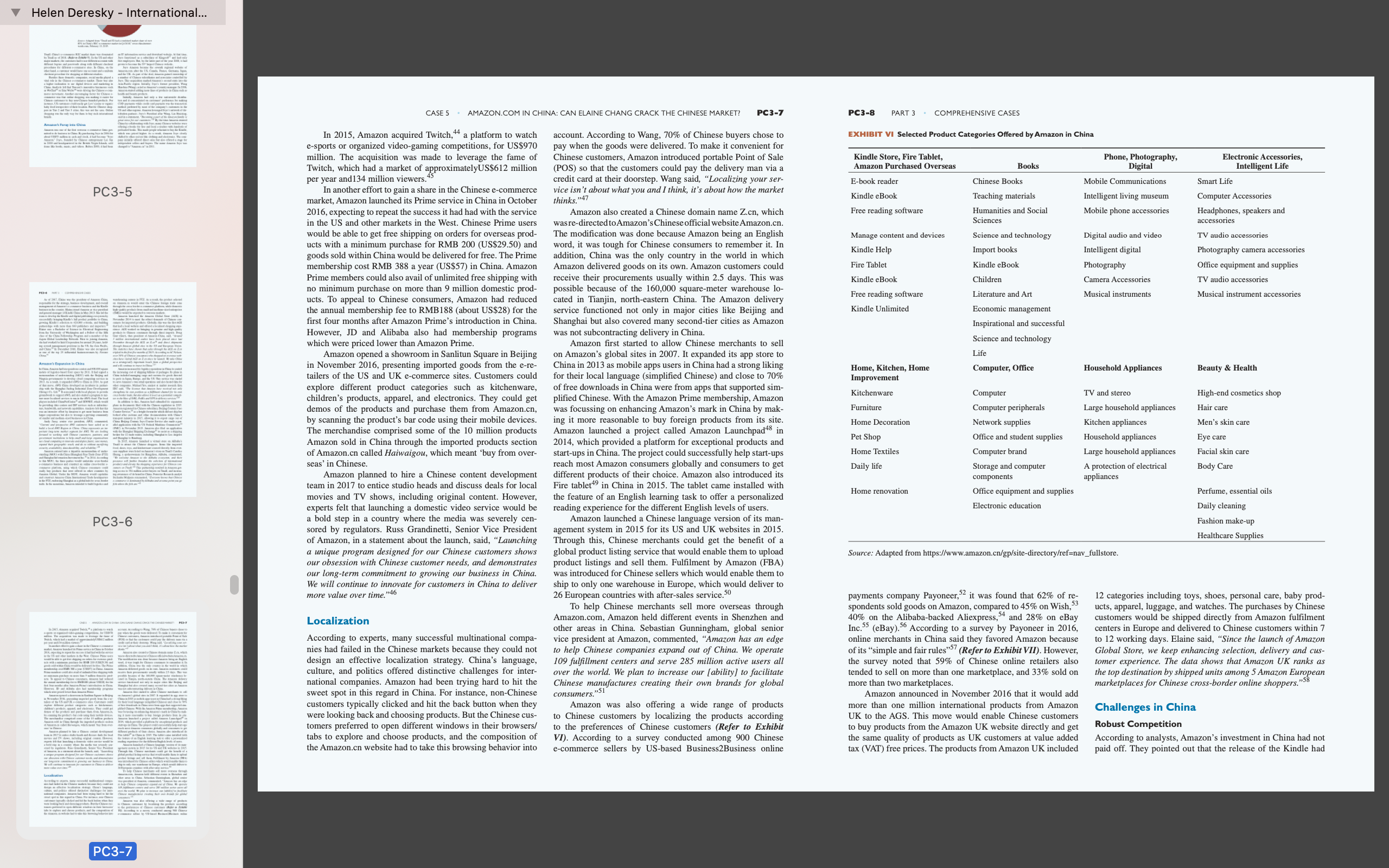

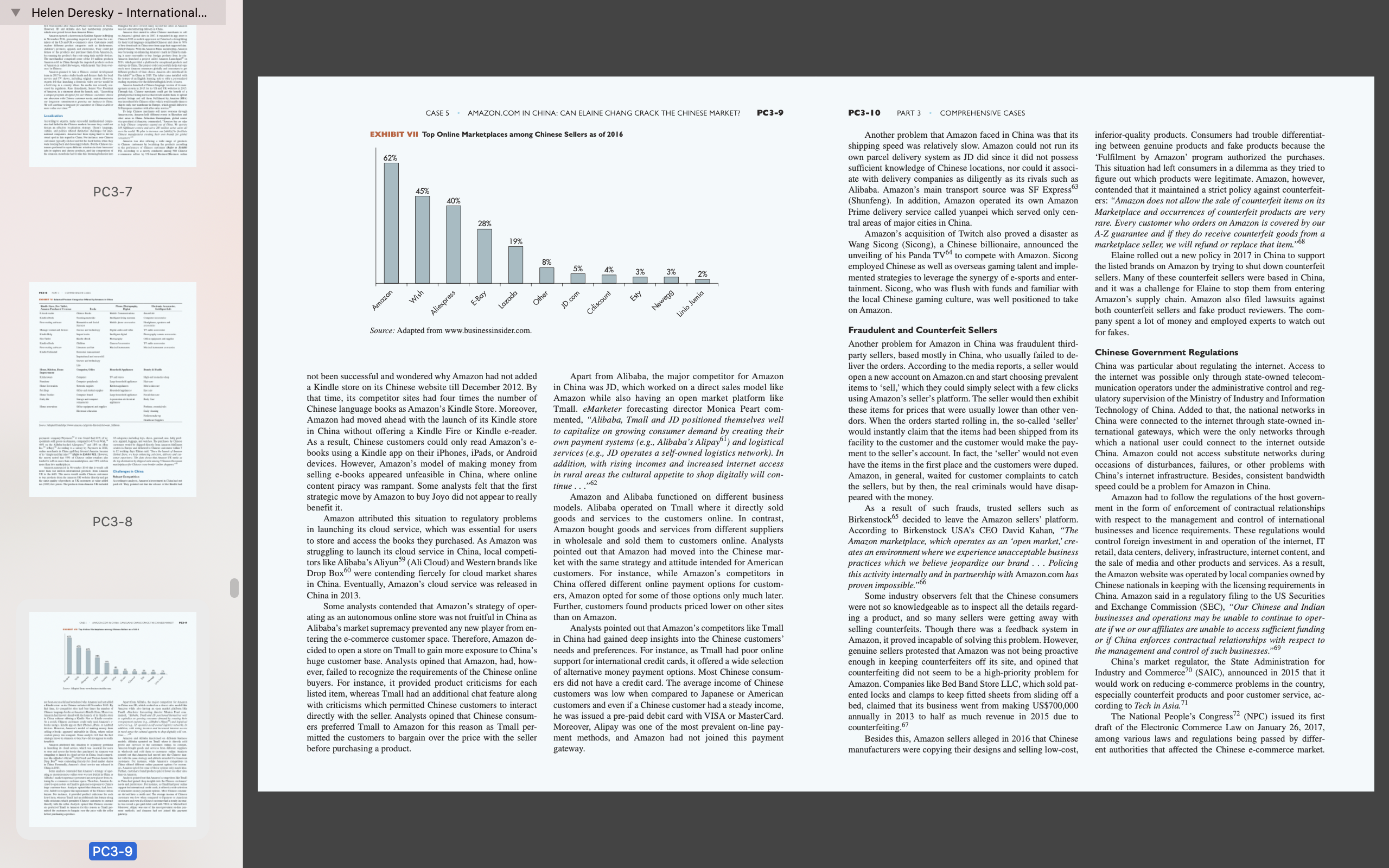

PART 3: Comprehensive Cases ICMR IBS Center for Management Research www.lcmrindia.org Case 5 Amazon.com in China: Can Elaine Chang Crack the Chinese Market? This case was written by Koti Vinod Babu, under the direction of Debapratim Purkayastha, IBS Hyderabad. "China is a very important market for Amazon. We're commit- ted to growing our business here." "The demand for international brands is rising rapidly, thanks to cross-border online shopping, which is prob- ably one of the fastest rising trends in e-commerce."2 -ELAINE CHANG, VICE-PRESIDENT OF AMAZON AND PRESIDENT OF AMAZON CHINA, IN 2017 "Amazon is a prime example of a company which thought it could succeed in an entirely different market just by continuing to do business as usual [. . .], This method of going about globalizing a product will almost never result in good success and analysts are actually calling for Amazon to pull out of China. -CLAYTON JACOBS, AN ENTREPRENEUR-IN-RESIDENCE WITH AND THE HEAD OF CROSS-CULTURAL DESIGN, AT READWRITE, IN 2017 3 Amazon.com, Inc. (Amazon) entered China in 2004, taking over Joyo.com (Joyo) for US$75 million. But as of mid-2018, Amazon held less than a 1% e-commerce market share in Chi- na, according to research firm eMarketer.5 Analysts pointed out that despite its global growth, Amazon had not been able to make a mark in China. Amazon was facing stiff competition from local companies such as Jingdong Mall (JD), Tencent Holdings Limited (Tencent), Taobao Mall87 (Tmall) owned by Alibaba Group Holding Limited (Alibaba), etc., despite the scorching growth of e-commerce in China. Apart from stiff local competition, factors such as censor- ship by Chinese regulators over the internet, restrictions on for- eign investment, and counterfeit sellers, were posing big chal- lenges for the company in China. Analysts were left wondering whether Amazon had localized its innovations enough to ap- peal to the Chinese consumers and whether Amazon had really understood the Chinese-commerce market. While speculations were on about Amazon merging a certain portion of its overseas purchase business with Kaola0 in 2019, Elaine Chang (Elaine), VP of Amazon and Amazon China president, had the big re- sponsibility of streamlining Amazon's operations in the country and overcoming the challenges. About Amazon Amazon was founded in June 1994 by Jeff Bezos (Bezos). In June 1995, he launched his online bookstore, Amazon.co It soon increased its product portfolio and became a force to reckon with in retailing. Analysts felt that by offering low prices, a wide selection, and a great customer experience, Amazon was able to drive traffic (customers) and increase sales, which in turn attracted third-party sellers and accelerated the wheel. In 2002, Amazon identified a new arena of growth by launching Amazon Web Services (AWS), a platform of computing services offered online for other websites or client- side applications by Amazon. These web services provided developers access to Amazon's technology infrastructure that they could use to run virtually any type of business. The move was largely successful and within five years of its launch, AWS had grown into one of the largest computing services platforms in the world. In 2003, Amazon expanded its overseas business by launching international websites in Asia-Pacific and European countries. To deliver goods to end consumers at a reasonable price, Amazon employed a business model called the 'Online Retailers of Physical Goods' wherein obtained products di- rectly from the distributors rather than stocking all the goods in its warehouse. In 2005, it launched a free shipping program for its customers called Amazon Prime, 12 wherein customers received free two-day shipping on their purchases for a fee of US$79 per year. In 2006, Amazon developed a new business model aimed at serving an entirely different customer-the third-party seller. The company offered fulfilment services to sellers through the Fulfilment by Amazon (FBA) program where merchants sent cartons of their products to Amazon's warehouses while Amazon took the orders online, shipped the products, answered queries, and processed returns. In late 2007, it released the Kindle e-book reader for which it had to partner with indepen- dent publishers to generate content for the Kindle. In July 2009, Amazon acquired US-based online shoe re- tailer Zappos.3 In 2012, it forayed into the world of designer fashion, selling high-end clothing, shoes, handbags, and acces- sories through its website, Amazon Fashion. Amazon had individual retail websites for the US, the UK and Ireland, France, Canada, Germany, Italy, Spain, the Netherlands, Australia, Brazil, Japan, China, India, and Mexico. As of 2015, the e-retailer reported more than 304 mil- lion active customer accounts worldwide. Due to Amazon's global scope and reach, it was also considered one of the most valuable brands worldwide.14 However, Amazon's interna- tional segment was much less compared to North American market by size as Amazon got a major portion of its income from its US market (Refer to Exhibit I). Its growth rate was also less than that in its home market. The company posted a total operating loss abroad of more than US$2.6 billion. PC3-1 PC3-2 PART 3. COMPREHENSIVE CASES EXHIBIT I Net Sales Generated from Internationally Focused Websites of Amazon.com, Inc. (In US$ Billions) United States Germany United Kingdom Japan Rest of world 2016 90.34 14.15 9.55 10.8 11.15 2017 120.49 16.95 11.37 11.91 17.15 Source: Adapted from www.statista.com and Amazon's annual reports. Half of that was incurred in 2016.15 Amazon's net revenue was US$135.99 billion, up from US$107.01 billion in 2015. For the year 2018, Amazon announced net sales of US$ 232.887 billion (Refer to Exhibit II). It posted an amount of (In US$ millions, except per share data) Net product sales Net service sales Total net sales Operating expenses: Cost of sales Fulfillment Marketing Technology and content General and administrative Other operating expense, net Total operating expenses Operating income Interest income 2018 160.15 19.88 14.52 13.83 24.51 Interest expense Other income (expense), net Total non-operating income (expense) Income before income taxes Provision for income taxes EXHIBIT II Selected Consolidated Financial Data of Amazon.com, Inc. Year Ended December 31 2016 94,665 41,322 135,987 88,265 17,619 7,233 16,085 2,432 167 131,801 4,186 100 (484) 90 (294) 3,892 (1,425) (96) US$ 65.866 billion as international sales income for the year 2018. (Refer to Exhibit III). E-Commerce Market in China The e-commerce market in China started developing in the 1990s and experienced quick growth. According to the World Bank Development report, by January 1999, there were only 0.14 internet hosts for 10,000 people in China as compared to 1,132 per 10,000 people in the US. Most Internet Service Providers6 (ISPs) offered connections at 33.6 kilobytes per second Thus, logging into any site with even the simplest graphics involved a considerable waiting time. Moreover, secure pay channels for online payments were not available in China. Shoppers chose their own mode of payment - online, cash-on-delivery (COD), postal remittance, or telegraphic money order. $2,371 $5.01 $4.9 2017 118,573 59,293 177,866 111,934 25,249 10,069 22,620 3,674 214 173,760 4,106 202 (848) 346 (300) 3,806 (769) (4) Equity-method investment activity, net of tax Net income Basic earnings per share Diluted earnings per share Weighted-average shares used in computation of earnings per share: 474 484 Basic 480 Diluted 493 Source: *Amazon's financial year ends on December 31. Adapted from Amazon 10k Report and other sources. $3,033 $6.32 $6.15 2018 141,915 90,972 232,887 139,156 34,027 13,814 28,837 4,336 296 220,466 12,421 440 (1,417) (183) (1,160) 11,261 (1,197) 9 $10,073 $20.68 $20.14 487 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started