Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss the following statement. The rise and general availability of artificial intelligence and the public availability of relevant data undermine the existence of financial intermediaries

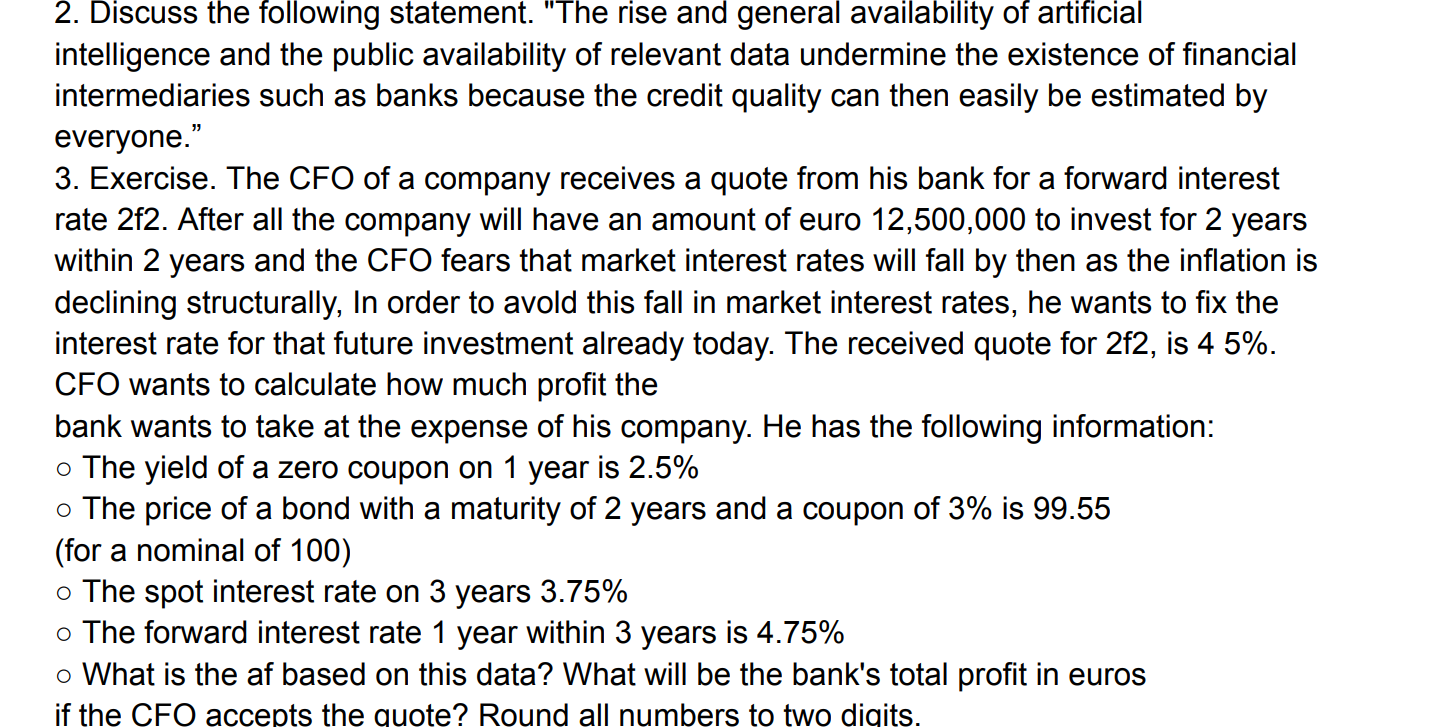

Discuss the following statement. "The rise and general availability of artificial

intelligence and the public availability of relevant data undermine the existence of financial

intermediaries such as banks because the credit quality can then easily be estimated by

everyone."

Exercise. The CFO of a company receives a quote from his bank for a forward interest

rate After all the company will have an amount of euro to invest for years

within years and the CFO fears that market interest rates will fall by then as the inflation is

declining structurally, In order to avold this fall in market interest rates, he wants to fix the

interest rate for that future investment already today. The received quote for is

CFO wants to calculate how much profit the

bank wants to take at the expense of his company. He has the following information:

The yield of a zero coupon on year is

The price of a bond with a maturity of years and a coupon of is

for a nominal of

The spot interest rate on years

The forward interest rate year within years is

What is the af based on this data? What will be the bank's total profit in euros

if the CFO accepts the quote? Round all numbers to two diaits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started