Answered step by step

Verified Expert Solution

Question

1 Approved Answer

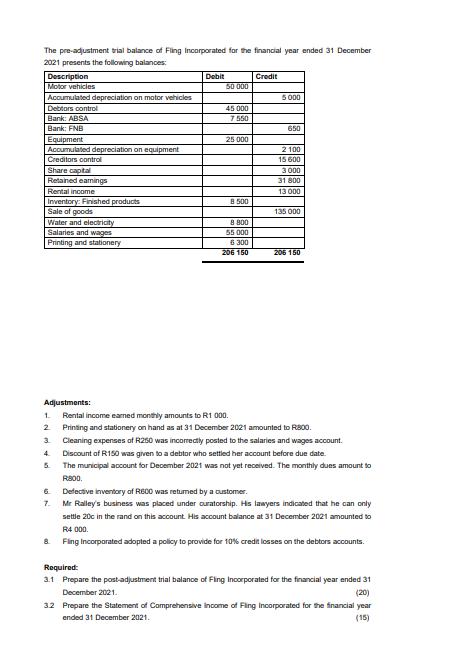

The pre-adjustment trial balance of Fling Incorporated for the financial year ended 31 December 2021 presents the following balances: Description Motor vehicles Accumulated depreciation

The pre-adjustment trial balance of Fling Incorporated for the financial year ended 31 December 2021 presents the following balances: Description Motor vehicles Accumulated depreciation on motor vehicles Debtors control Bank: ABSA Bank: FNB Equipment Accumulated depreciation on equipment Creditors control Share capital Retained earnings Rental income Inventory: Finished products Sale of goods Water and electricity Salaries and wages Printing and stationery Adjustments: 1. 2 3 4. 5 6 7. 8 Debit 50 000 45 000 7550 25 000 8 500 8 800 55 000 6300 206 150 Credit 5 000 650 2100 15 600 3 000 800 31 13 000 135 000 206 150 Rental income earned monthly amounts to R1 000. Printing and stationery on hand as at 31 December 2021 amounted to R800. Cleaning expenses of R250 was incorrectly posted to the salaries and wages account. Discount of R150 was given to a debtor who settled her account before due date. The municipal account for December 2021 was not yet received. The monthly dues amount to R800. Defective inventory of R600 was returned by a customer. Mr Ralley's business was placed under curatorship. His lawyers indicated that he can only settle 20c in the rand on this account. His account balance at 31 December 2021 amounted to R4 000. Fling Incorporated adopted a policy to provide for 10% credit losses on the debtors accounts. Required: 3.1 Prepare the post-adjustment trial balance of Fling Incorporated for the financial year ended 31 December 2021. (20) 3.2 Prepare the Statement of Comprehensive income of Fling Incorporated for the financial year ended 31 December 2021. (15)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

31 Post adjustment trial balance 32 statement of comprehensive income Nuclear ene...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started