Question

Given the following information, answer questions accordingly. Trial Balance Suffolk's cumulative translation adjustment 1. Discuss the impacts that the change in the value of the

Given the following information, answer questions accordingly.

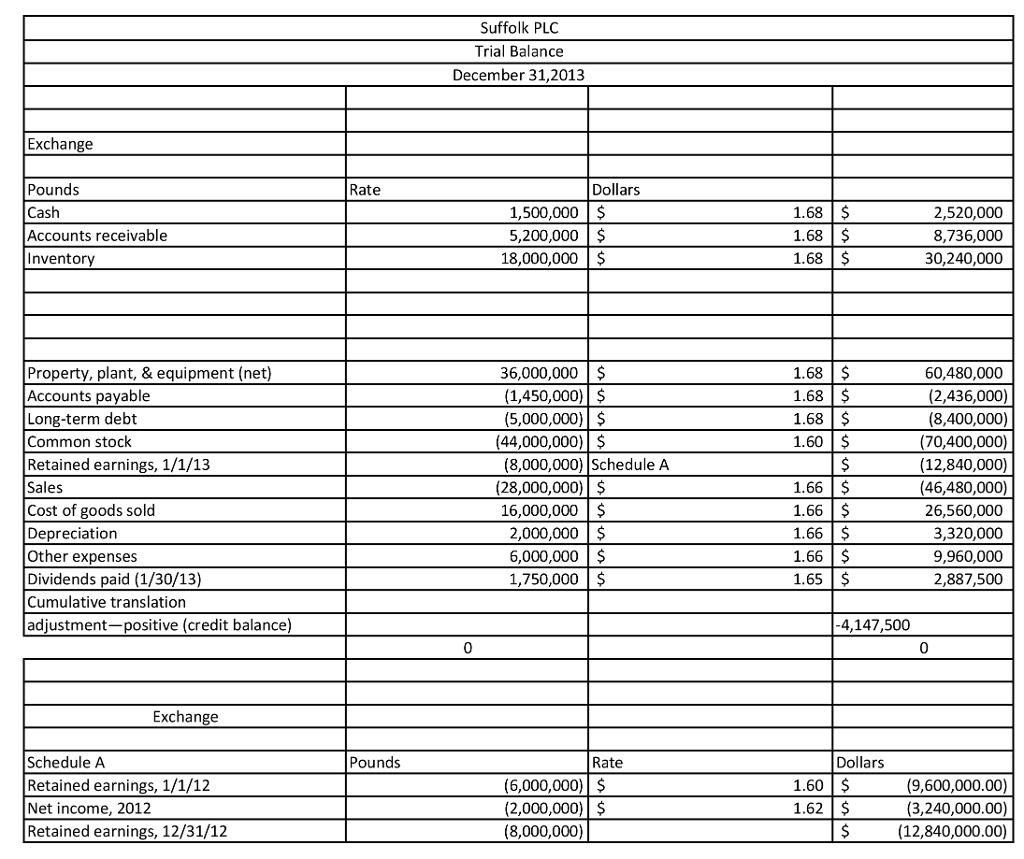

Trial Balance

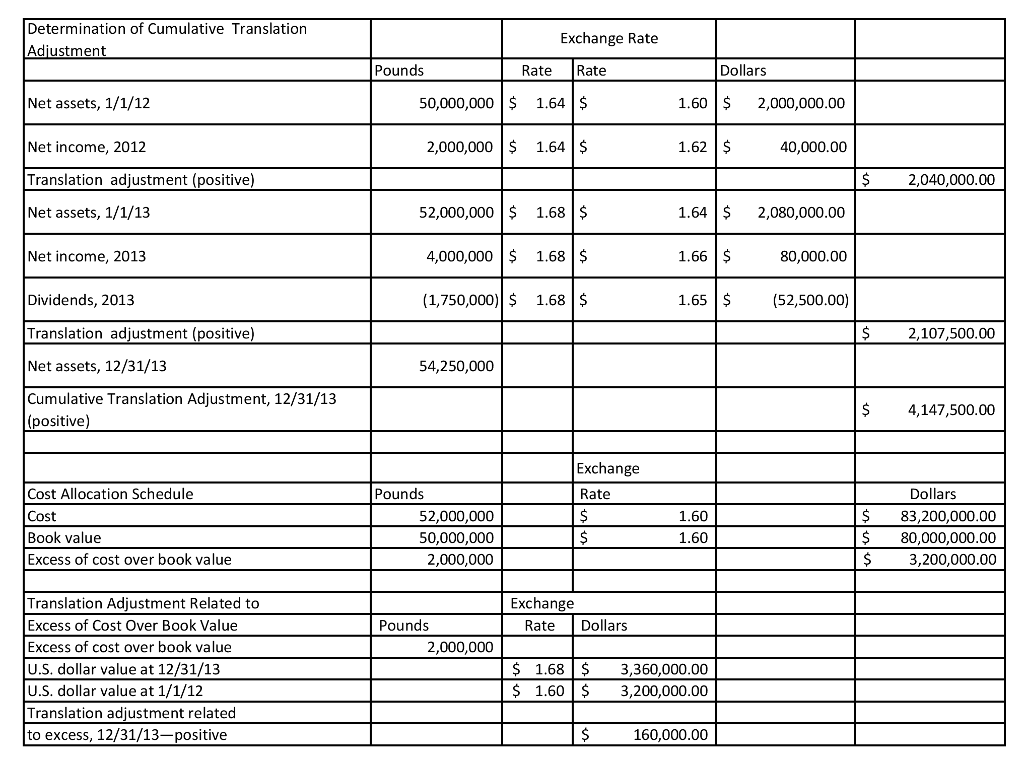

Suffolk's cumulative translation adjustment

1. Discuss the impacts that the change in the value of the pound has had on results due to exchange rate fluctuations with results that would have occurred had the dollar value of the pound remained constant or declined during the first two years of Parker?s ownership. ? ASSESS THREATS TO QUALITY OF INFORMATION.

2.?Should Suffolk recognize a provision for the environmental contingency as of December 31, Year 2 in reporting to its U.S. parent under U.S. GAAP? How about when it reports to its U.K.-based lender under IFRS?

3.?Parker?s purchase of Suffolk has created additional accounting complexities. Identify some of the additional accounting issues that Parker now faces. How do these additional complexities potentially impact the quality of the accounting information for Parker? What internal controls can Parker implement to assure that the company is able to meet all information quality and disclosure requirements?

4.?Parker is considering adopting IFRS for financial reporting.?What are some of the key differences between IFRS and US GAAP that might impact Parker??What are some of the advantages and disadvantages that might accrue to Parker if it adopted IFRS for all of its operations?

5. Would the adoption of IFRS require additional reporting requirements for the SEC? What role do the IASB, FASB, PCAOB, and SEC play in promoting high-quality accounting information for US and global businesses? Does the retention of a separate US GAAP in an otherwise IFRS world environment present any challenges for US-based companies?

Exchange Pounds Cash Accounts receivable Inventory Property, plant, & equipment (net) Accounts payable Long-term debt Common stock Retained earnings, 1/1/13 Sales Cost of goods sold Depreciation Other expenses Dividends paid (1/30/13) Cumulative translation adjustment-positive (credit balance) Exchange Schedule A Retained earnings, 1/1/12 Net income, 2012 Retained earnings, 12/31/12 Rate Pounds Suffolk PLC Trial Balance December 31,2013 0 Dollars 1,500,000 $ 5,200,000 $ S 18,000,000 36,000,000 $ (1,450,000) $ (5,000,000) $ (44,000,000) $ (8,000,000) Schedule A (28,000,000) $ 16,000,000 S 2,000,000 $ 6,000,000 $ 1,750,000 $ Rate (6,000,000) $ (2,000,000) $ (8,000,000) 1.68 $ 1.68 $ 1.68 $ 1.68 $ 1.68 $ 1.68 $ 1.60 $ $ 1.66 $ 1.66 $ 1.66 $ 1.66 $ 1.65 $ -4,147,500 Dollars 1.60 $ 1.62 $ $ 2,520,000 8,736,000 30,240,000 60,480,000 (2,436,000) (8,400,000) (70,400,000) (12,840,000) (46,480,000) 26,560,000 3,320,000 9,960,000 2,887,500 0 (9,600,000.00) (3,240,000.00) (12,840,000.00)

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 In the goods market a positive shock to the exchange rate of the domestic currency an unexpected appreciation will make exports more expensive and imports less expensive As a result the competition ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started