Answered step by step

Verified Expert Solution

Question

1 Approved Answer

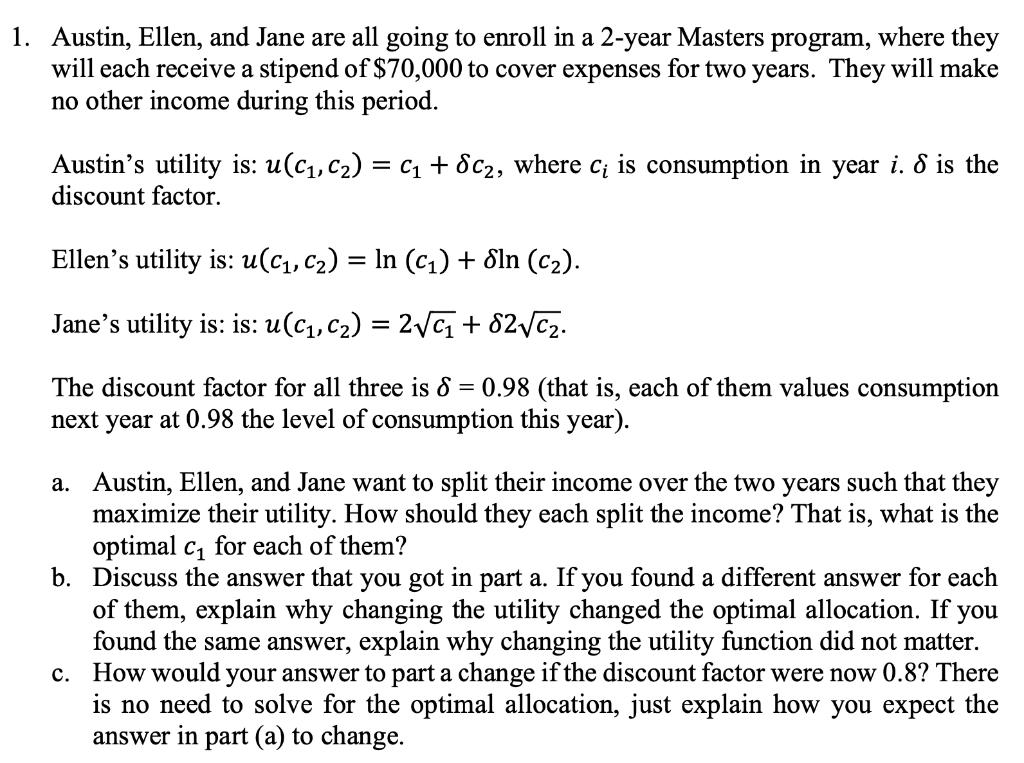

where they 1. Austin, Ellen, and Jane are all going to enroll in a 2-year Masters program, will each receive a stipend of $70,000

where they 1. Austin, Ellen, and Jane are all going to enroll in a 2-year Masters program, will each receive a stipend of $70,000 to cover expenses for two years. They will make no other income during this period. Austin's utility is: u(C, C) = C + 8c, where c; is consumption in year i. 8 is the discount factor. Ellen's utility is: u(C, C) = ln (c) + Sln (C). - Jane's utility is: is: u(C, C) = 2 +82C. - The discount factor for all three is 8 = 0.98 (that is, each of them values consumption next year at 0.98 the level of consumption this year). a. Austin, Ellen, and Jane want to split their income over the two years such that they maximize their utility. How should they each split the income? That is, what is the optimal c for each of them? b. Discuss the answer that you got part a. If you found a different answer for each of them, explain why changing the utility changed the optimal allocation. If you found the same answer, explain why changing the utility function did not matter. c. How would your answer to part a change if the discount factor were now 0.8? There is no need to solve for the optimal allocation, just explain how you expect the answer in part (a) to change.

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer Given Austin C C 78c Ellen UC C In c Sin C 4 C 2 2C 2 Jone C C 8 0984 In 70000 dollars ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started