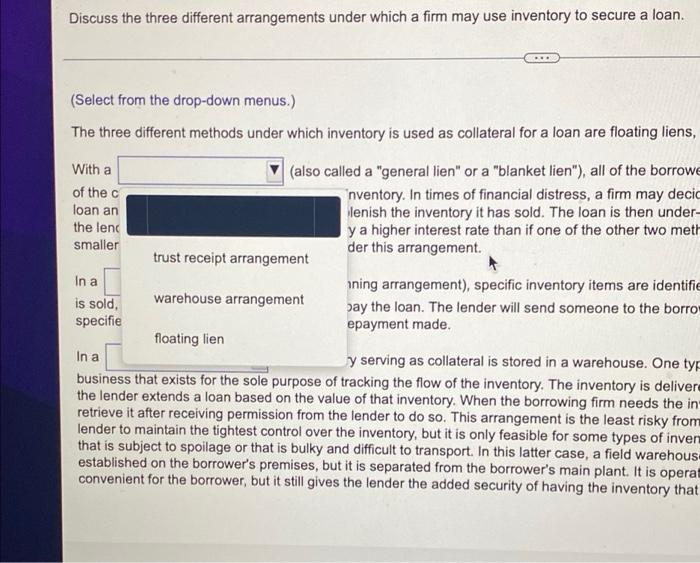

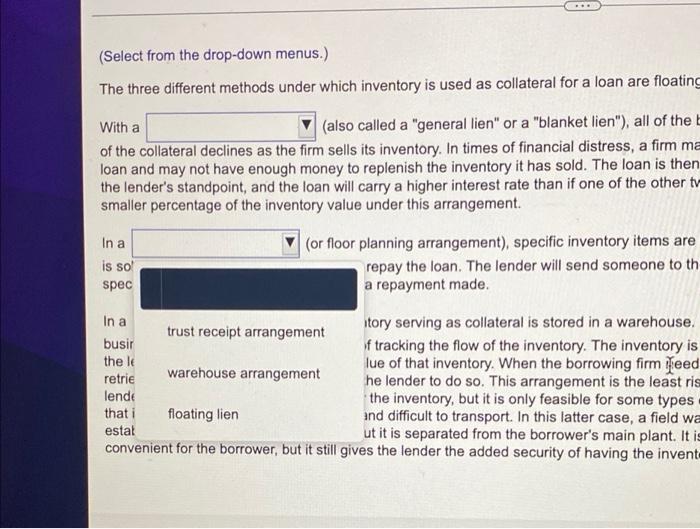

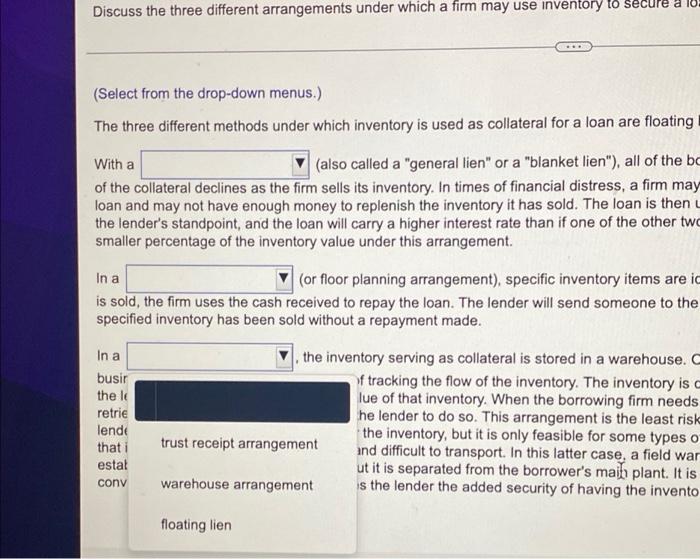

Discuss the three different arrangements under which a firm may use inventory to secure a loan. With a (Select from the drop-down menus) The three different methods under which inventory is used as collateral for a loan are floating liens, trust receipts, and warehouse arrangements (also called a "general lion or a "blanket lien"), all of the borrower's inventory serves as collateral for a loan. The value of the collateral declines as the firm sells its inventory. In times of financial distress, a firm may decide to sell its inventory without making payments on the loan and may not have enough money to replenish the inventory it has sold. The loan is then under-collateralized. This is the riskiest arrangement from the lender's standpoint, and the loan will carry a higher interest rate than it one of the other two methods is used. Additionally, the lender wil lend a much smaller percentage of the inventory value under this arrangement In a (of floor planning arrangement), specific inventory toms are identified as collateral for the loan. As the specified inventory has sold the firm uses the cash received to repay the loan. The lender will send someone to the borrower's premises periodically to ensure that none of the specified inventory has been sold without a repayment made. the inventory serving as collateral is stored in a warehouse One type of borehouse is a public warehouse, which is a business that exists for the sole purpose of tracking the flow of the inventory. The inventory is delivered to the public warehouse by the borrowing firm, and the lender extends a loan based on the value of that inventory When the borrowing firm needs the inventory to sell, it must return to the warehouse to retrieve it after receiving permission from the lender to do so. This arrangement is the least risky from the standpoint of the londer since it allows the Jender to maintain the tightest control over the inventory, but it is only feasible for some types of inventory. This method would not be usable for inventory that is subject to spoilage or that is bulky and difficult to transport in this latter case, a field warehouse might be a good alternative. A field warehouse is established on the borrower's premises, but it is separated from the borrower's main plant. It is operated by a third party. This type of arrangement is more convenient for the borrower, but it still gives the tender the added security of having the inventory that serves as collateral tracked by a third party In a Discuss the three different arrangements under which a firm may use inventory to secure a loan. (Select from the drop-down menus.) The three different methods under which inventory is used as collateral for a loan are floating liens, With a (also called a "general lien" or a "blanket lien"), all of the borrowe of the c 'nventory. In times of financial distress, a firm may decic loan an lenish the inventory it has sold. The loan is then under- the lens y a higher interest rate than if one of the other two meth smaller der this arrangement. trust receipt arrangement In a aning arrangement), specific inventory items are identifie is sold, warehouse arrangement pay the loan. The lender will send someone to the borro specifie epayment made. floating lien In a y serving as collateral is stored in a warehouse. One typ business that exists for the sole purpose of tracking the flow of the inventory. The inventory is deliver the lender extends a loan based on the value of that inventory. When the borrowing firm needs the in retrieve it after receiving permission from the lender to do so. This arrangement is the least risky from lender to maintain the tightest control over the inventory, but it is only feasible for ome types of inven that is subject to spoilage or that is bulky and difficult to transport. In this latter case, a field warehous established on the borrower's premises, but it is separated from the borrower's main plant. It is operat convenient for the borrower, but it still gives the lender the added security of having the inventory that (Select from the drop-down menus.) The three different methods under which inventory is used as collateral for a loan are floating With a (also called a "general lien" or a "blanket lien"), all of the of the collateral declines as the firm sells its inventory. In times of financial distress, a firm ma loan and may not have enough money to replenish the inventory it has sold. The loan is then the lender's standpoint, and the loan will carry a higher interest rate than if one of the other tv- smaller percentage of the inventory value under this arrangement. In a is sol spec (or floor planning arrangement), specific inventory items are repay the loan. The lender will send someone to th a repayment made. in a tory serving as collateral is stored in a warehouse. trust receipt arrangement busir of tracking the flow of the inventory. The inventory is the le lue of that inventory. When the borrowing firm feed retrie warehouse arrangement he lender to do so. This arrangement is the least ris lende the inventory, but it is only feasible for some types that i floating lien and difficult to transport. In this latter case, a field wa estat ut it is separated from the borrower's main plant. It is convenient for the borrower, but it still gives the lender the added security of having the invent Discuss the three different arrangements under which a firm may use inventory to secure a 10 (Select from the drop-down menus.) The three different methods under which inventory is used as collateral for a loan are floating With a (also called a "general lien" or a "blanket lien"), all of the bo of the collateral declines as the firm sells its inventory. In times of financial distress, a firm may loan and may not have enough money to replenish the inventory it has sold. The loan is then the lender's standpoint, and the loan will carry a higher interest rate than if one of the other two smaller percentage of the inventory value under this arrangement. In a (or floor planning arrangement), specific inventory items are i is sold, the firm uses the cash received to repay the loan. The lender will send someone to the specified inventory has been sold without a repayment made. In a busir the le retrie lende that i estal cony the inventory serving as collateral is stored in a warehouse. f tracking the flow of the inventory. The inventory is lue of that inventory. When the borrowing firm needs he lender to do so. This arrangement is the least risk the inventory, but it is only feasible for some types o trust receipt arrangement and difficult to transport. In this latter case, a field war ut it is separated from the borrower's maib plant. It is warehouse arrangement is the lender the added security of having the invento floating lien