Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss whether each of following statements is true or false and WHY. a) The robust empirical asset-pricing evidences show that the portfolio of the

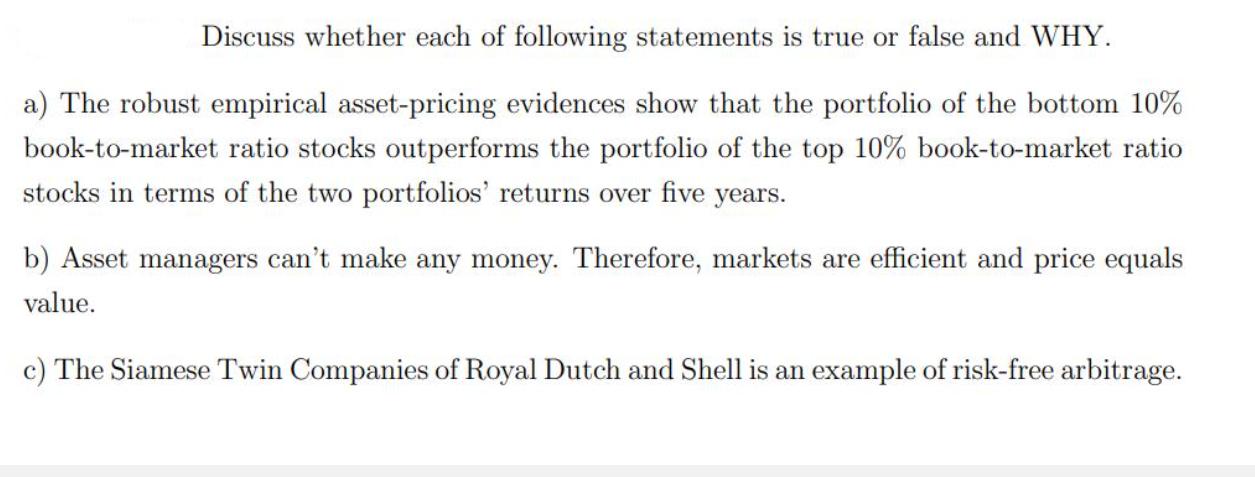

Discuss whether each of following statements is true or false and WHY. a) The robust empirical asset-pricing evidences show that the portfolio of the bottom 10% book-to-market ratio stocks outperforms the portfolio of the top 10% book-to-market ratio stocks in terms of the two portfolios' returns over five years. b) Asset managers can't make any money. Therefore, markets are efficient and price equals value. c) The Siamese Twin Companies of Royal Dutch and Shell is an example of risk-free arbitrage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The statement is true The empirical evidence does show that the portfolio of stocks with a low boo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started