Answered step by step

Verified Expert Solution

Question

1 Approved Answer

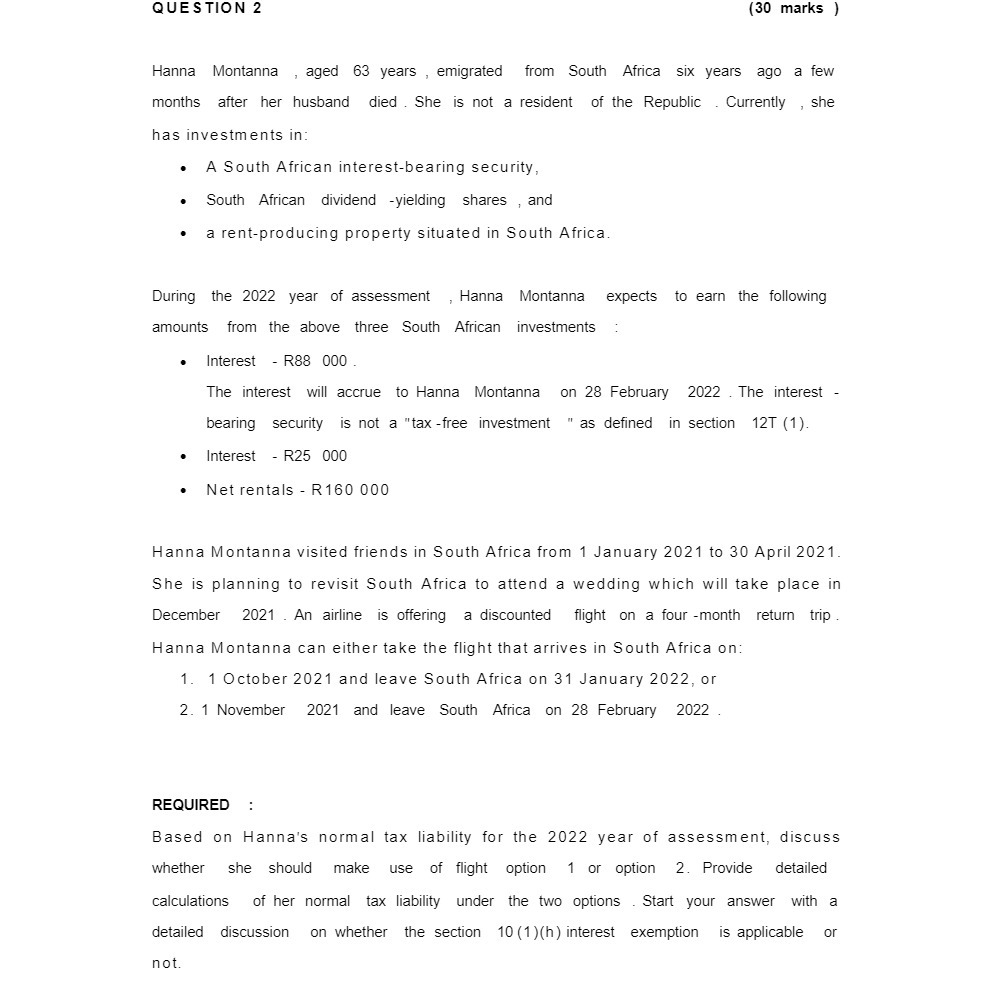

discuss whether she should make use of flight option 1 or option 2. Provide detailed calculations of her normal tax liability under the two

discuss whether she should make use of flight option 1 or option 2. Provide detailed calculations of her normal tax liability under the two options Start your answer with a detailed discussion on whether the section 10 (1)(h) interest exemption is applicable or not. QUESTION 2 Hanna Montanna , aged 63 years, emigrated from South Africa six years ago a few months after her husband died. She is not a resident of the Republic Currently, she has investments in: . A South African interest-bearing security, South African dividend -yielding shares and a rent-producing property situated in South Africa. . During the 2022 year of assessment , Hanna Montannal expects to earn the following amounts from the above three South African investments : . . (30 marks) 1 Net rentals - R 160 000 not. Interest - R88 000 The interest will accrue to Hanna Montanna on 28 February 2022. The interest bearing security is not a "tax-free investment "as defined in section 12T (1). Interest - R25 000 Hanna Montanna visited friends in South Africa from 1 January 2021 to 30 April 2021. She is planning to revisit South Africa to attend a wedding which will take place in December 2021 An airline is offering a discounted flight on a four-month return trip. Hanna Montanna can either take the flight that arrives in South Africa on: 1. 1 October 2021 and leave South Africa on 31 January 2022, or 2. 1 November 2021 and leave South Africa on 28 February 2022 REQUIRED : Based on Hanna's normal tax liability for the 2022 year of assessment, discuss whether she should make use of flight option 1 or option 2. Provide detailed calculations of her normal tax liability under the two options Start your answer with a detailed discussion on whether the section 10 (1)(h) interest exemption is applicable or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Section 101h of the South African Income Tax Act provides an exemption for interest income derived b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started