Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss whether the contract contains a lease according to the flow chart to assess whether a contract is, or contains, a lease. (CTSPS 4 and

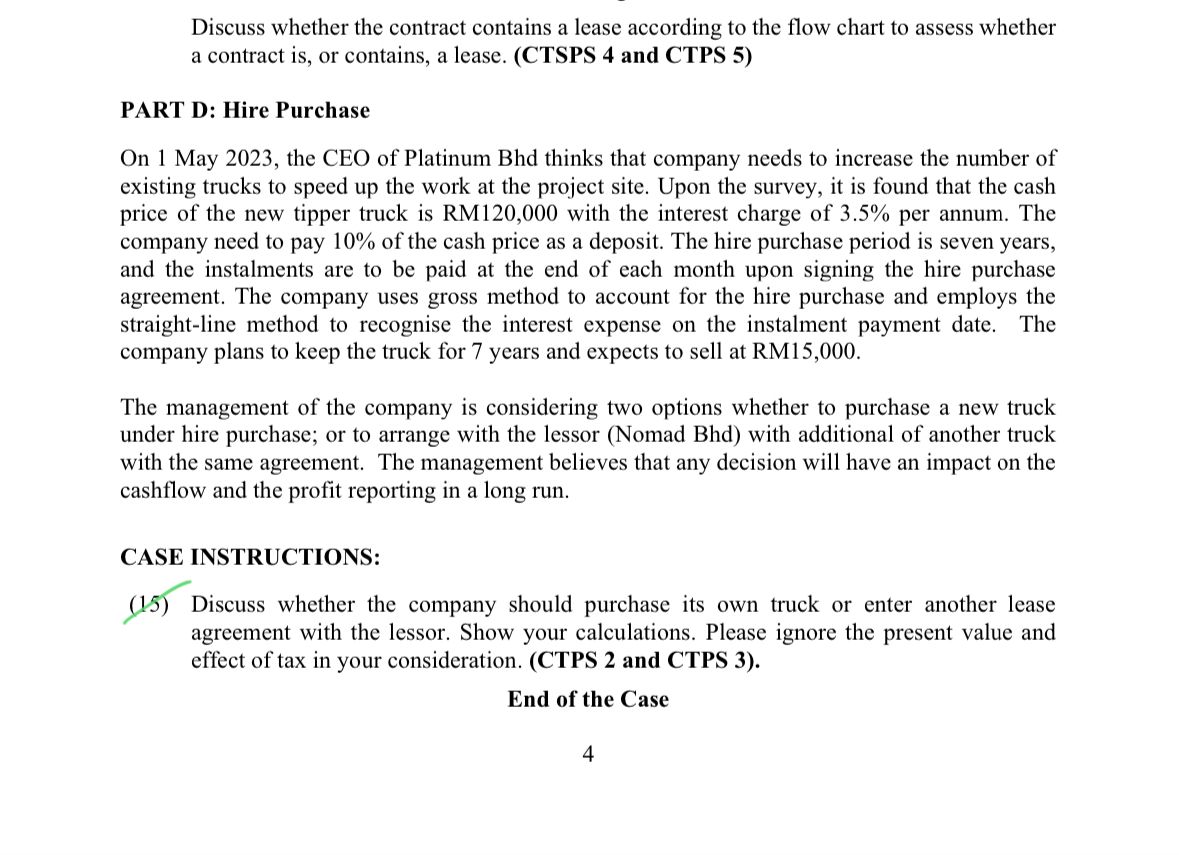

Discuss whether the contract contains a lease according to the flow chart to assess whether a contract is, or contains, a lease. (CTSPS 4 and CTPS 5) PART D: Hire Purchase On 1 May 2023, the CEO of Platinum Bhd thinks that company needs to increase the number of existing trucks to speed up the work at the project site. Upon the survey, it is found that the cash price of the new tipper truck is RM120,000 with the interest charge of 3.5% per annum. The company need to pay 10% of the cash price as a deposit. The hire purchase period is seven years, and the instalments are to be paid at the end of each month upon signing the hire purchase agreement. The company uses gross method to account for the hire purchase and employs the straight-line method to recognise the interest expense on the instalment payment date. The company plans to keep the truck for 7 years and expects to sell at RM15,000. The management of the company is considering two options whether to purchase a new truck under hire purchase; or to arrange with the lessor (Nomad Bhd) with additional of another truck with the same agreement. The management believes that any decision will have an impact on the cashflow and the profit reporting in a long run. CASE INSTRUCTIONS: (15) Discuss whether the company should purchase its own truck or enter another lease agreement with the lessor. Show your calculations. Please ignore the present value and effect of tax in your consideration. (CTPS 2 and CTPS 3)

Discuss whether the contract contains a lease according to the flow chart to assess whether a contract is, or contains, a lease. (CTSPS 4 and CTPS 5) PART D: Hire Purchase On 1 May 2023, the CEO of Platinum Bhd thinks that company needs to increase the number of existing trucks to speed up the work at the project site. Upon the survey, it is found that the cash price of the new tipper truck is RM120,000 with the interest charge of 3.5% per annum. The company need to pay 10% of the cash price as a deposit. The hire purchase period is seven years, and the instalments are to be paid at the end of each month upon signing the hire purchase agreement. The company uses gross method to account for the hire purchase and employs the straight-line method to recognise the interest expense on the instalment payment date. The company plans to keep the truck for 7 years and expects to sell at RM15,000. The management of the company is considering two options whether to purchase a new truck under hire purchase; or to arrange with the lessor (Nomad Bhd) with additional of another truck with the same agreement. The management believes that any decision will have an impact on the cashflow and the profit reporting in a long run. CASE INSTRUCTIONS: (15) Discuss whether the company should purchase its own truck or enter another lease agreement with the lessor. Show your calculations. Please ignore the present value and effect of tax in your consideration. (CTPS 2 and CTPS 3) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started