Answered step by step

Verified Expert Solution

Question

1 Approved Answer

.Discuss whether the standard deviation of a portfolio is, or is not, a weighted average of the standard deviations of the assets in the portfolio.

.Discuss whether the standard deviation of a portfolio is, or is not, a weighted average of the standard deviations of the assets in the portfolio. Explain your answer.

2.How does opportunity cost affect an investor's required rate of return?

3.Discuss the two components of a portfolios risk that has been used to measure a firm's market risk.

4.Calculate the following for each projects

- Expected return

- Variance and standard deviation

- Coefficient of variation

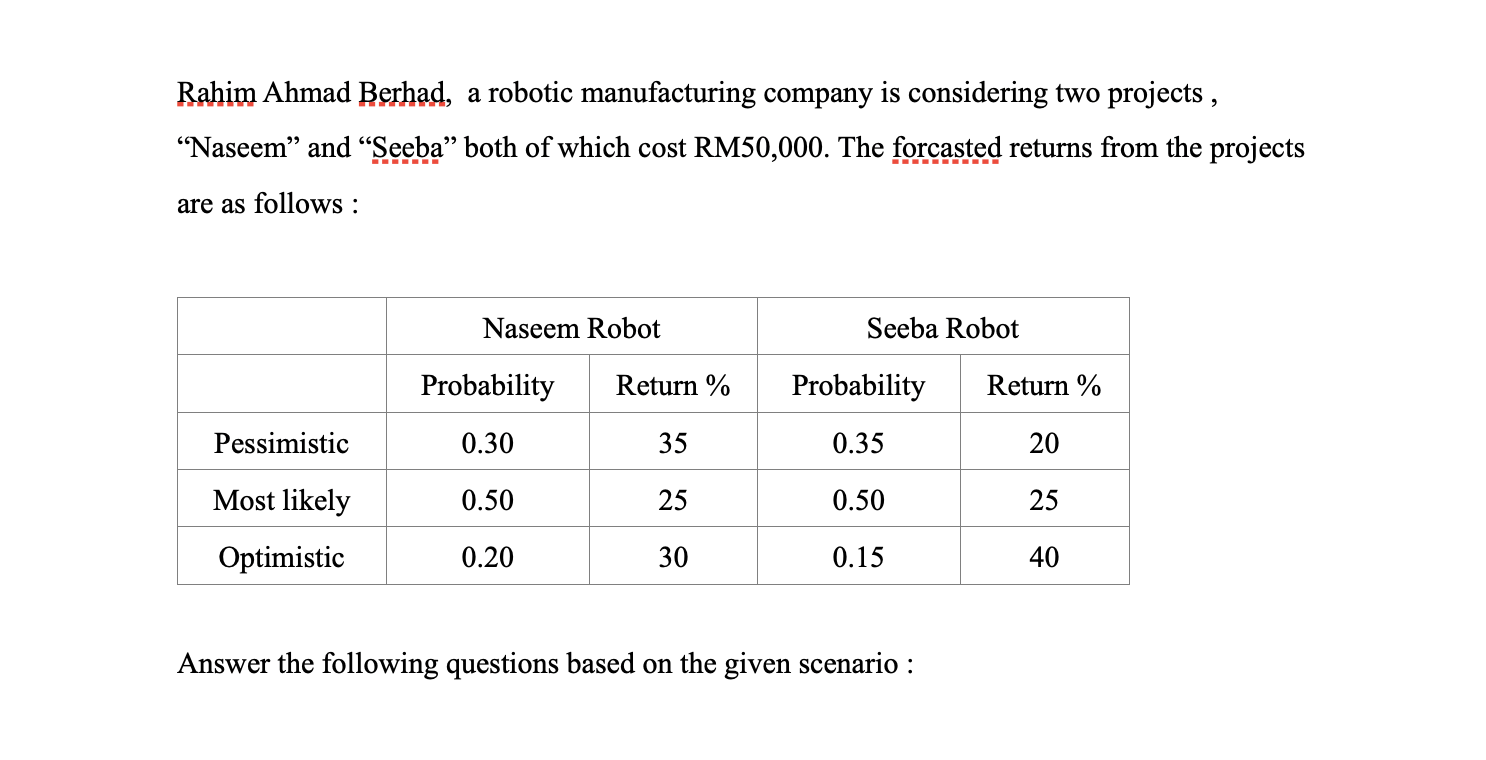

Rahim Ahmad Berhad, a robotic manufacturing company is considering two projects , Naseem and Seeba both of which cost RM50,000. The forcasted returns from the projects are as follows: Naseem Robot Seeba Robot Probability Return % Probability Return % Pessimistic 0.30 35 0.35 20 Most likely 0.50 25 0.50 25 Optimistic 0.20 30 0.15 40 Answer the following questions based on the given scenario

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started