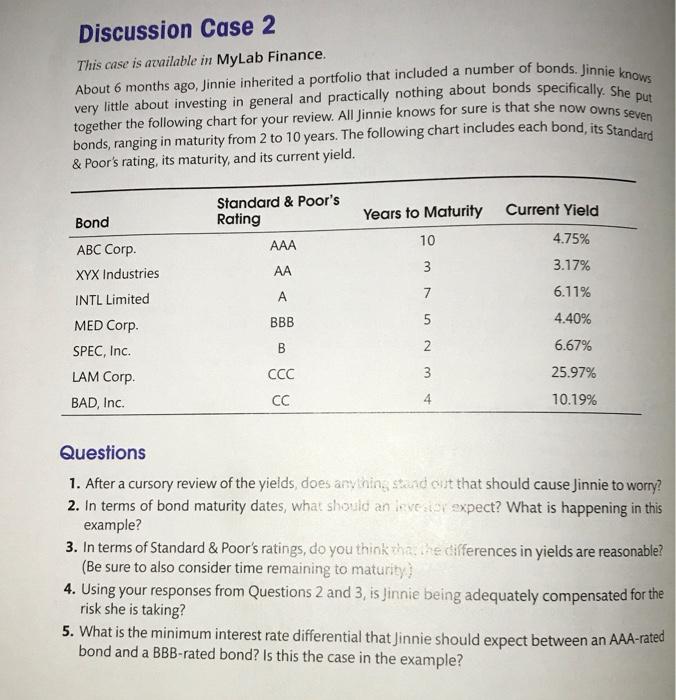

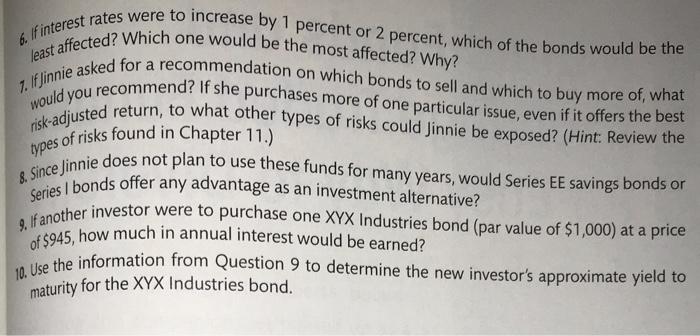

Discussion Case 2 This case is available in MyLab Finance About 6 months ago, Jinnie inherited a portfolio that included a number of bonds. Jinnie knows very little about investing in general and practically nothing about bonds specifically. She put together the following chart for your review. All Jinnie knows for sure is that she now owns seven bonds, ranging in maturity from 2 to 10 years. The following chart includes each bond, its Standard & Poor's rating, its maturity, and its current yield. Current Yield Bond Standard & Poor's Rating AAA Years to Maturity 10 4.75% AA 3 3.17% A 7 6.11% 5 BBB 5 ABC Corp. XYX Industries INTL Limited MED Corp SPEC, Inc. LAM Corp. BAD, Inc. 4.40% B 2 6.67% CCC 3 25.97% CC 4 10.19% Questions 1. After a cursory review of the yields, does anything stand out that should cause Jinnie to worry? 2. In terms of bond maturity dates, what should an investoy expect? What is happening in this example? 3. In terms of Standard & Poor's ratings, do you think that the differences in yields are reasonable? (Be sure to also consider time remaining to maturity) 4. Using your responses from Questions 2 and 3, is Jinnie being adequately compensated for the risk she is taking? 5. What is the minimum interest rate differential that Jinnie should expect between an AAA-rated bond and a BBB-rated bond? Is this the case in the example? would 6. If interest rates were to increase by 1 percent or 2 percent, which of the bonds would be the least affected? Which one would be the most affected? Why? 7. If Jinnie asked for a recommendation on which bonds to sell and which to buy more of, what risk-adjusted return, to what other types of risks could Jinnie be exposed? (Hint: Review the of risks found in Chapter 11.) & Since Jinnie does not plan to use these funds for many years, would Series EE savings bonds or Series / bonds offer any advantage as an investment alternative? 9. If another investor were to purchase one XYX Industries bond (par value of $1,000) at a price of $945, how much in annual interest would be earned? types maturity for the XYX Industries bond