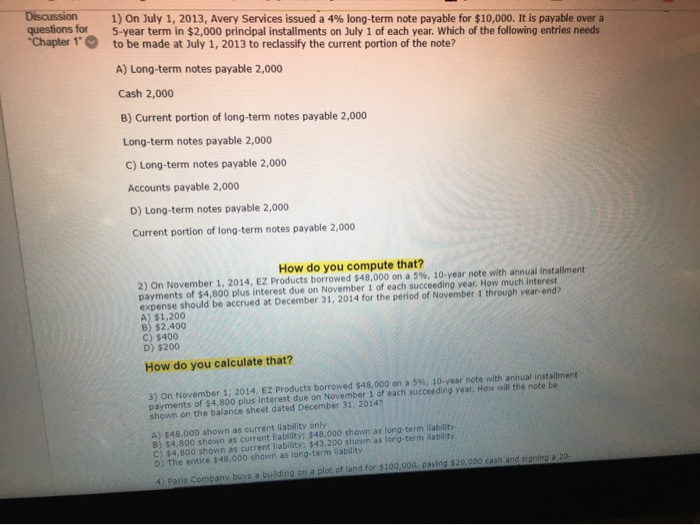

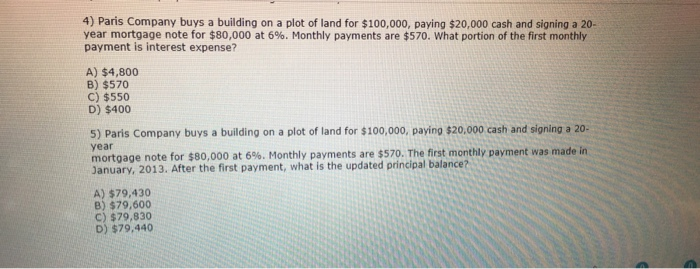

Discussion questions for "Chapter 1 1) On July 1, 2013, Avery Services issued a 4% long-term note payable for $10,000. It is payable over a 5-year term in $2,000 principal installments on July 1 of each year. Which of the following entries needs to be made at July 1, 2013 to reclassify the current portion of the note? A) Long-term notes payable 2,000 Cash 2,000 B) Current portion of long-term notes payable 2,000 Long-term notes payable 2,000 C) Long-term notes payable 2,000 Accounts payable 2,000 D) Long-term notes payable 2,000 Current portion of long-term notes payable 2,000 How do you compute that? 2) On November 1, 2014, EZ Products borrowed $48,000 on a 5%, 10-year note with annual installment payments of $4,800 plus interest due on November 1 of each succeeding year. How much interest expense should be accrued at December 31, 2014 for the period of November 1 through year-end? A) $1,200 B) $2.400 C) 5400 D) $200 How do you calculate that? 3) on November 1, 2014, EZ Products borrowed $48.000 on a 5, 10-year note with annual installment payments of $4,800 plus interest due on November 1 of each succeeding year. How will the note be shown on the balance sheet dated December 31, 20147 C A) $45.000 shown as current liability only B) 54.800 shown as current liability: $48.000 shown as long-term ability 54.800 shown as current liability 543,200 shown as long-term buty D) The entire 548.000 shown as long-termauity Company bus building on a plot of land for $100.000 paring 120.000 am and 20 4) Paris Company buys a building on a plot of land for $100.000. Daving $20.000 cash and signing a 20- year mortgage note for $80,000 at 6%. Monthly payments are $570. What portion of the first monthly payment is interest expense? A) $4,800 B) $570 C) $550 D) $400 5) Paris Company buys a building on a plot of land for $100,000, paying $20,000 cash and signing a 20- year mortgage note for $80,000 at 6%. Monthly payments are $570. The first monthly payment was made in January, 2013. After the first payment, what is the updated principal balance? A) $79,430 B) $79,600 C) $79,830 D) $79,440 Steps how to get Answer : That way I can see the Process pls