Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Discussion / Workings Providing the full description of the mathematical workings for all projects and discussion on the theoretical aspects identified by the manager

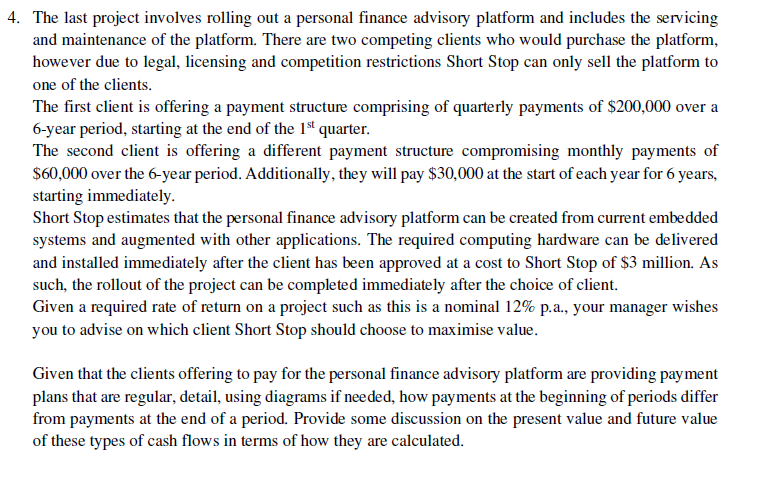

- Discussion / Workings Providing the full description of the mathematical workings for all projects and discussion on the theoretical aspects identified by the manager Brief: You have recently been employed at Short Stop Technology as an analyst to provide experience in valuation techniques and for your fundamental knowledge of financial theory. Your new employer is within the financial technology firm and employs many computer science and engineering graduates. As such, many of your new colleagues have little knowledge of your field of expertise and, possibly more importantly, neither does your manager or her boss. Your manger has little knowledge of finance therefore it is your responsibility to provide financial theory and all mathematical calculations for any investment(s). Background: Your manager, for whom you are writing the report, is an engineer and will, after reading your report, deliver the highlights of the report onto the company board. While your manager's knowledge of maths and statistics is extensive, her knowledge of financial theory and financial mathematics is almost nonexistent. As the objective of the company is to expand the business to position the company in the FinTech space, mangers within the company have identified several possible expansion projects that are appealing. These projects have basic estimates of the cash flows and are both short and long term in duration. In your capacity as an analyst, you do not need to identify other investments at this stage of your employment and, as such, the report should only detail the viability and the surrounding financial theory of the investments. Lastly, the company has access to funding for these projects through loans or internally generated revenue, it is not expected that you make a judgement on the ability of investment or how many projects the company can invest. Rather you are expected to provide advice on each investment in isolation from the other investments, i.e. not as a portfolio of investments. 4. The last project involves rolling out a personal finance advisory platform and includes the servicing and maintenance of the platform. There are two competing clients who would purchase the platform, however due to legal, licensing and competition restrictions Short Stop can only sell the platform to one of the clients. The first client is offering a payment structure comprising of quarterly payments of $200,000 over a 6-year period, starting at the end of the 1st quarter. The second client is offering a different payment structure compromising monthly payments of $60,000 over the 6-year period. Additionally, they will pay $30,000 at the start of each year for 6 years, starting immediately. Short Stop estimates that the personal finance advisory platform can be created from current embedded systems and augmented with other applications. The required computing hardware can be delivered and installed immediately after the client has been approved at a cost to Short Stop of $3 million. As such, the rollout of the project can be completed immediately after the choice of client. Given a required rate of return on a project such as this is a nominal 12% p.a., your manager wishes you to advise on which client Short Stop should choose to maximise value. Given that the clients offering to pay for the personal finance advisory platform are providing payment plans that are regular, detail, using diagrams if needed, how payments at the beginning of periods differ from payments at the end of a period. Provide some discussion on the present value and future value of these types of cash flows in terms of how they are calculated

- Discussion / Workings Providing the full description of the mathematical workings for all projects and discussion on the theoretical aspects identified by the manager Brief: You have recently been employed at Short Stop Technology as an analyst to provide experience in valuation techniques and for your fundamental knowledge of financial theory. Your new employer is within the financial technology firm and employs many computer science and engineering graduates. As such, many of your new colleagues have little knowledge of your field of expertise and, possibly more importantly, neither does your manager or her boss. Your manger has little knowledge of finance therefore it is your responsibility to provide financial theory and all mathematical calculations for any investment(s). Background: Your manager, for whom you are writing the report, is an engineer and will, after reading your report, deliver the highlights of the report onto the company board. While your manager's knowledge of maths and statistics is extensive, her knowledge of financial theory and financial mathematics is almost nonexistent. As the objective of the company is to expand the business to position the company in the FinTech space, mangers within the company have identified several possible expansion projects that are appealing. These projects have basic estimates of the cash flows and are both short and long term in duration. In your capacity as an analyst, you do not need to identify other investments at this stage of your employment and, as such, the report should only detail the viability and the surrounding financial theory of the investments. Lastly, the company has access to funding for these projects through loans or internally generated revenue, it is not expected that you make a judgement on the ability of investment or how many projects the company can invest. Rather you are expected to provide advice on each investment in isolation from the other investments, i.e. not as a portfolio of investments. 4. The last project involves rolling out a personal finance advisory platform and includes the servicing and maintenance of the platform. There are two competing clients who would purchase the platform, however due to legal, licensing and competition restrictions Short Stop can only sell the platform to one of the clients. The first client is offering a payment structure comprising of quarterly payments of $200,000 over a 6-year period, starting at the end of the 1st quarter. The second client is offering a different payment structure compromising monthly payments of $60,000 over the 6-year period. Additionally, they will pay $30,000 at the start of each year for 6 years, starting immediately. Short Stop estimates that the personal finance advisory platform can be created from current embedded systems and augmented with other applications. The required computing hardware can be delivered and installed immediately after the client has been approved at a cost to Short Stop of $3 million. As such, the rollout of the project can be completed immediately after the choice of client. Given a required rate of return on a project such as this is a nominal 12% p.a., your manager wishes you to advise on which client Short Stop should choose to maximise value. Given that the clients offering to pay for the personal finance advisory platform are providing payment plans that are regular, detail, using diagrams if needed, how payments at the beginning of periods differ from payments at the end of a period. Provide some discussion on the present value and future value of these types of cash flows in terms of how they are calculated Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started