Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Disney needs to close Magic Kingdom to remodel and update the castle. Disney's advisors presented two renovation alternatives: (1) a quick facelift or (2)

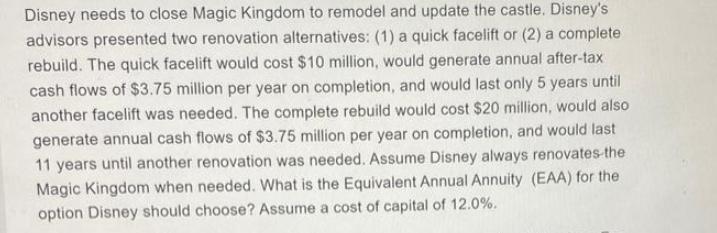

Disney needs to close Magic Kingdom to remodel and update the castle. Disney's advisors presented two renovation alternatives: (1) a quick facelift or (2) a complete rebuild. The quick facelift would cost $10 million, would generate annual after-tax cash flows of $3.75 million per year on completion, and would last only 5 years until another facelift was needed. The complete rebuild would cost $20 million, would also generate annual cash flows of $3.75 million per year on completion, and would last 11 years until another renovation was needed. Assume Disney always renovates-the Magic Kingdom when needed. What is the Equivalent Annual Annuity (EAA) for the option Disney should choose? Assume a cost of capital of 12.0%. David's Fine Kitchen purchased a $300000 machine that falls into Class 39 with a 25% depreciation rate. The machine is used for 4 years and then sold. Calculate the depreciation expense in year 2.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense in year 2 for Davids Fine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started