Answered step by step

Verified Expert Solution

Question

1 Approved Answer

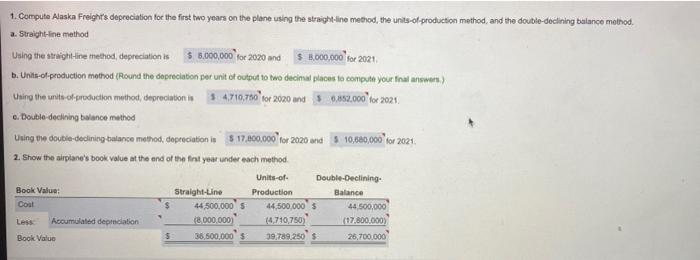

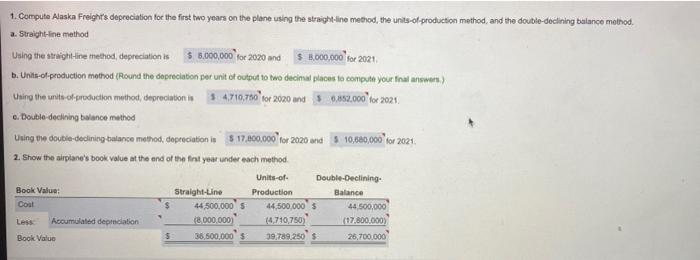

disregard the first pictures' numbers in red. reference key for the totals are found in the second photo please utilize those. 1. ComputeAlaska Freight's depreciation

disregard the first pictures' numbers in red. reference key for the totals are found in the second photo please utilize those.

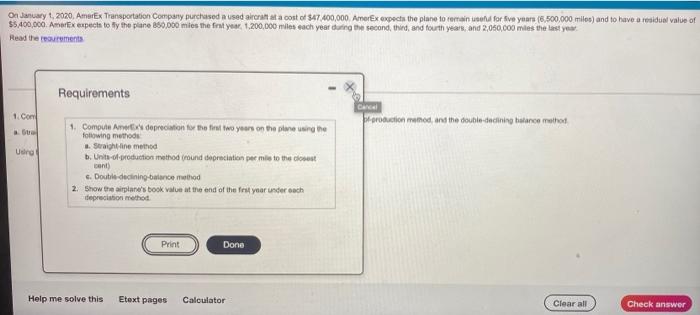

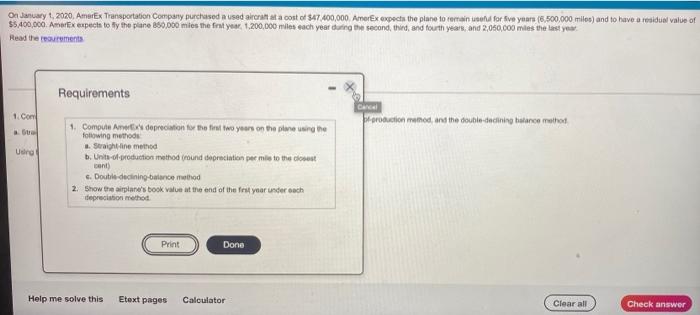

1. ComputeAlaska Freight's depreciation for the first two years on the plane using the straight-line method, the units of production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, depreciation is $ 6,000,000 for 2020 and $ 2,000,000 for 2021 b. Units-of-production method (Round the depreciation per unit of output to two decimal places to compute your final answers.) Using the units of production method, depreciation is 14710,700 for 2020 und 6,882,000 for 2021 c. Double declining balance method Using the double-declining balance method, depreciation in $17,000,000 for 2020 and $10,680,000 for 2021 2. Show the airplane's book value at the end of the first year under each method Units-of- Double-Declining Straight-Line Production Balance Cost 44 500,000 $ 44,500,000 $ 44 500,000 Accumulated depreciation (8000.000) (4,710,750) (17.800.000 38.500,000 $ Book Value 39,789,250 $ 26.700.000 Book Value: Less On January 1, 2020. Amarex Transportation Company purchased a used alrcraft at a cost of $47 400,000 AmerEx expects the plane to remain user for five years (6.500,000 miles) and to have a residus value of $5.400,000. Amerx expects to the plane 850,000 miles the first year 1.200.000 miles each year during the second third and fourth years, and 2,050,000 miles the last year Read the rarements Requirements 1.Com Cancel poroduction method and the double-dedining balance method Udre 1. Computer's depreciation for the first two years on the plane sing the following methods Straight line method b. Units of production method found depreciation per me to the count Bent) 6. Double-declining balance method 2. Show the airplane's book value at the end of the first year under each depreciation method Print Done Help me solve this Etext pages Calculator Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started