Answered step by step

Verified Expert Solution

Question

1 Approved Answer

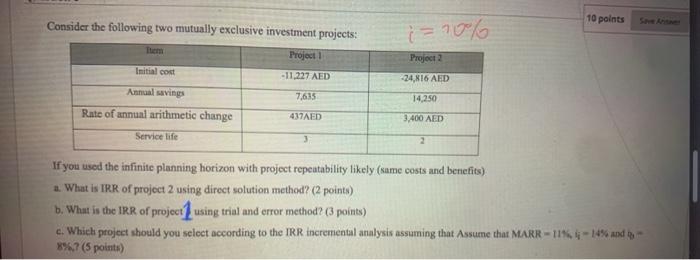

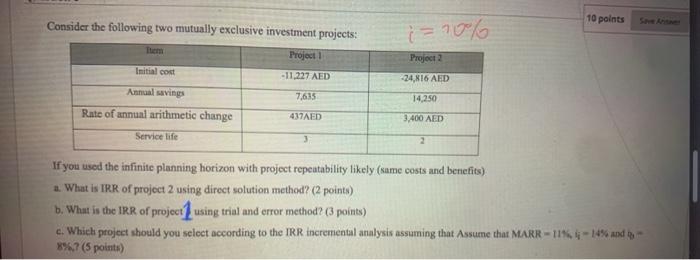

disregard the the written in red for part c). MARR=11%, ii=14%, ib=8% 10 points i=106 Consider the following two mutually exclusive investment projects: Project Initial

disregard the the written in red

for part c). MARR=11%, ii=14%, ib=8%

10 points i=106 Consider the following two mutually exclusive investment projects: Project Initial cost -11,227 AED Project 2 -24,816 AED Anaal savings 14.250 Rate of annual arithmetic change 7.635 437AED 9,400 AED Service life 3 If you used the infinite planning horizon with project repeutability likely (same costs and benefits) a. What is IRR of project 2 using direct solution method? (2 points) b. What is the IRR of project using trial and error method? (3 points) 6. Which project should you select according to the IRR incremental analysis assuming that Assume that MARR -11% -14% and 8%? (5 points) 10 points i=106 Consider the following two mutually exclusive investment projects: Project Initial cost -11,227 AED Project 2 -24,816 AED Anaal savings 14.250 Rate of annual arithmetic change 7.635 437AED 9,400 AED Service life 3 If you used the infinite planning horizon with project repeutability likely (same costs and benefits) a. What is IRR of project 2 using direct solution method? (2 points) b. What is the IRR of project using trial and error method? (3 points) 6. Which project should you select according to the IRR incremental analysis assuming that Assume that MARR -11% -14% and 8%? (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started