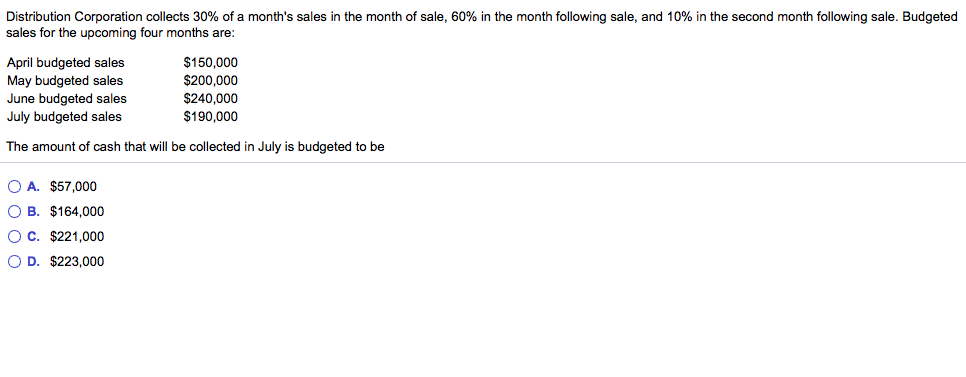

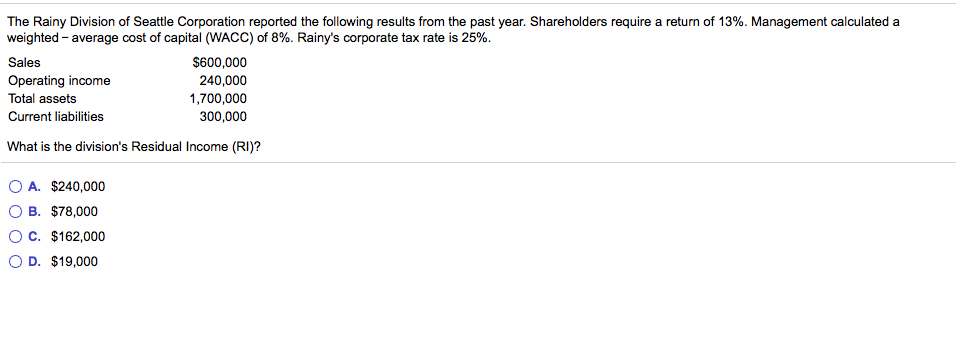

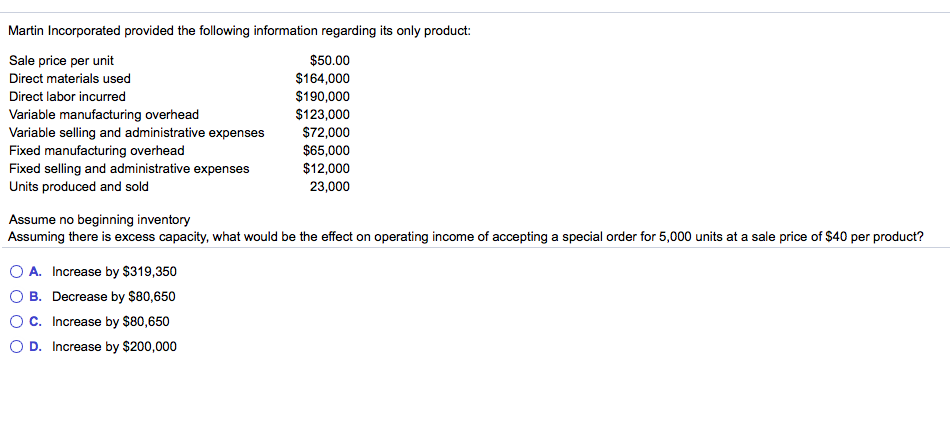

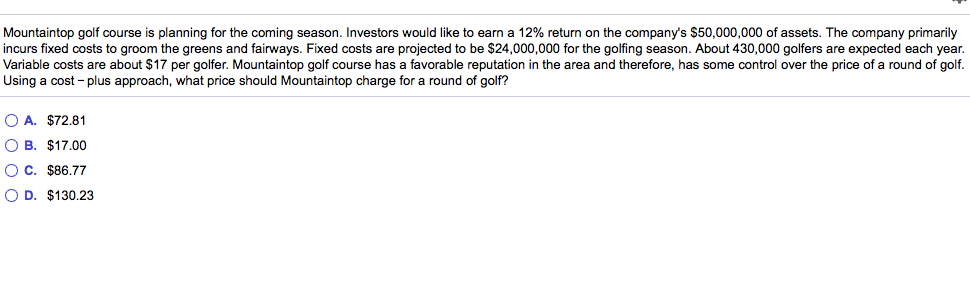

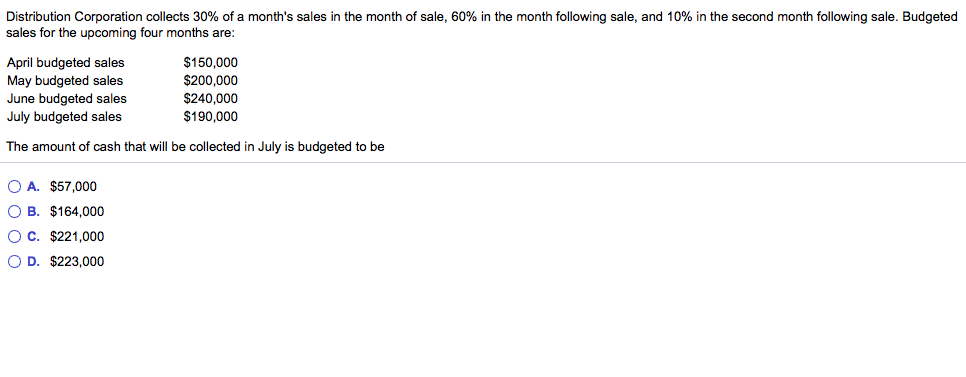

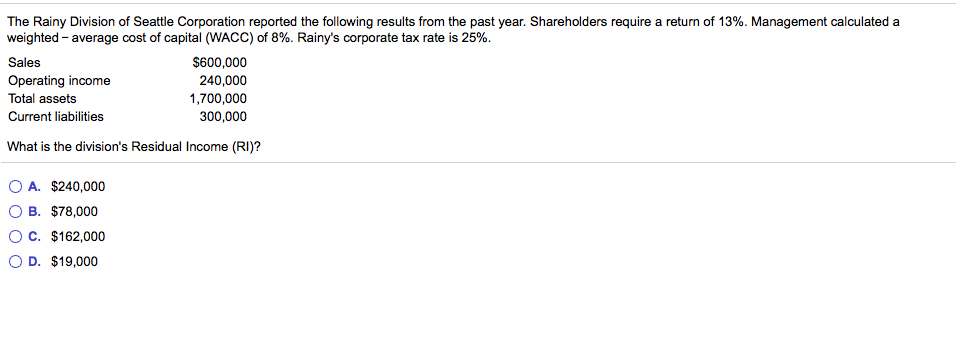

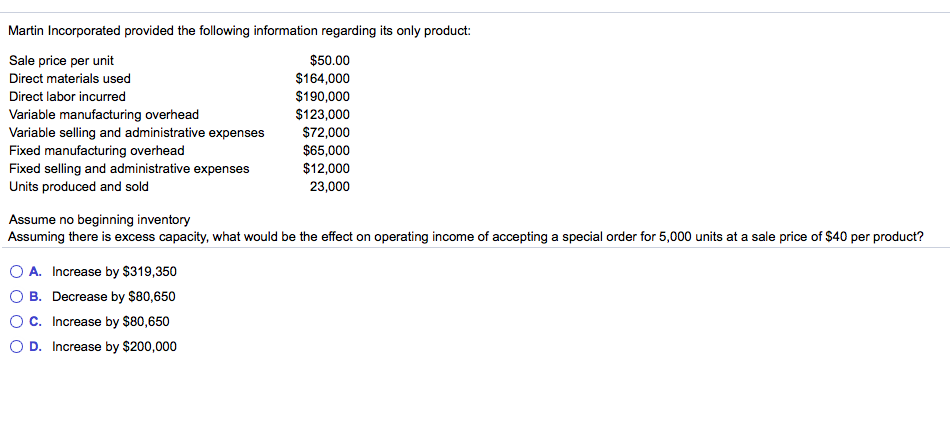

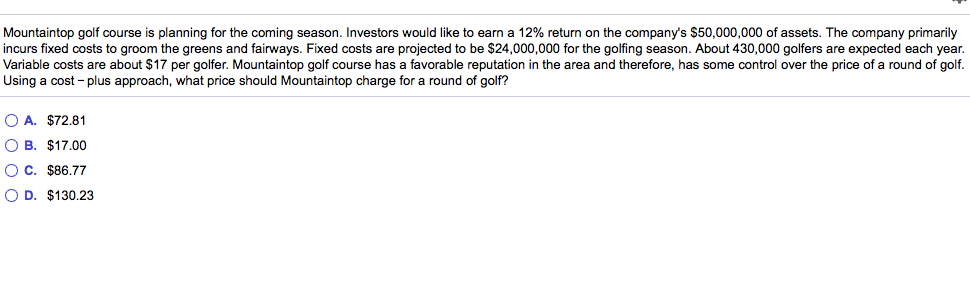

Distribution Corporation collects 30% of a month's sales in the month of sale, 60% in the month following sale, and 10% in the second month following sale. Budgeted sales for the upcoming four months are: April budgeted sales May budgeted sales June budgeted sales July budgeted sales $150,000 $200,000 $240,000 $190,000 The amount of cash that will be collected in July is budgeted to be O A. $57,000 OB. $164,000 OC. $221,000 OD. $223,000 The Rainy Division of Seattle Corporation reported the following results from the past year. Shareholders require a return of 13%. Management calculated a weighted - average cost of capital (WACC) of 8%. Rainy's corporate tax rate is 25%. Sales $600,000 Operating income 240,000 Total assets 1,700,000 Current liabilities 300,000 What is the division's Residual Income (RI)? O A. $240,000 OB. $78,000 OC. $162,000 OD. $19,000 Martin Incorporated provided the following information regarding its only product: Sale price per unit Direct materials used Direct labor incurred Variable manufacturing overhead Variable selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative expenses Units produced and sold $50.00 $164,000 $190,000 $123,000 $72,000 $65,000 $12,000 23,000 Assume no beginning inventory Assuming there is excess capacity, what would be the effect on operating income of accepting a special order for 5,000 units at a sale price of $40 per product? O A. Increase by $319,350 O B. Decrease by $80,650 OC. Increase by $80,650 OD. Increase by $200,000 Mountaintop golf course is planning for the coming season. Investors would like to earn a 12% return on the company's $50,000,000 of assets. The company primarily incurs fixed costs to groom the greens and fairways. Fixed costs are projected to be $24,000,000 for the golfing season. About 430,000 golfers are expected each year. Variable costs are about $17 per golfer. Mountaintop golf course has a favorable reputation in the area and therefore, has some control over the price of a round of golf. Using a cost-plus approach, what price should Mountaintop charge for a round of golf? O A. $72.81 OB. $17.00 OC. $86.77 OD. $130.23