Question

Ditafole (Pty) Ltd (Ditafole) was established in the year 2001 by the two brothers, Meza and Tafura. Ditafole manufactures tables to be sold to major

Ditafole (Pty) Ltd (Ditafole) was established in the year 2001 by the two brothers, Meza and Tafura. Ditafole manufactures tables to be sold to major retailers and individuals who wish to buy in bulk. There are two types of tables manufactured, the Marble and Quartz tables. Ditafole has a 31 December year-end. The Financial Manager, Ms. Isichazamazwi, will be reviewing all the financial budgets in the coming week when she is back from a conference in Cape Town. Ms. Isichazamazwi has tasked you to compile a cash budget for the finance team while other team members work on other budgets.

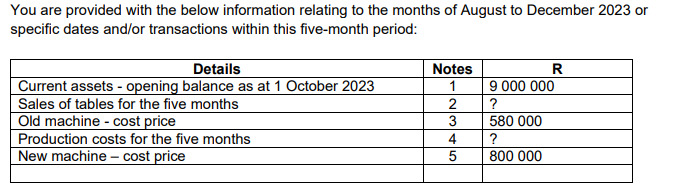

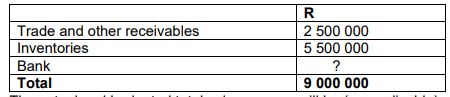

1. The extract with the current assets section of the actual statement of financial position on 30 September 2023:

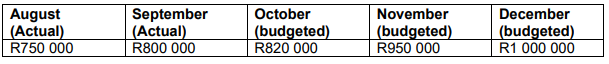

2. The actual and budgeted total sales were or will be (as applicable) as follows:

The cash collection in terms of the total sales for each individual month is projected to be as follows:

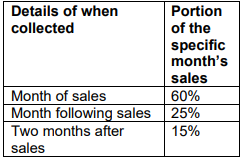

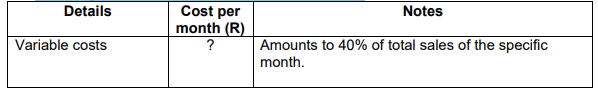

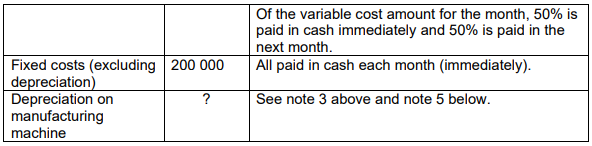

3. The sale of the old machine: The old machine used in production of the tables is expected to be sold during the month of November 2023. The cost of the old machine was R580 000 three years ago. The depreciation of all machines is 15% each year on cost. The machine is likely to be sold for R300 000 based on the ongoing negotiations. 4. The budgeted total production costs are as follows:

5. The purchase of the new machine: The new machine to produce tables with will be purchased for cash in December 2023. The expected purchase price in the market during October 2023 is R800 000. This price is not expected to change in the next 12 months. The depreciation policy of the company will be consistent throughout the 2023 financial year. REQUIRED Round only your final answer to the nearest whole number. (a) Prepare the cash budget of Ditafole (Pty) Ltd for the months of October, November, and December 2023. Important: Use a separate column for each month. Total column is not required. (20)

\begin{tabular}{|l|l|} \hline & R \\ \hline Trade and other receivables & 2500000 \\ \hline Inventories & 5500000 \\ \hline Bank & ? \\ \hline Total & 9000000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \begin{tabular}{l} Details of when \\ collected \end{tabular} & \begin{tabular}{l} Portion \\ of the \\ specific \\ month's \\ sales \end{tabular} \\ \hline Month of sales & 60% \\ \hline Month following sales & 25% \\ \hline \begin{tabular}{l} Two months after \\ sales \end{tabular} & 15% \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \begin{tabular}{l} August \\ (Actual) \end{tabular} & \begin{tabular}{l} September \\ (Actual) \end{tabular} & \begin{tabular}{l} October \\ (budgeted) \end{tabular} & \begin{tabular}{l} November \\ (budgeted) \end{tabular} & \begin{tabular}{l} December \\ (budgeted) \end{tabular} \\ \hline R750 000 & R800 000 & R820000 & R950000 & R1000 000 \\ \hline \end{tabular} \begin{tabular}{|l|c|l|} \hline \multicolumn{1}{|c|}{ Details } & \begin{tabular}{c} Cost per \\ month (R) \end{tabular} & \multicolumn{1}{|c|}{ Notes } \\ \hline Variable costs & ? & \begin{tabular}{l} Amounts to 40\% of total sales of the specific \\ month. \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|l|c|l|} \hline & & \begin{tabular}{l} Of the variable cost amount for the month, 50\% is \\ paid in cash immediately and 50\% is paid in the \\ next month. \end{tabular} \\ \hline \begin{tabular}{l} Fixed costs (excluding \\ depreciation) \end{tabular} & 200000 & All paid in cash each month (immediately). \\ \hline \begin{tabular}{l} Depreciation on \\ manufacturing \\ machine \end{tabular} & ? & See note 3 above and note 5 below. \\ \hline \end{tabular} You are provided with the below information relating to the months of August to December 2023 or specific dates and/or transactions within this five-month periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started