Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Diversified Products, Inc., has recently acquired a small publishing company that offers three books for salea cookbook, a travel guide, and a handy speller. Each

Diversified Products, Inc., has recently acquired a small publishing company that offers three books for salea cookbook, a travel guide, and a handy speller. Each book sells for $10. The publishing companys most recent monthly income statement is shown below.

Product Line

Total

Company

Cookbook

Travel

Guide

Handy

Speller

Sales

$

300,000

$

90,000

$

150,000

$

60,000

Expenses:

Printing costs

102,000

27,000

63,000

12,000

Advertising

36,000

13,500

19,500

3,000

General sales

18,000

5,400

9,000

3,600

Salaries

33,000

18,000

9,000

6,000

Equipment depreciation

9,000

3,000

3,000

3,000

Sales commissions

30,000

9,000

15,000

6,000

General administration

42,000

14,000

14,000

14,000

Warehouse rent

12,000

3,600

6,000

2,400

Depreciationoffice facilities

3,000

1,000

1,000

1,000

Total expenses

285,000

94,500

139,500

51,000

Net operating income (loss)

$

15,000

$

(4,500

)

$

10,500

$

9,000

The following additional information is available:

a. Only printing costs and sales commissions are variable; all other costs are fixed. The printing costs (which include materials, labor, and variable overhead) are traceable to the three product lines as shown in the income statement above. Sales commissions are 10% of sales.

b. The same equipment is used to produce all three books, so the equipment depreciation expense has been allocated equally among the three product lines. An analysis of the companys activities indicates that the equipment is used 30% of the time to produce cookbooks, 50% of the time to produce travel guides, and 20% of the time to produce handy spellers.

c. The warehouse is used to store finished units of product, so the rental cost has been allocated to the product lines on the basis of sales dollars. The warehouse rental cost is $3 per square foot per year. The warehouse contains 48,000 square feet of space, of which 7,200 square feet is used by the cookbook line, 24,000 square feet by the travel guide line, and 16,800 square feet by the handy speller line.

d. The general sales cost above includes the salary of the sales manager and other sales costs not traceable to any specific product line. This cost has been allocated to the product lines on the basis of sales dollars.

e. The general administration cost and depreciation of office facilities both relate to administration of the company as a whole. These costs have been allocated equally to the three product lines.

f. All other costs are traceable to the three product lines in the amounts shown on the income statement above.

The management of Diversified Products, Inc., is anxious to improve the publishing companys 5% return on sales.

Required:

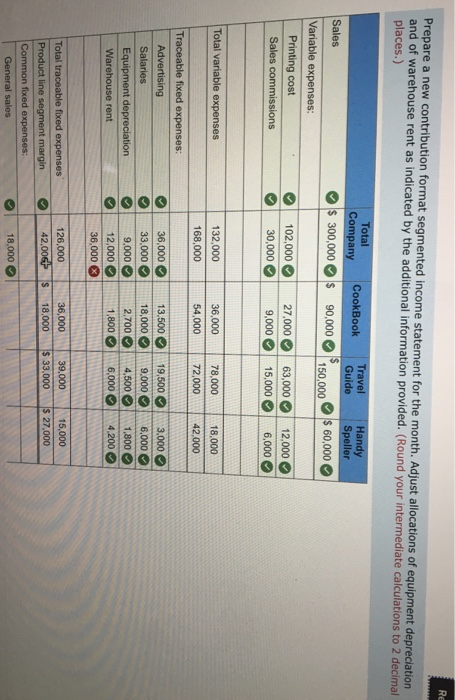

1. Prepare a new contribution format segmented income statement for the month. Adjust allocations of equipment depreciation and of warehouse rent as indicated by the additional information provided.

2. Based on the segmented income statements given in the problem, management plans to eliminate the cookbook because it is not returning a profit, and to focus all available resources on promoting the travel guide. However, based on the new contribution format segmented income statement that you prepared:

a. Do you agree with management's plan to eliminate the cookbook?

b-1. Compute the contribution margin ratio for each product.

b-2. Based on the statement you have prepared, do you agree with the decision to focus all available resources on promoting the travel guide?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started