Answered step by step

Verified Expert Solution

Question

1 Approved Answer

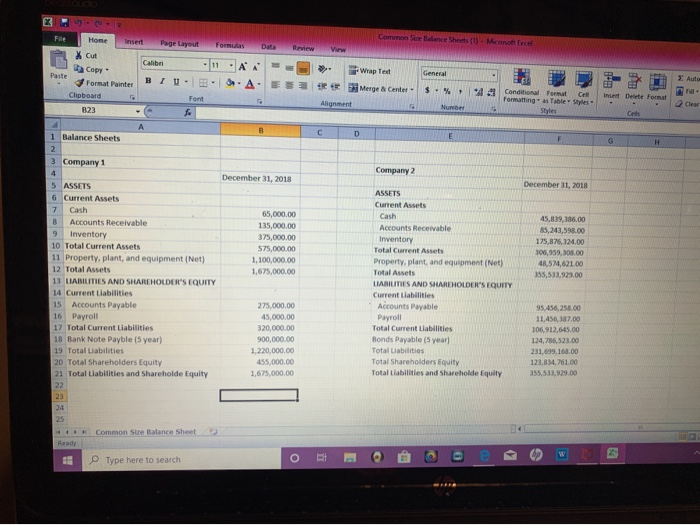

Divide each ledger account by total assets to get a percentage of total assets. Do this for both balance sheets. XR Common See Balance Sheets

Divide each ledger account by total assets to get a percentage of total assets. Do this for both balance sheets.

XR Common See Balance Sheets (1) - Microsoft Excel - X Cut Wap Test Copy Calibri AA BIU-BOA Paste Merge Center % Format Painter Conditional Format Formatting as Table Celine Dite forma Styles 1 Balance Sheets 3 Company 1 Company 2 December 31, 2018 December 31, 2018 65.000.00 135,000.00 375,000.00 575.000.00 1,100,000.00 1.675.000.00 5 ASSETS 6 Current Assets 7 Carsh B Accounts Receivable 9 Inventory 10 Total Current Assets 11 Property, plant, and equipment (Net) 12 Total Assets 13 LIABILITIES AND SHAREHOLDER'S EQUITY 14 Current Liabilities 15 Accounts Payable 16 Payroll 17 Total Current Liabilities 18 Bank Note Payble 15 year) 19 Total Liabilities 20 Total Shareholders Equity 21 Total Liabilities and Shareholde Equity ASSETS Current Assets Cash Accounts Receivable Inventory Total Current Assets Property, plant and equipment (Net) Total Assets LIABILITIES AND SHAREHOLDER'S EQUITY Current Liabilities Accounts Payable 5.3 .00 35,241,598.00 125. 8 2 .00 106. 5 00 4,5 ,621.00 00 Payroll 275.000.00 45.000.00 320.000.00 900,000.00 1,220,000.00 455.000.00 1,675,000.00 Total Current Liabilities Bonds Payable 15 year) Total Liabilities Total Shareholders Equity Total Liabilities and Shareholde Equity 11,456, 187,00 106912,645.00 17.00 211.699,160.00 14100 Common Size Balance Sheet Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started