Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dividend growth model of oil and gas development company Dividend Growth Model, Free cash flow valuation model and book value per share method 1. You

Dividend growth model of oil and gas development company

Dividend Growth Model, Free cash flow valuation model and book value per share method

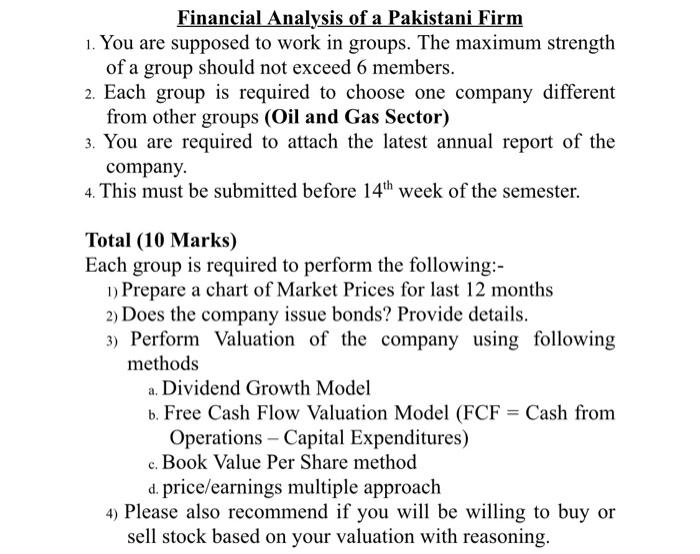

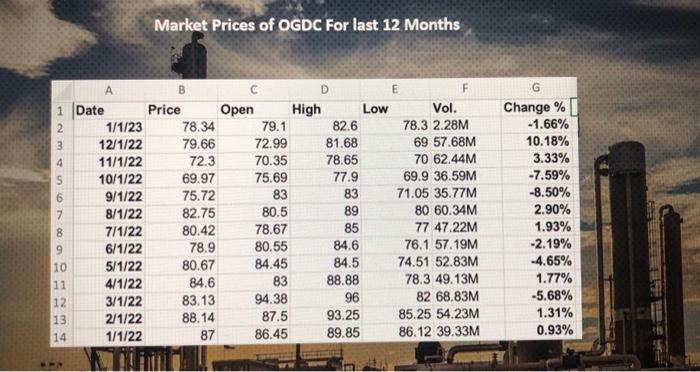

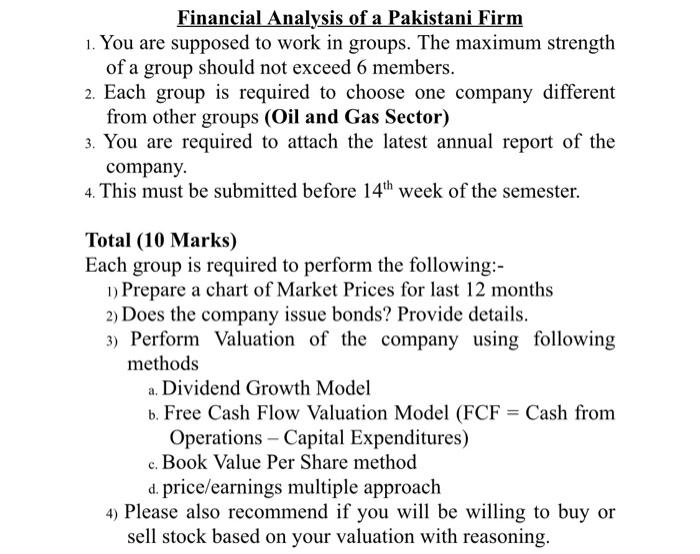

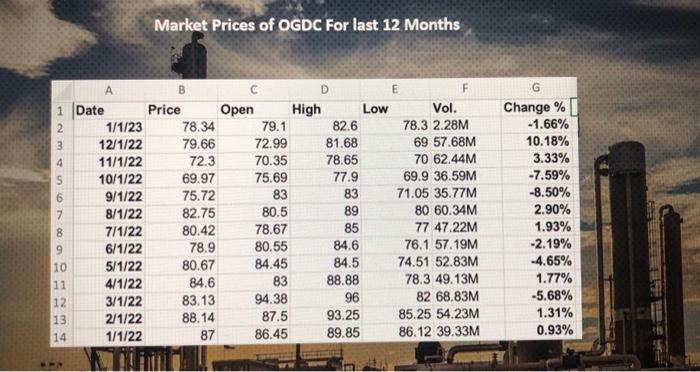

1. You are supposed to work in groups. The maximum strength of a group should not exceed 6 members. 2. Each group is required to choose one company different from other groups (Oil and Gas Sector) 3. You are required to attach the latest annual report of the company. 4. This must be submitted before 14th week of the semester. Total (10 Marks) Each group is required to perform the following:- 1) Prepare a chart of Market Prices for last 12 months 2) Does the company issue bonds? Provide details. 3) Perform Valuation of the company using following methods a. Dividend Growth Model b. Free Cash Flow Valuation Model (FCF= Cash from Operations - Capital Expenditures) c. Book Value Per Share method d. price/earnings multiple approach 4) Please also recommend if you will be willing to buy or sell stock based on your valuation with reasoning. Market Prices of OGDC For last 12 Months 1. You are supposed to work in groups. The maximum strength of a group should not exceed 6 members. 2. Each group is required to choose one company different from other groups (Oil and Gas Sector) 3. You are required to attach the latest annual report of the company. 4. This must be submitted before 14th week of the semester. Total (10 Marks) Each group is required to perform the following:- 1) Prepare a chart of Market Prices for last 12 months 2) Does the company issue bonds? Provide details. 3) Perform Valuation of the company using following methods a. Dividend Growth Model b. Free Cash Flow Valuation Model (FCF= Cash from Operations - Capital Expenditures) c. Book Value Per Share method d. price/earnings multiple approach 4) Please also recommend if you will be willing to buy or sell stock based on your valuation with reasoning. Market Prices of OGDC For last 12 Months

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started