Question

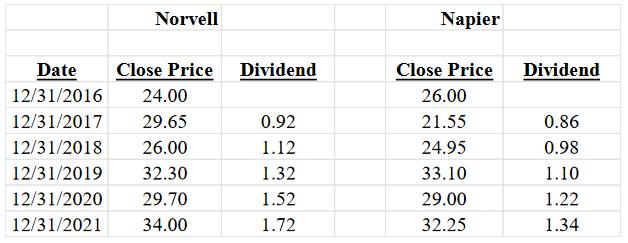

Use the end of year price and dividend data (dividend paid during year) provided below for the common stocks of Norvell and Mullen to respond

Use the end of year price and dividend data (dividend paid during year) provided below for the common stocks of Norvell and Mullen to respond to part a through part e.

a. Compute the annual holding period returns for 2017 through 2021 for each stock

b. Compute the arithmetic mean annual return and the geometric mean annual return over the five

year period for each stock.

c. Compute the standard deviation of the annual returns over the five-year period for each stock.

d. Assuming that the inflation rate was 2.34% in 2019, what was the "real rate of return" on Norvell’s

common stock in 2019?

e. Given that the annual yield on a one-year Treasury Note in 2021 was 2.26%, what was the ex post

risk premium on Napier’s common stock in 2021?

Norvell Napier Date 12/31/2016 Close Price Dividend Close Price Dividend 24.00 26.00 12/31/2017 29.65 0.92 21.55 0.86 12/31/2018 26.00 1.12 24.95 0.98 12/31/2019 32.30 1.32 33.10 1.10 12/31/2020 29.70 1.52 29.00 1.22 12/31/2021 34.00 1.72 32.25 1.34

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the franking debit amount we first need to determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started