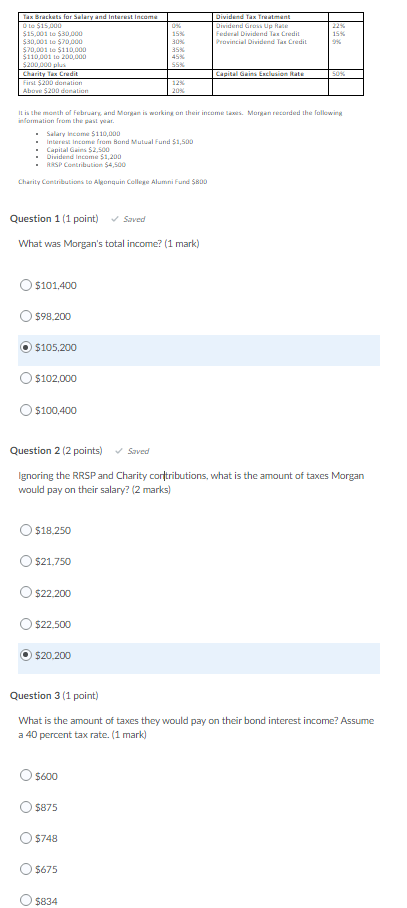

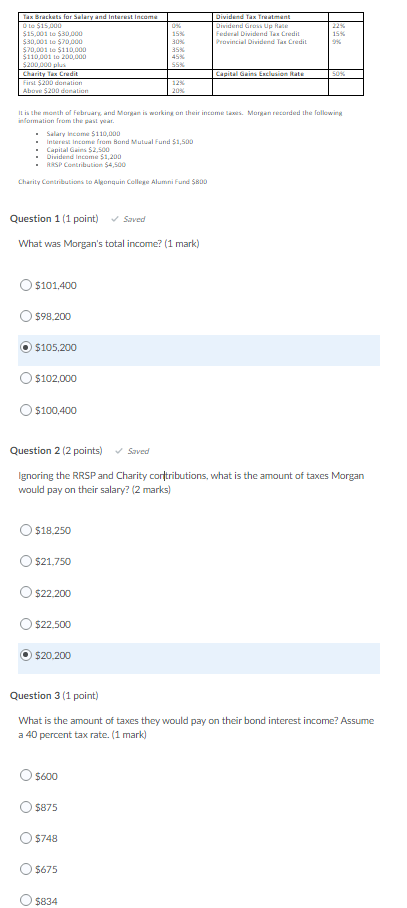

Dividend Tax Treatment Dividend Group Federal Dividend Tex Credit Provincial Divided Tax Credit 15% 9% Tax Brackets for Salary and Interest Income Ole $15,000 $15,001 to $30,000 $30,001 to $70,000 $70,001 to $110.000 $110.001 to 200.000 $200.000 Charity Tex Credit First $200 donation Above $200 donation OK 15% 30% 35 45% SSX Capital Gains Exclusion Rate 50% 12% 20% It is the month of February, and Morgan is working on their income taxes. Morgen recorded the followin information from the past year. Salary income $110,000 Interest Income from Bond Mutual Fund $1,500 Capital Gains 52,500 Dividend Income $1,200 RESP Contribution $4,500 Charily Contributions to Algonquin College Alumni Fund $800 Question 1 (1 point) Saved What was Morgan's total income? (1 mark) $101,400 $98.200 $105,200 $102,000 $100,400 Question 2 (2 points) Saved Ignoring the RRSP and Charity contributions, what is the amount of taxes Morgan would pay on their salary? (2 marks) $18.250 $21,750 $22 200 $22.500 $20.200 Question 3 (1 point) What is the amount of taxes they would pay on their bond interest income? Assume a 40 percent tax rate. (1 mark) O $600 $875 O $748 $675 $834 Dividend Tax Treatment Dividend Group Federal Dividend Tex Credit Provincial Divided Tax Credit 15% 9% Tax Brackets for Salary and Interest Income Ole $15,000 $15,001 to $30,000 $30,001 to $70,000 $70,001 to $110.000 $110.001 to 200.000 $200.000 Charity Tex Credit First $200 donation Above $200 donation OK 15% 30% 35 45% SSX Capital Gains Exclusion Rate 50% 12% 20% It is the month of February, and Morgan is working on their income taxes. Morgen recorded the followin information from the past year. Salary income $110,000 Interest Income from Bond Mutual Fund $1,500 Capital Gains 52,500 Dividend Income $1,200 RESP Contribution $4,500 Charily Contributions to Algonquin College Alumni Fund $800 Question 1 (1 point) Saved What was Morgan's total income? (1 mark) $101,400 $98.200 $105,200 $102,000 $100,400 Question 2 (2 points) Saved Ignoring the RRSP and Charity contributions, what is the amount of taxes Morgan would pay on their salary? (2 marks) $18.250 $21,750 $22 200 $22.500 $20.200 Question 3 (1 point) What is the amount of taxes they would pay on their bond interest income? Assume a 40 percent tax rate. (1 mark) O $600 $875 O $748 $675 $834