Answered step by step

Verified Expert Solution

Question

1 Approved Answer

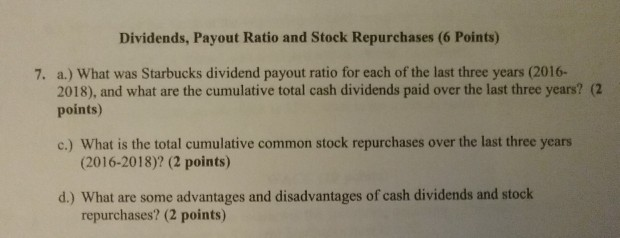

Dividends, Payout Ratio and Stock Repurchases (6 Points) 7. a.) What was Starbucks dividend payout ratio for each of the last three years (2016- 2018),

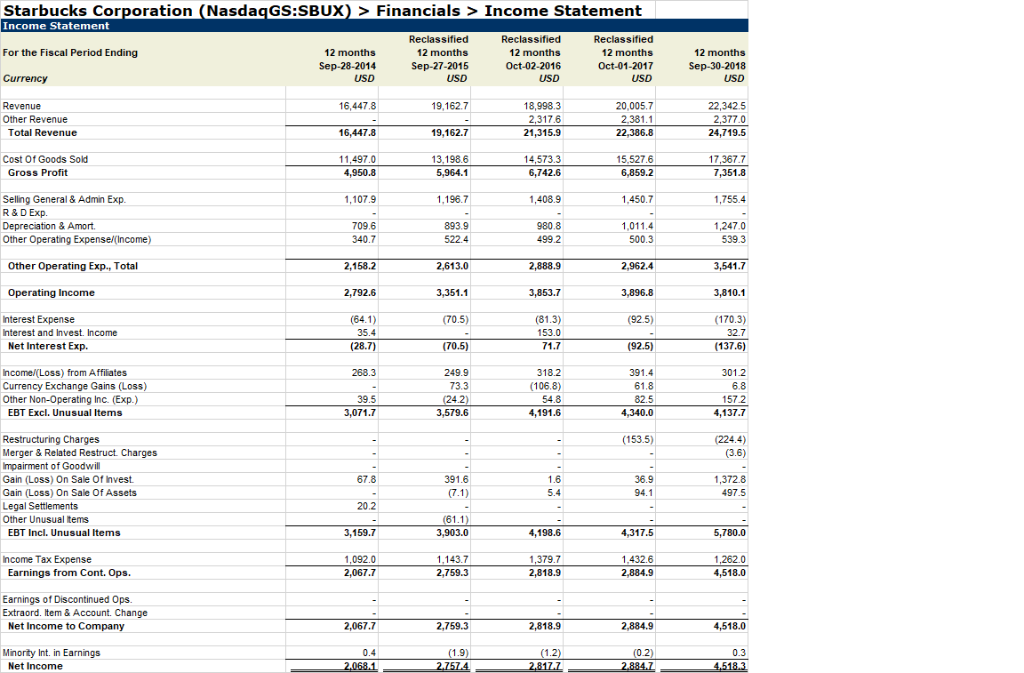

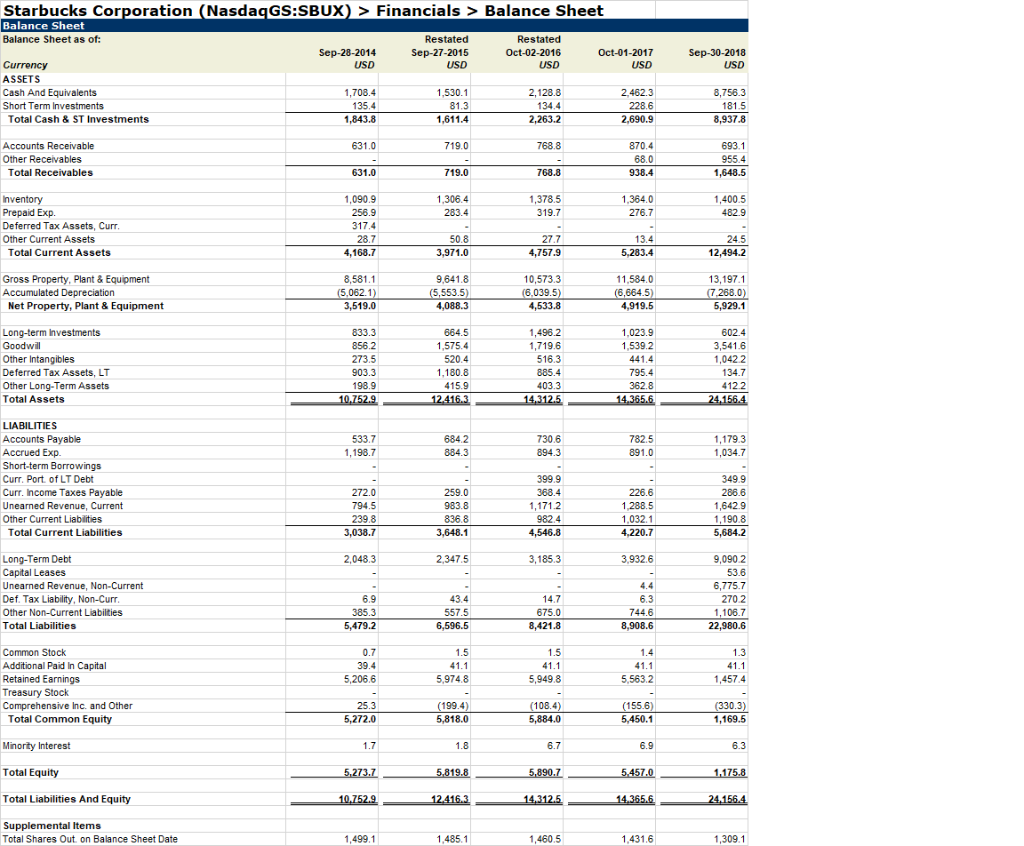

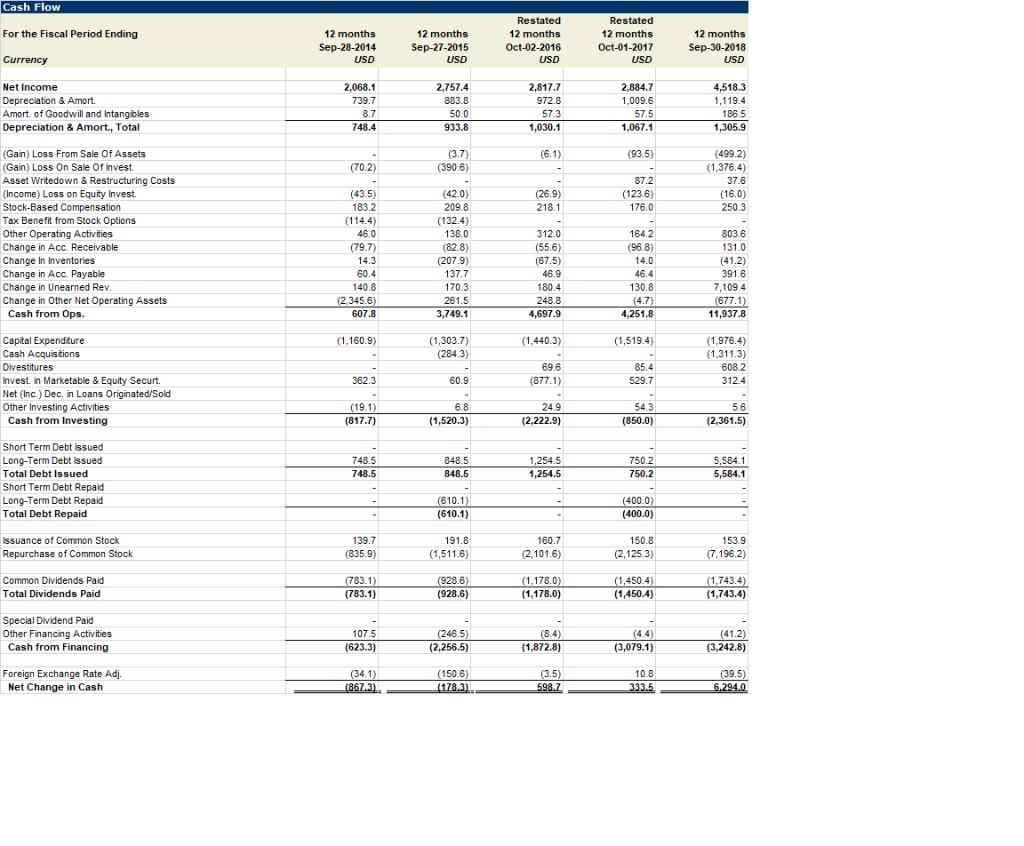

Dividends, Payout Ratio and Stock Repurchases (6 Points) 7. a.) What was Starbucks dividend payout ratio for each of the last three years (2016- 2018), and what are the cumulative total cash dividends paid over the last three years? (2 points) c.) What is the total cumulative common stock repurchases over the last three years (2016-2018)? (2 points) d.) What are some advantages and disadvantages of cash dividends and stock repurchases? (2 points) Starbucks Corporation (Nasdaq GS:SBUX) > Financials > Income Statement Income Statement Reclassified Reclassified Reclassified For the Fiscal Period Ending 12 months 12 months 12 months 12 months Sep-28-2014 Sep-27-2015 Oct-02-2016 Oct-01-2017 Currency USD USD USD USD 12 months Sep-30-2018 USD 16,447.8 19,162.7 Revenue Other Revenue Total Revenue 18,998.3 2,317.6 21,315.9 20,005.7 2.381.1 22,386.8 22,342.5 2,377.0 24,719.5 16,447.8 19,162.7 Cost Of Goods Sold Gross Profit 11,497.0 4,950.8 13,198.6 5,964.1 14,573.3 6,742.6 15.527.6 6,859.2 17,367.7 7,351.8 1,107.9 1,196.7 1,408.9 1,450.7 1,755.4 Selling General & Admin Exp. R&D Exp. Depreciation & Amort. Other Operating Expense/(Income) 1,011,4 709.6 340.7 893.9 522.4 980.8 4992 1,247.0 5393 500.3 Other Operating Exp., Total 2,158.2 2,613.0 2,888.9 2,962.4 3,541.7 Operating Income 2,792.6 3,351.1 3,853.7 3,896.8 3,810.1 (70.5) (92.5) (170.3) Interest Expense Interest and Invest. Income Net Interest Exp. (64.1) 35.4 (28.7) (81.3) 153.0 71.7 32.7 (70.5) (92.5) (137.6) 268.3 Income/(Loss) from Affiliates Currency Exchange Gains (Loss) Other Non-Operating Inc. (Exp.) EBT Excl. Unusual Items 39.5 3,071.7 249.9 73.3 (242) 3,579.6 318.2 (106.8) 54.8 4,191.6 391.4 61.8 82.5 4,340.0 301.2 6.8 1572 4,137.7 (153.5) (224.4) (3.6) 67.8 Restructuring Charges Merger & Related Restruct. Charges Impairment of Goodwill Gain (Loss) On Sale Of Invest. Gain (Loss) On Sale Of Assets Legal Settlements Other Unusual Items EBT Incl. Unusual Items 391.6 (7.1) 1.6 5.4 36.9 94.1 1,372.8 497.5 20.2 3,159.7 (61.1) 3,903.0 4,198.6 4,317.5 5,780.0 Income Tax Expense Earnings from Cont. Ops. 1,092.0 2,067.7 1,143.7 2,759.3 1,379.7 2,818.9 1,432.6 2,884.9 1,262.0 4,518.0 Earnings of Discontinued Ops. Extraord. Item & Account Change Net Income to Company 2,067.7 2,759.3 2,818.9 2,884.9 4,518.0 Minority Int. in Earnings Net Income 0.4 2.068.1 (1.9) 2.757.4 (1.2) 2,812.7 (0.2) 2.884.7 - - 0.3 4,518.3 Starbucks Corporation (NasdaqGS:SBUX) > Financials > Balance Sheet Balance Sheet Balance Sheet as of: Restated Restated Sep-28-2014 Sep-27-2015 Oct-02-2016 Oct-01-2017 Currency USD USD USD USD ASSETS Cash And Equivalents 1,708.4 1.530.1 2,128.8 2.462.3 Short Term Investments 135.4 81.3 134.4 228.6 Total Cash & ST Investments 1,843.8 1,611.4 2,263.2 2,690.9 Sep-30-2018 USD 8,756.3 181.5 8,937.8 631.0 719.0 768.8 Accounts Receivable Other Receivables Total Receivables 870.4 68.0 938.4 693.1 955.4 1,648.5 631.0 719.0 768.8 1,306.4 283.4 1,378.5 319.7 1.364.0 276.7 1,400.5 482.9 Inventory Prepaid Exp. Deferred Tax Assets, Curr. Other Current Assets Total Current Assets 1,090.9 256.9 317.4 28.7 4,168.7 50.8 3,971.0 27.7 4,757.9 13.4 5.283.4 24.5 12,494.2 Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment 8,581.1 (5,062.1) 3,519.0 9,641.8 (5,553.5) 4,088.3 10,573.3 (6.039.5) 4,533.8 11.584.0 (6,664.5) 4,919.5 13,197.1 (7.268.0) 5,929.1 Long-term Investments Goodwill Other Intangibles Deferred Tax Assets, LT Other Long-Term Assets Total Assets 833.3 856.2 273.5 903.3 198.9 10.752.9 664.5 1,575.4 5204 1,180.8 415.9 12.416.3 1,496.2 1,719.6 5163 885.4 403.3 14,312.5 1,023.9 1,539.2 441.4 795.4 362.8 14.365.6 602.4 3,541.6 1,0422 134.7 4122 24.156.4 533.7 1,198.7 6842 884.3 730.6 894.3 782.5 891.0 1,179.3 1,034.7 LIABILITIES Accounts Payable Accrued Exp Short-term Borrowings Curr. Port of LT Debt Curr. Income Taxes Payable Unearned Revenue, Current Other Current Liabilities Total Current Liabilities 272.0 794.5 239.8 3,038.7 259.0 983.8 836.8 3,648.1 399.9 368.4 1,1712 982.4 4,546.8 226.6 1.288.5 1,032.1 4,220.7 349.9 286.6 1,642.9 1,1908 5,684.2 2,048.3 2,347.5 3,1853 3,932.6 Long-Term Debt Capital Leases Unearned Revenue, Non-Current Def. Tax Liability. Non-Curr. Other Non-Current Liabilities Total Liabilities 9,090 2 53.6 6,775.7 2702 1,106.7 22,980.6 6.9 385.3 5,479.2 43.4 557.5 6,596.5 14.7 675.0 8,421.8 6.3 744.6 8,908.6 0.7 39.4 5,206.6 41.1 5,974.8 1.5 41.1 5,949.8 1.4 41.1 5,563.2 1.3 41.1 1,4574 Common Stock Additional Paid in Capital Retained Earnings Treasury Stock Comprehensive Inc. and Other Total Common Equity 25.3 5,272.0 (199.4) 5,818.0 (108.4) 5,884.0 (155.6) 5,450.1 (330.3) 1,169.5 Minority Interest 1.7 1.8 6.7 6.9 6.3 Total Equity 5,273.7 5,819.8 5,890.7 5.457.0 1,175.8 Total Liabilities And Equity 10,752.9 12.416.3 14,312.5 - 14.365.6 24.156.4 Supplemental Items Total Shares Out on Balance Sheet Date 1,499.1 1,485.1 1,460.5 1,431.6 1,309.1 Cash Flow For the Fiscal Period Ending 12 months Sep-28-2014 USD 12 months Sep-27-2015 USD Restated 12 months Oct-02-2016 USD Restated 12 months Oct-01-2017 USD 12 months Sep-30-2018 USD Currency Net Income Depreciation & Amort. Amort, of Goodwill and Intangibles Depreciation & Amort., Total 2,068.1 739.7 8.7 748.4 2,757.4 883.8 50.0 933.8 2,817.7 972.8 57.3 1,030.1 2,884.7 1,009.6 57.5 1,067.1 4,518.3 1,119.4 186.5 1,305.9 (6.1) (93.5) (70.2) (3.7) (390.6) (499.2) (1.376.4) 37.6 (16.0) 250.3 87.2 (123.6) 176.0 (26.9) 218.1 (Gain) Loss From Sale Of Assets (Gain) Loss On Sale Of Invest Asset Writedown & Restructuring Costs (Income) Loss on Equity Invest Stock-Based Compensation Tax Benefit from Stock Options Other Operating Activities Change in Acc. Receivable Change In Inventories Change in Acc. Payable Change in Unearned Rev. Change in Other Net Operating Assets Cash from Ops. (43.5) 1832 (114.4) 46.0 (79.7) 14.3 60.4 140.8 (2.345.6) 607.8 (42.0) 209.8 (132.4) 138.0 (82.8) (207.9) 137.7 170.3 261.5 3,749.1 312.0 (55.6) (67.5) 46.9 1804 248.8 4,697.9 164.2 (96.8) 14.0 46.4 130.8 803.6 131.0 (41.2) 391.6 7,109.4 (677.1) 11,937.8 4,251.8 (1.160.9) (1,440.3) (1,519.4) (1,303.7) (284.3) Capital Expenditure Cash Acquisitions Divestitures Invest. in Marketable & Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing (1.976.4) (1,311.3) 6082 3124 85.4 529.7 362.3 69.6 (877.1) 60.9 (19.1) (817.7) 6.8 (1,520.3) 24.9 (2,222.9) 543 (850.0) 5.6 (2,361.5) 748.5 748.5 848.5 848.5 1,254.5 1,254.5 750.2 750.2 5,584.1 5,584.1 Short Term Debt issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid (610.1) (610.1) (400.0) (400.0) 153.9 Issuance of Common Stock Repurchase of Common Stock 139.7 (835.9) 191.8 (1,511.6) 160.7 (2,101.6) 150.8 (2,125.3) (7.196.2) Common Dividends Paid Total Dividends Paid (783.1) (783.1) (928.6) (928.6) (1.178.0) (1,178.0) (1,450.4) (1,450.4) (1.743.4) (1,743.4) Special Dividend Paid Other Financing Activities Cash from Financing 107.5 (623.3) (246.5) (2,256.5) (8.4) (1,872.8) (3,079.1) (41.2) (3,242.8) Foreign Exchange Rate Adj. Net Change in Cash (34.1) (867,3). - (150.6) (178.31 (3.5) 598. 10.8 33.5 (39.5) 6.294.0 7 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started