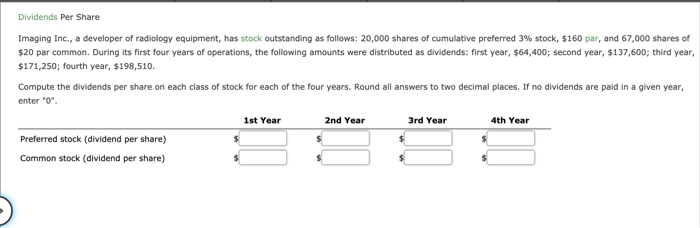

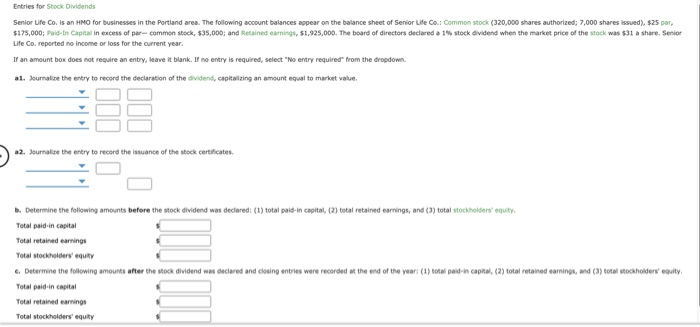

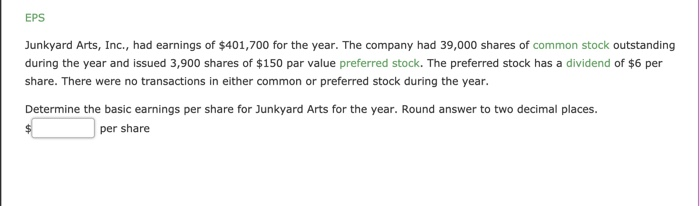

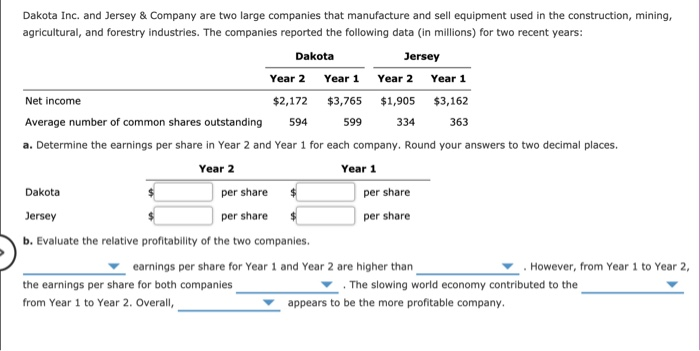

Dividends Per Share Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 3% stock, $160 par, and 67,000 shares of $20 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $64,400; second year, $137,600; third year, $171,250; fourth year, $198,510. Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) Common stock (dividend per share) Entries for Stock Dividends Senior Life Co. is an HMO for businesses in the Portland area. The following account balances appear on the balance sheet of Senior Life Co.: Common stock (320,000 shares authorized; 7,000 shares issued), $25 par, $17,000; Paid-in Capital in excess of par-common stock, 535,000 and Retained earnings, $1,925,000. The board of directors declared a 15 stock dividend when the market price of the stock was $31 a share. Senior Life Co. reported no income or loss for the current year. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required from the dropdown. al. Journaline the entry to record the declaration of the dividend, capitalizing an amount equal to market value 12. Journalize the entry to record the issuance of the stock certificates . Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity Total paid in capital Total retained earnings Total stockholders'uty c. Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (1) total paid in capital, (2) total retained earings, and (3) total stockholders guilty Total paid in capital Total retained earning Total stockholders' equity EPS Junkyard Arts, Inc., had earnings of $401,700 for the year. The company had 39,000 shares of common stock outstanding during the year and issued 3,900 shares of $150 par value preferred stock. The preferred stock has a dividend of $6 per share. There were no transactions in either common or preferred stock during the year. Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places. per share 334 Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the following data (in millions) for two recent years: Dakota Jersey Year 2 Year 1 Year 2 Year 1 Net income $2,172 $3,765 $1,905 $3,162 Average number of common shares outstanding 594 599 363 a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places. Year 2 Year 1 Dakota per share per share Jersey per share per share b. Evaluate the relative profitability of the two companies. earnings per share for Year 1 and Year 2 are higher than However, from Year 1 to Year 2, the earnings per share for both companies . The slowing world economy contributed to the from Year 1 to Year 2. Overall, appears to be the more profitable company