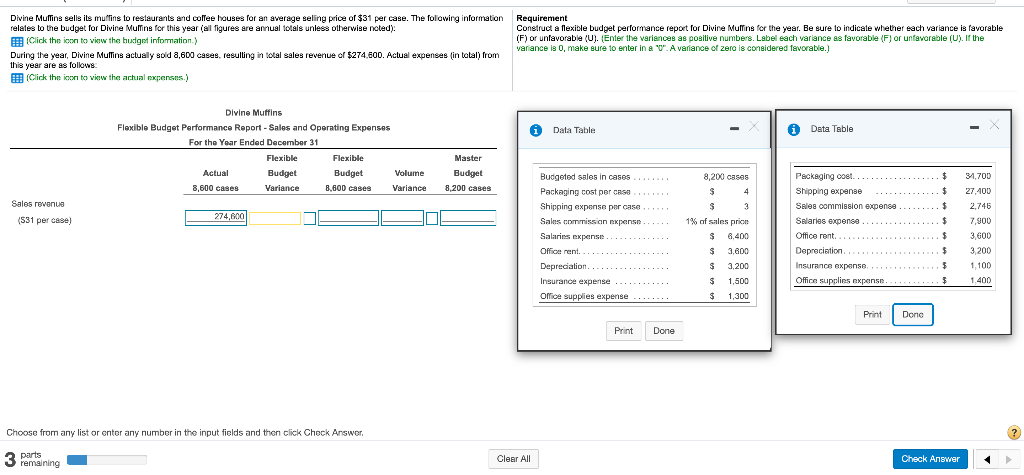

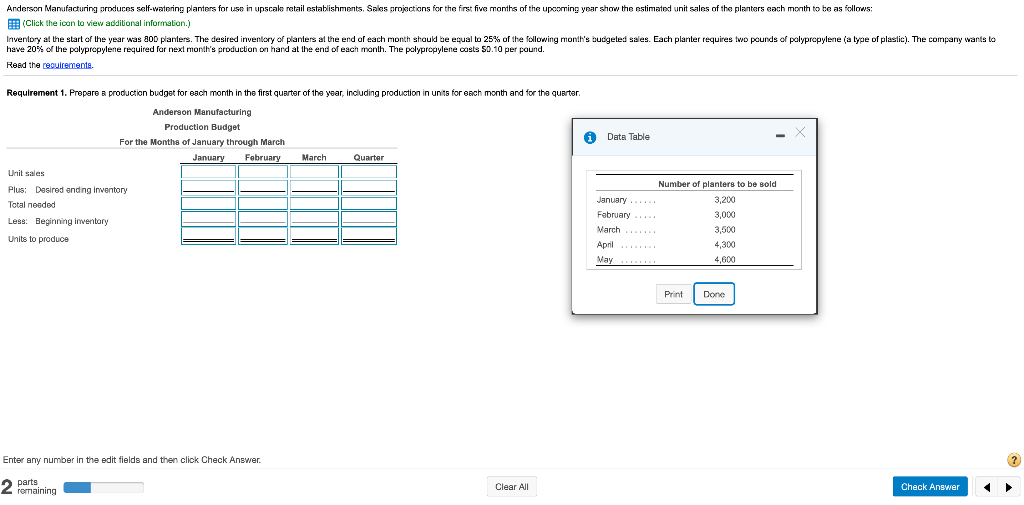

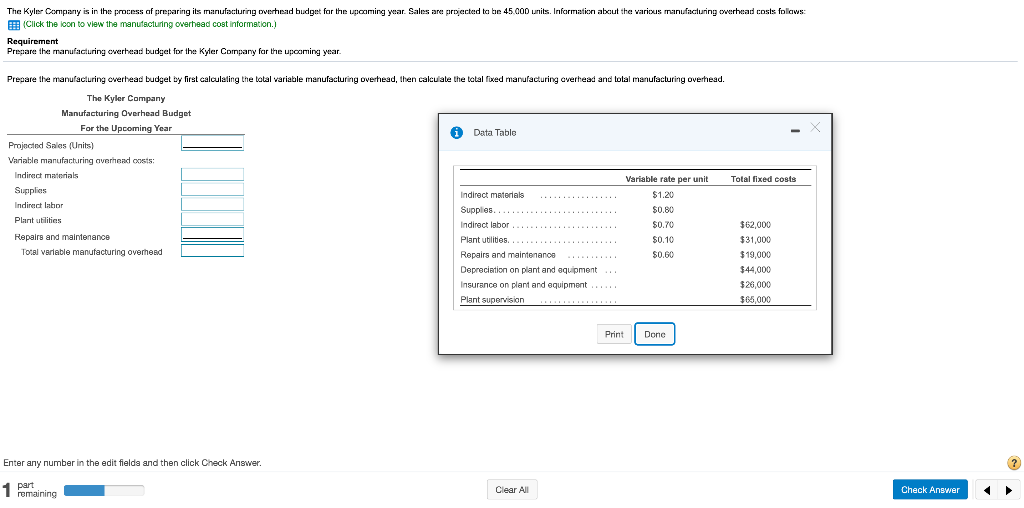

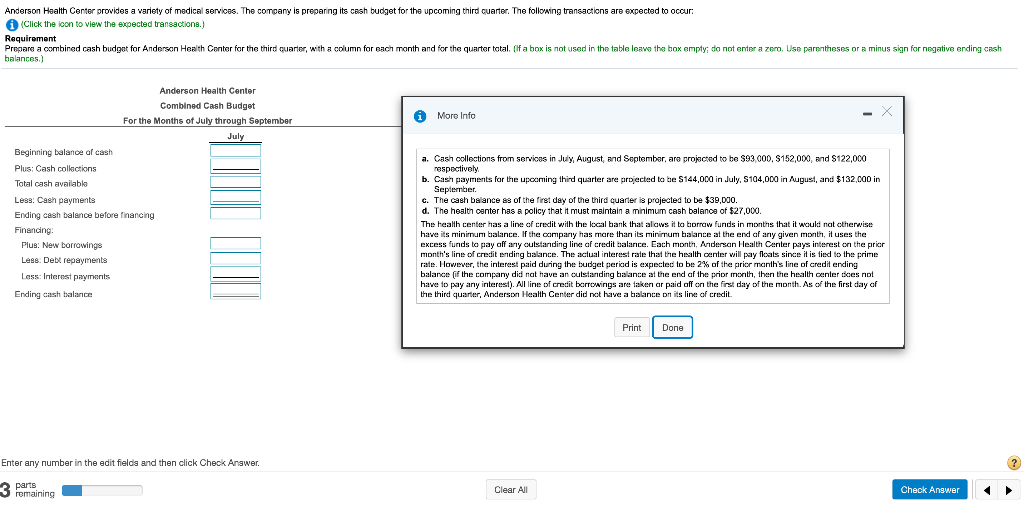

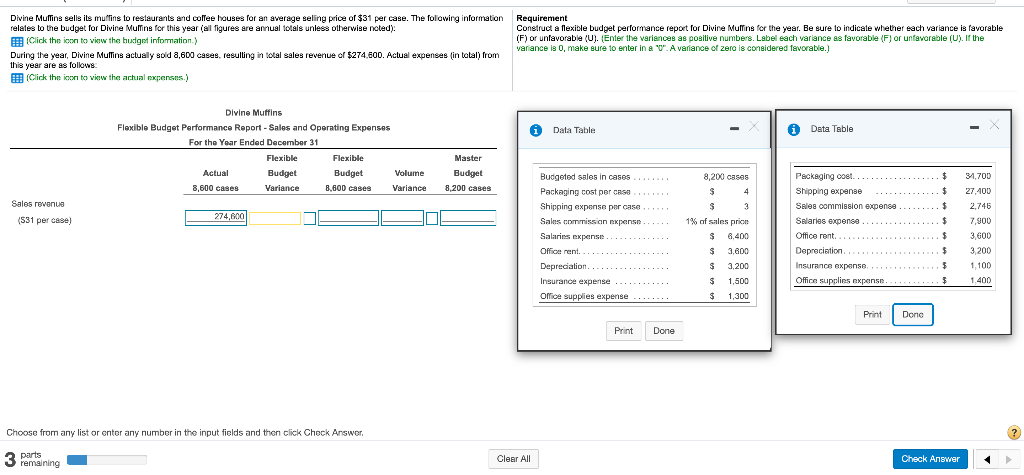

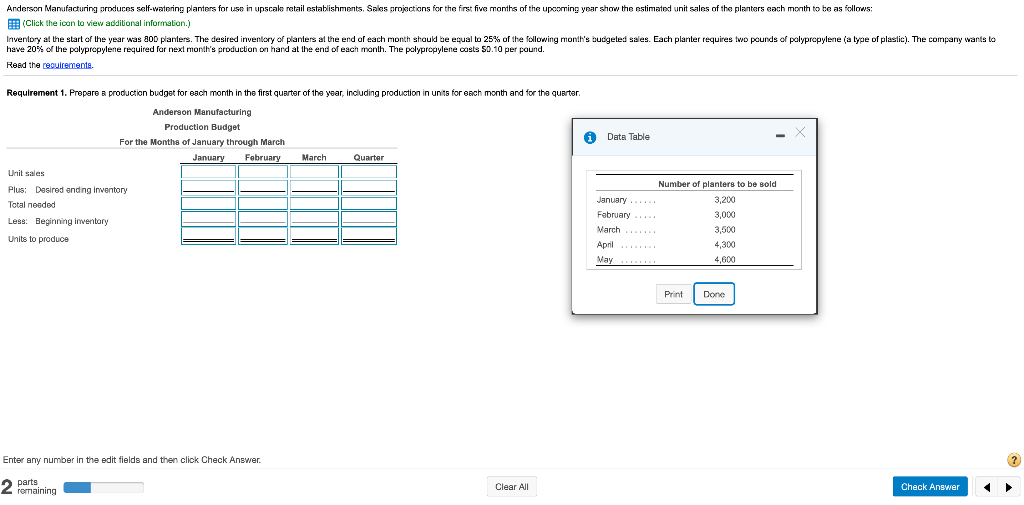

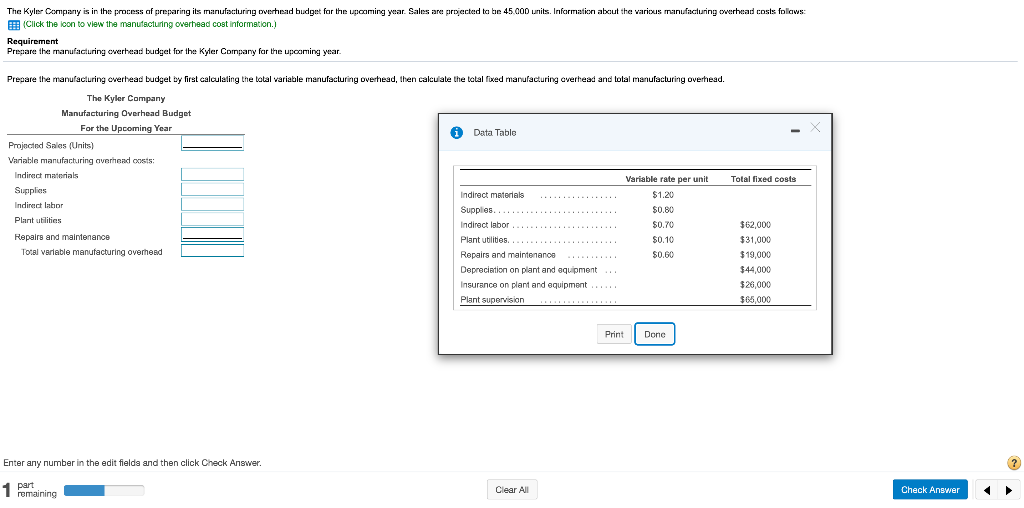

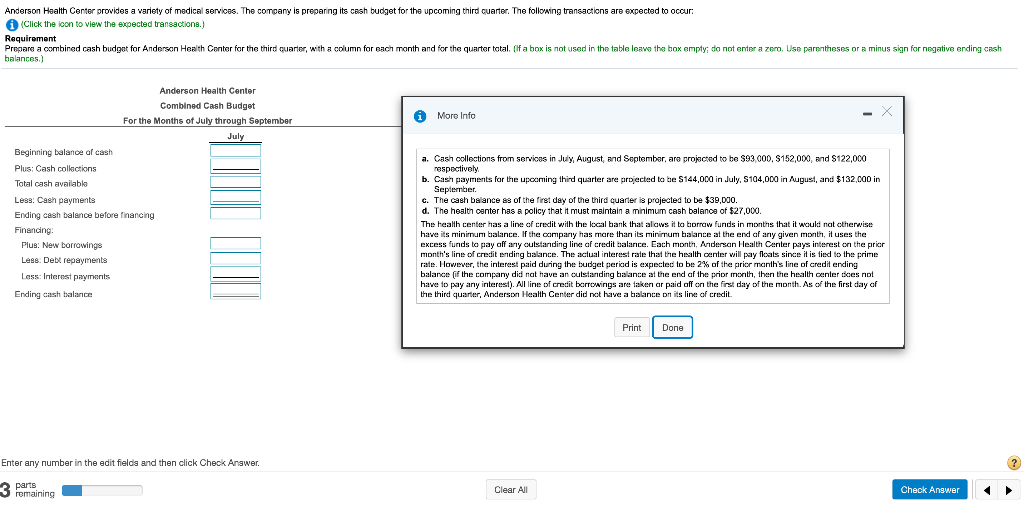

Divine Mullins sells ils muffins to restaurants and coffee houses for an average seling price of $31 per case. The following information relates to the budget for Divine Mullins for this year (al figures are annual totals unless otherwise noted): (Click the icon to view the budget information) During the year, Divine Mullins actually sold 8,600 cases, resulting in total sales revenue of $274.500. Actual expenses in total) from this year are as follows (Click the icon to view the actual expenses.) Requirement Construct a flexible budget performance report for Divine Muffins for the year. Be sure to indicate whether each variance is favorable (F) or unfavorable (U). (Enter the variances as positive numbers. Label each variance as favorable (F) or unfavorable (U). If the variance is 0, make sure to enter in a "0". A variance of zero is considered favorable.) i Data Table Data Table Divine Muffins Flexible Budget Performance Report - Sales and Operating Expenses For the Year Ended December 31 Flexible Flexible Actual Budget Budget Volume 8,600 cases Variance 8.600 cases Variance Master $ Budget 8,200 cases 34,700 27,400 $ Sales revenue 8,200 casos $ 4 $ 3 1% of sales prion $ 6,400 2,746 $ $ (531 per case) 274,600 Budgeted sales in cases. Packaging cost per AS Shipping expense per case Sales commission expense Salaris expense Office rent. Depreciation... Insurance expense Office Supplies expense Packaging cost....... Shipping expense Sales commission expense Salarios expense Office rent. Depreciation... Insurance expense Office supplies expense $ $ 7,900 3,600 3.200 1,100 1.400 S 3,600 $ 3,200 $ 1,500 $ 1,300 $ $ Print Der Donc Print Done Choose from any list or enter any number in the input fields and then click Check Answer ? parts remaining Clear All Check Answer Anderson Manufacturing produces self-watering planters for use in upscale retail establishments. Sales projections for the first five months of the upcoming year show the estimated unit sales of the planters each month to be as follows: (Click the icon to view additional information.) Inventory at the start of the year was 800 planters. The desired inventory of planters at the end of each month should be equal to 25% of the following month's budgeled sales. Each planter requires two pounds of polypropylene (a type of plastic). The company wants to have 20% of the polypropylene required for next month's production on hard at the end of each month. The polypropylene costs $0.10 per pound. Read the requiremente. Data Table Requirement 1. Prepare a production budget for each month in the first quarter of the year, including production in units for each month and for the quarter Anderson Manufacturing Production Budget For the Months of January through March January February March Quarter Unit sales Plus: Desired ending inventory Total nooded Less: Beginning inventory Units to produce January February March April May Number of planters to be sold 3,200 3,000 3,500 4,300 4,600 Print Done Enter any number in the edit fields and then click Check Answer. ? 2 parts Clear All Check Answer remaining The Kyler Company is in the process of preparing its manufacturing overhead budget for the upcoming year. Sales are projected to be 45.000 units. Information about the various manufacturing overhead costs follows: (Click the icon to view the manufacturing overhead cost information.) Requirement Prepare the manufacturing overhead budget for the Kyler Company for the upcoming year. Prepare the manufacluring overhead budget by first calculating the total variable manufacturing overhead, then calculate the total fixed manufacturing overhead and lolal manufacturing overhead. Data Table The Kyler Company Manufacturing Overhead Budget For the upcoming Year Projected Sales (Units) Variable manufacturing overhead costs: Indirect materials Supplies Indirect labor Plant utilities Repairs and maintenance Total variable manufacturing overhead Variable rate per unit Total fixed costs $1.20 $0.80 Indirect materials Supplies Indirect labor... Plant utilities Repairs and maintenance Depreciation on plant and equipment Insurance on plant and equipment ...... Plant supervision $0.70 $0.10 $0.00 $62,000 $31,000 $19,000 $44,000 $26.000 $65,000 Print Donc Enter any number in the edit fields and then click Check Answer. ? part remaining Clear All Check Answer Anderson Health Center provides a variety of medical services. The company is preparing its cash budget for the upcoming third quarter. The following transactions are expected to occur (Click the loon to view the expected transactions.) Requirement Prepare a combined cash budget for Anderson Health Center for the third quarter, with a column for each month and for the quarter total. (If a box is not used in the table leave the box empty, do not enter a zero. Use parentheses or a minus sign for negative ending cash balances.) i More Info Anderson Health Center Combined Cash Budget For the Months of July through September July Beginning balance of cash Plus: Cash collections Total cash available Less: Cash payments Ending cash balance before financing Financing Plus: New borrowings Less Debt repayments Less: Interest payments Ending cash balance a. Cash collections from services in July August, and September, are projected to be $93.000, S152,000, and $122,000 respectively b. Cash payments for the upcoming third quarter are projected to be $144,000 in July, S104,000 in August, and $132.000 in September c. The cash balance as of the first day of the third quarter is projected to be $39,000. d. The health center has a policy that it must maintain a minimum cash balance of $27,000. The health center has a line of credit with the local bank that allows it to borrow funds in months that it would not otherwise have its minimum balance. If the company has more than its minimum balance at the end of any given month, it uses the excess funds to pay off any outstanding line of credit balance. Each month. Anderson Health Center pays interest on the prior month's line of credit ending balance. The aclual interest rate that the health center will pay floats since it is tied to the prime rate. However, the interest paid during the budget period is expected to be 2% of the prior manth's line of credit ending balance of the company did not have an outstanding balance at the end of the prior month, then the health center does not have to pay any interest). All line of credit borrowings are taken ar paid off on the first day of the month. As of the first day of the third quarter, Anderson Health Center did not have a balance on its line of credit. Print Done Enter any number in the edit fields and then click Check Answer. ? 3 parts remaining Clear All Check