Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Division A manufactures components for plasma TVs. The components can be sold either to Division B of the same company or to outside customers.

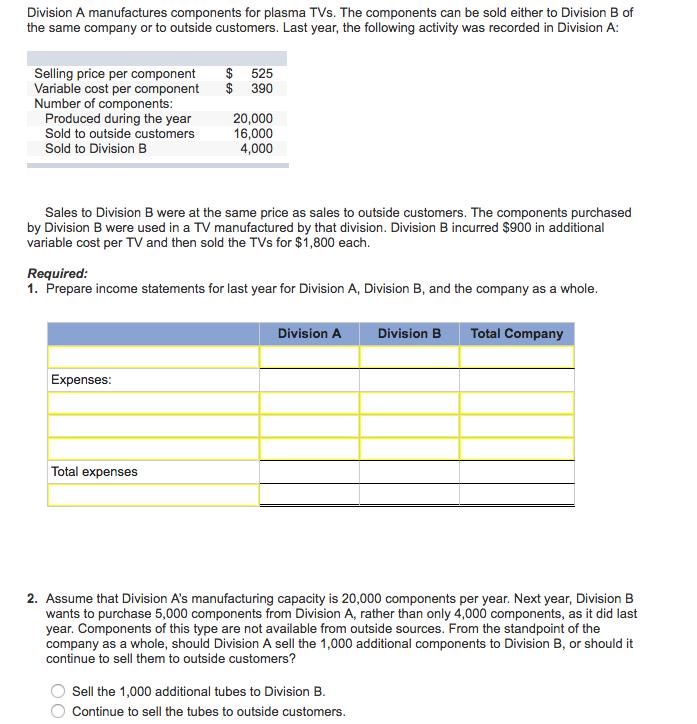

Division A manufactures components for plasma TVs. The components can be sold either to Division B of the same company or to outside customers. Last year, the following activity was recorded in Division A: $ 525 $ 390 Selling price per component Variable cost per component Number of components: Produced during the year Sold to outside customers 20,000 16,000 4,000 Sold to Division B Sales to Division B were at the same price as sales to outside customers. The components purchased by Division B were used in a TV manufactured by that division. Division B incurred $900 in additional variable cost per TV and then sold the TVs for $1,800 each. Required: 1. Prepare income statements for last year for Division A, Division B, and the company as a whole. Division A Division B Total Company Expenses: Total expenses 2. Assume that Division A's manufacturing capacity is 20,000 components per year. Next year, Division B wants to purchase 5,000 components from Division A, rather than only 4,000 components, as it did last year. Components of this type are not available from outside sources. From the standpoint of the company as a whole, should Division A sell the 1,000 additional components to Division B, or should it continue to sell them to outside customers? Sell the 1,000 additional tubes to Division B. Continue to sell the tubes to outside customers.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Income statement for the last year Division A 1 Division B 2 Whole company 12 A Sales revenue 1050...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started