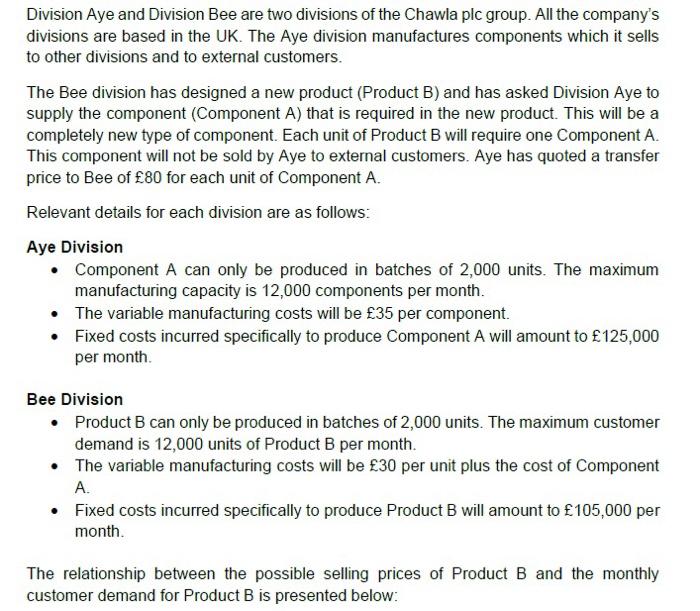

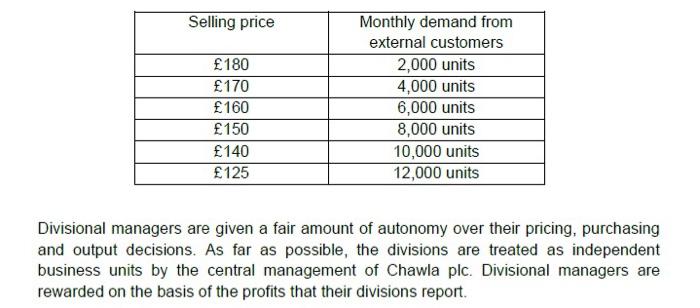

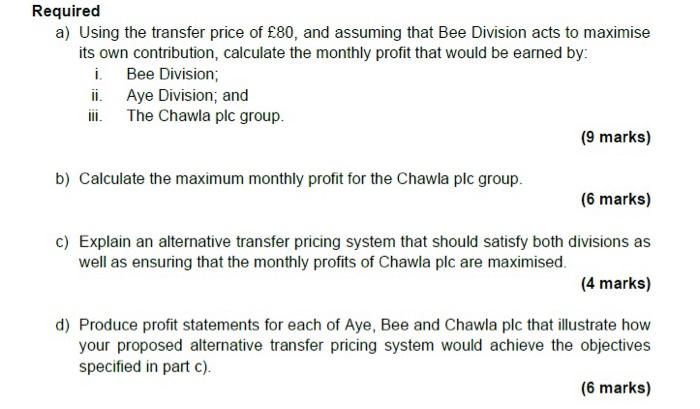

Division Aye and Division Bee are two divisions of the Chawla plc group. All the company's divisions are based in the UK. The Aye division manufactures components which it sells to other divisions and to external customers. The Bee division has designed a new product (Product B) and has asked Division Aye to supply the component (Component A) that is required in the new product. This will be a completely new type of component. Each unit of Product B will require one Component A. This component will not be sold by Aye to external customers. Aye has quoted a transfer price to Bee of 80 for each unit of Component A. Relevant details for each division are as follows: Aye Division Component A can only be produced in batches of 2,000 units. The maximum manufacturing capacity is 12,000 components per month. The variable manufacturing costs will be 35 per component. Fixed costs incurred specifically to produce Component A will amount to 125,000 per month Bee Division Product B can only be produced in batches of 2,000 units. The maximum customer demand is 12,000 units of Product B per month. The variable manufacturing costs will be 30 per unit plus the cost of Component A. Fixed costs incurred specifically to produce Product B will amount to 105,000 per month. The relationship between the possible selling prices of Product B and the monthly customer demand for Product B is presented below: Selling price 180 170 160 150 140 125 Monthly demand from external customers 2,000 units 4,000 units 6,000 units 8,000 units 10,000 units 12,000 units Divisional managers are given a fair amount of autonomy over their pricing, purchasing and output decisions. As far as possible, the divisions are treated as independent business units by the central management of Chawla plc. Divisional managers are rewarded on the basis of the profits that their divisions report. Required a) Using the transfer price of 80, and assuming that Bee Division acts to maximise its own contribution, calculate the monthly profit that would be earned by: i. Bee Division; ii. Aye Division, and ili. The Chawla plc group. (9 marks) b) Calculate the maximum monthly profit for the Chawla plc group (6 marks) c) Explain an alternative transfer pricing system that should satisfy both divisions as well as ensuring that the monthly profits of Chawla plc are maximised. (4 marks) d) Produce profit statements for each of Aye, Bee and Chawla plc that illustrate how your proposed alternative transfer pricing system would achieve the objectives specified in part c). (6 marks)