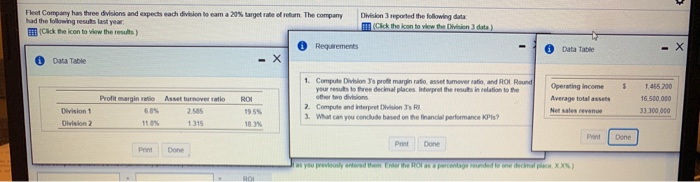

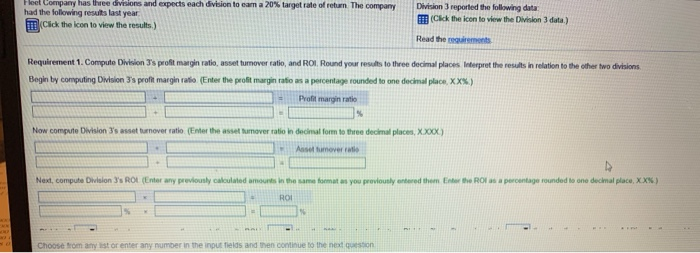

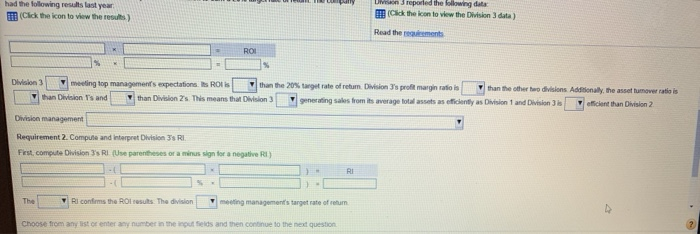

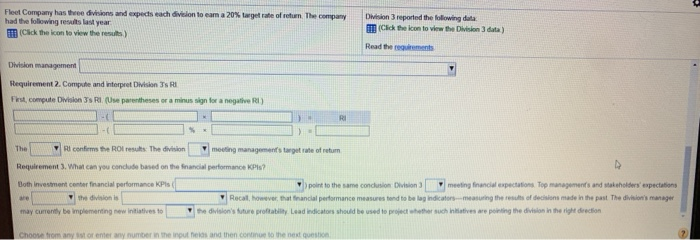

Division reported the following data Click the boon to view the vision 3 data) Fleet Company has three divisions and expects each division to com a 20% target rate of return. The company had the following results last year Click the icon to view the results) Requirements Data Table - X Data Table $ ROL 1. Compute Division's profit margin ratio, asset tumover ratio, and ROI Round your results to three decimal places. Interpret the results in relation to the other two divisions 2. Compute and interpret Division SRL 3. What can you conclude based on the financial performance Pis? Profit margin ratio Asset turnover ratio 2505 110 1315 Operating income Average total assets Net sales reven 1 455 200 16 500 000 3JJ00.000 Division 1 Division 2 183 Print Done Done Print Done Is you previously entered thom. Enter the Rosa percentage rounded to one decimal place XXX) ROL Fleet Company has three divisions and expects each division to earn a 20% target rate of return The company had the following results last year III (Click the icon to view the results.) Division 3 reported the following data IF (Ckck the icon to view the Division 3 data) Read the requirements Requirement 1. Compute Division 3's profit margin ratio, asset turnover ratio, and ROI. Round your results to three decimal places interpret the results in relation to the other two divisions. Begin by computing Dillon 3's profit margin ratio (Enter the profit margin ratio as a percentage rounded to one decimal place XXX) Profit margin ratio Now compute Division 3's asset turnover ratio (Enter the asset tuover ratio in decimal form to three decimal places, XXX) Asset famoverte Next, compute Division 3's ROL (Enter any previously calculated amounts in the same format as you previously entered them Enter the ROI as a percentage rounded to one decimal place, XX%) ROI Choose from a list or enter any number in the input fields and then continue to the need to had the following results last year 11. (Click the icon to view the results) Diven reported the following data (click the icon to view the Division 3 data) Read the cement ROI Division 3 meeting top management's expectations. Its ROI than the 20% target rate of retur Division 3's profit marginalis than the other two divisions. Additionally, the asset tumover ratio is than Division Is and than Division 2s. This means that Division 3 generating sales from its average total assets as efficiently as Division 1 and Division 3 is efficient than Division 2 Division management Requirement 2. Compute and interpret Division 3s RI First, compute Division 3's RI (Use parentheses or a minus sign for a negative RI) RI - 1 The Rl confirms the ROI results. The division meeting management's target rate of retum Choose from any list of enter any number in the input Selds and then continue to the next question Fleet Company has three divisions and expects each division to earn a 20% target rate of return. The company had the following relast year Click the icon to view the rest Division reported the following dala (Click the ken to view the Division 3 data) Read the requirements Division management Requirement 2. Compute and interpret Division 3 R First, compute Division RI (Uw parentheses or a minus sign for a negative RI) ) RI The Rl confirm the ROs results. The division meeting managements to get role of retum Requirement 3. What can you conclude based on the fnancial performance Pis? Both Investment center financial performance KPIs point to the same conclusion on meeting financial expectations Top managements and stakeholders' expectations the division is Recall, however that financial performance measures tend to be lag indicators-measuring the results of decisions made in the past the division's manager may currently be implementing new initiatives to the division's future profitability Lead indicators should be used to project whether such initiatives are pointing the division in the right direction Choose from any or enter any number in the inputs and then continue to the next