Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Divisional Performance and Departmentalisation of Overheads 20 Marks Study the scenario and complete the questions that follow: Maxmore South Africa Maxmore South Africa, a division

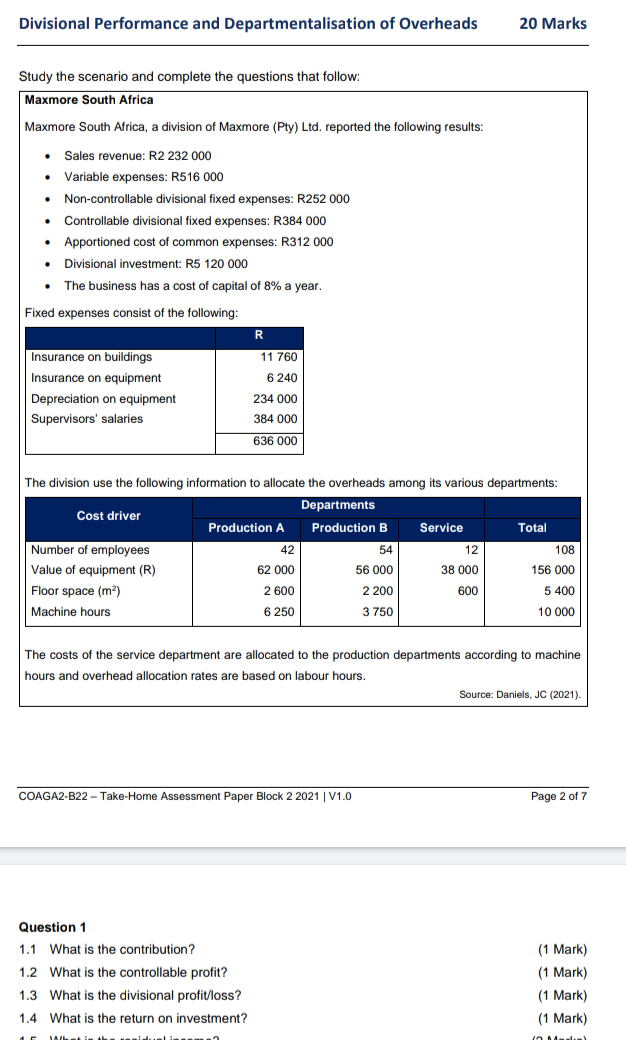

Divisional Performance and Departmentalisation of Overheads 20 Marks Study the scenario and complete the questions that follow: Maxmore South Africa Maxmore South Africa, a division of Maxmore (Pty) Ltd. reported the following results: Sales revenue: R2 232 000 Variable expenses: R516 000 Non-controllable divisional fixed expenses: R252 000 Controllable divisional fixed expenses: R384 000 Apportioned cost of common expenses: R312 000 Divisional investment: R5 120 000 The business has a cost of capital of 8% a year. Fixed expenses consist of the following: R 11 760 Insurance on buildings Insurance on equipment Depreciation on equipment Supervisors' salaries 6240 234 000 384 000 636 000 The division use the following information to allocate the overheads among its various departments: Departments Cost driver Production A Production B Service Total Number of employees 42 54 12 108 Value of equipment (R) 62 000 56 000 38 000 156 000 Floor space (m) 2 600 2 200 600 5 400 Machine hours 6 250 3750 10 000 The costs of the service department are allocated to the production departments according to machine hours and overhead allocation rates are based on labour hours. Source: Daniels, JC (2021). COAGA2-B22 - Take-Home Assessment Paper Block 2 2021 V1.0 Page 2 of 7 Question 1 1.1 What is the contribution? 1.2 What is the controllable profit? 1.3 What is the divisional profit/loss? 1.4 What is the return on investment? (1 Mark) (1 Mark) (1 Mark) (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started