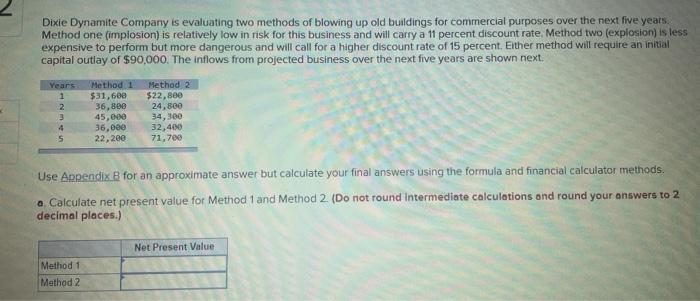

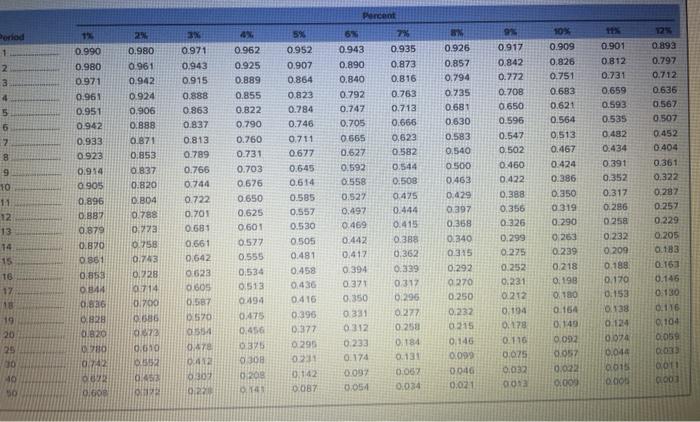

Dixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years. Method one (implosion) is relatively low in risk for this business and will carry a 11 percent discount rate. Method two (explosion) is less expensive to perform but more dangerous and will call for a higher discount rate of 15 percent. Either method will require an initial capital outlay of $90,000. The inflows from projected business over the next five years are shown next. Years 1 2 3 4 5 Method $31,600 36,800 45,000 36,000 22,200 Method 2 $22, Bee 24,800 34,300 32,400 71,700 Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods. a Calculate net present value for Method 1 and Method 2. (Do not round Intermediate calculations and round your answers to 2 decimal places.) Net Present Value Method 1 Method 2 3M 10% Period 1 2 3 4 2 0.980 0.961 0.942 9 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.924 0.906 1 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0905 0.896 0.887 INOD 0.888 0.871 0.853 8 0.971 0.943 0.915 0.888 0.963 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 1554 9 10 11 12 13 14 15 16 17 13 19 20 25 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0:391 0.352 0.317 0.286 BN 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0 500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0270 0.250 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0601 0577 0.555 0.534 0.513 0.194 0.475 0.456 0.375 0308 0:20 OT 0 837 0.820 0.804 0.788 0.228 0.758 0.743 10.728 0714 0.700 0.686 9872 0.010 05152 0483 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.665 0.623 0.627 0.582 0.592 0.544 0.558 0.508 0.52% 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.362 0.394 0.339 0.371 0317 0.350 0.296 0.331 0277 0312 0.250 0.233 0.184 0.174 0.131 0.09% 0.062 0.054 0.034 5% 0.952 0.907 0.864 0823 0.284 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0295 02 0.142 0.087 0.909 0.826 0.751 0.683 0.621 0.564 0,513 0.467 0.424 0.386 0.350 0319 0:290 0.263 0.239 0.218 0198 0.180 0.460 0.422 0,388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0:178 0.116 0.075 0.032 00 0.879 0.870 0 861 0.853 0.886 0.82 0.820 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0104 0.059 0 258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 6.615 0.000 0980 0742 OUR 0.00 Te 0412 0302 022 0.232 0215 0.145 0099 0040 0.021 0.154 0.149 0.092 0.057 0.022 0.009 CO! 1000 10 50