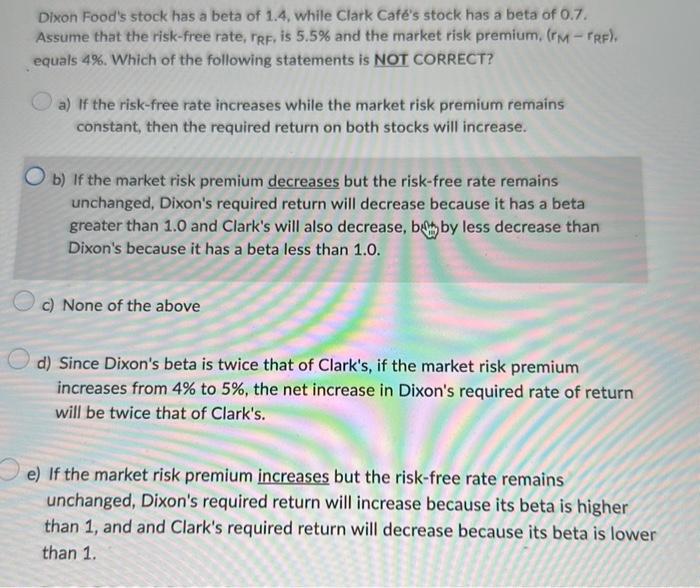

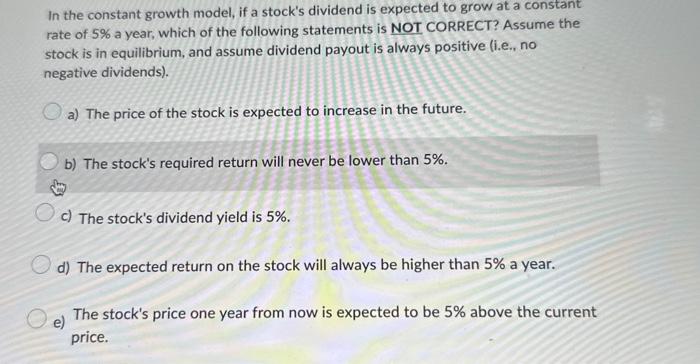

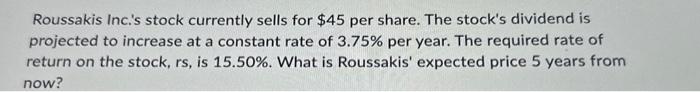

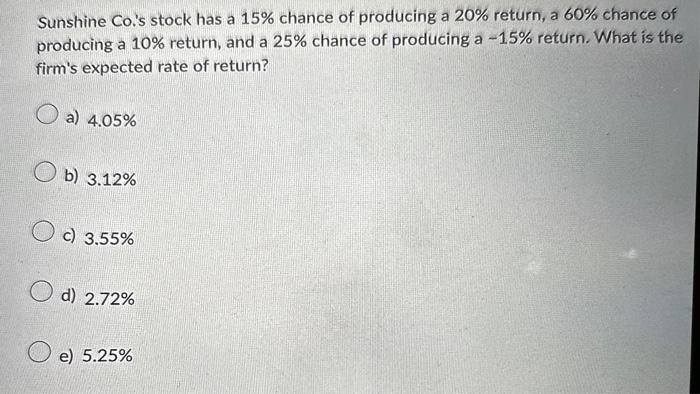

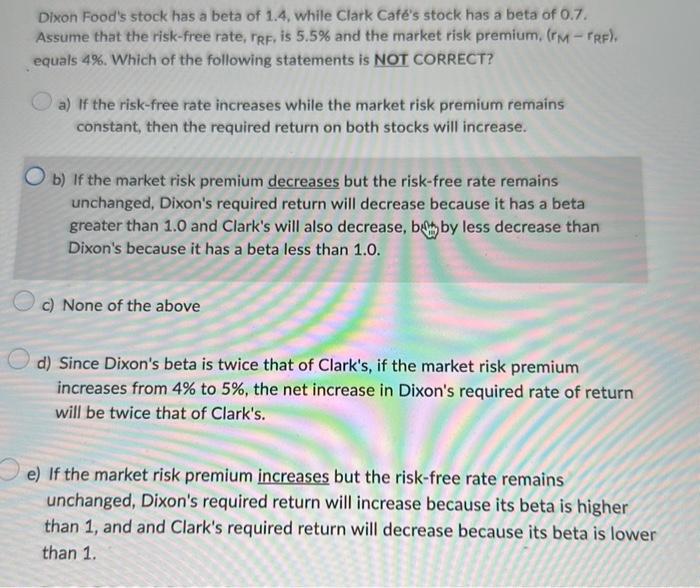

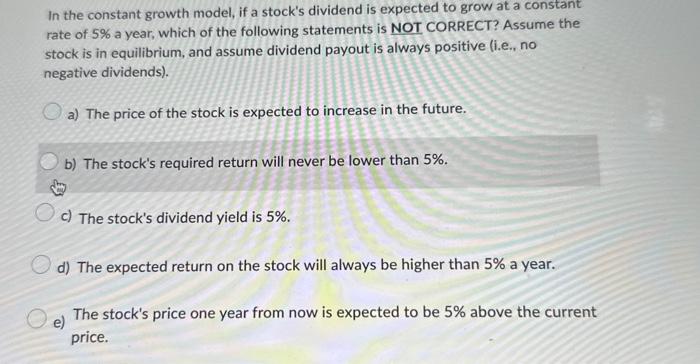

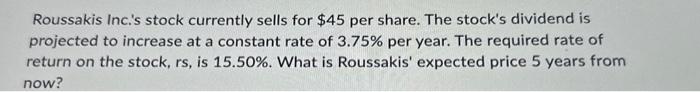

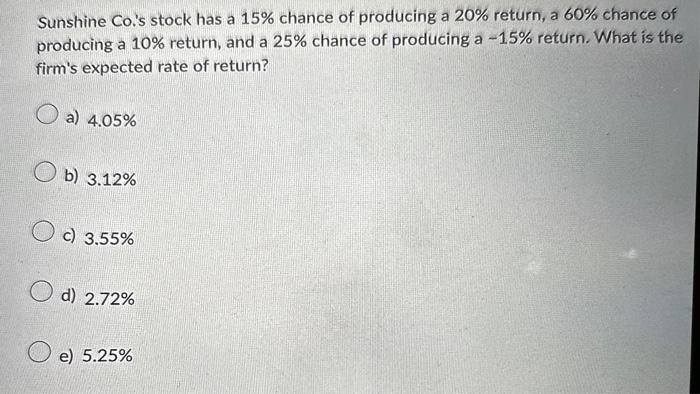

Dixon Food's stock has a beta of 1.4 , while Clark Caf's stock has a beta of 0.7. Assume that the risk-free rate, rRF, is 5.5% and the market risk premium, (rMrRF). equals 4%. Which of the following statements is NOT CORRECT? a) If the risk-free rate increases while the market risk premium remains constant, then the required return on both stocks will increase. b) If the market risk premium decreases but the risk-free rate remains unchanged, Dixon's required return will decrease because it has a beta greater than 1.0 and Clark's will also decrease, bith by less decrease than Dixon's because it has a beta less than 1.0. c) None of the above d) Since Dixon's beta is twice that of Clark's, if the market risk premium increases from 4% to 5%, the net increase in Dixon's required rate of return will be twice that of Clark's. e) If the market risk premium increases but the risk-free rate remains unchanged, Dixon's required return will increase because its beta is higher than 1, and and Clark's required return will decrease because its beta is lower than 1. In the constant growth model, if a stock's dividend is expected to grow at a constant rate of 5% a year, which of the following statements is NOT CORRECT? Assume the stock is in equilibrium, and assume dividend payout is always positive (i.e., no negative dividends). a) The price of the stock is expected to increase in the future. b) The stock's required return will never be lower than 5%. c) The stock's dividend yield is 5%. d) The expected return on the stock will always be higher than 5% a year. e) The stock's price one year from now is expected to be 5% above the current price. Roussakis Inc.'s stock currently sells for $45 per share. The stock's dividend is projected to increase at a constant rate of 3.75% per year. The required rate of return on the stock, rs, is 15.50%. What is Roussakis' expected price 5 years from now? Sunshine Co.'s stock has a 15% chance of producing a 20% return, a 60% chance of producing a 10% return, and a 25% chance of producing a 15% return. What is the firm's expected rate of return? a) 4.05% b) 3.12% c) 3.55% d) 2.72% e) 5.25% Dixon Food's stock has a beta of 1.4 , while Clark Caf's stock has a beta of 0.7. Assume that the risk-free rate, rRF, is 5.5% and the market risk premium, (rMrRF). equals 4%. Which of the following statements is NOT CORRECT? a) If the risk-free rate increases while the market risk premium remains constant, then the required return on both stocks will increase. b) If the market risk premium decreases but the risk-free rate remains unchanged, Dixon's required return will decrease because it has a beta greater than 1.0 and Clark's will also decrease, bith by less decrease than Dixon's because it has a beta less than 1.0. c) None of the above d) Since Dixon's beta is twice that of Clark's, if the market risk premium increases from 4% to 5%, the net increase in Dixon's required rate of return will be twice that of Clark's. e) If the market risk premium increases but the risk-free rate remains unchanged, Dixon's required return will increase because its beta is higher than 1, and and Clark's required return will decrease because its beta is lower than 1. In the constant growth model, if a stock's dividend is expected to grow at a constant rate of 5% a year, which of the following statements is NOT CORRECT? Assume the stock is in equilibrium, and assume dividend payout is always positive (i.e., no negative dividends). a) The price of the stock is expected to increase in the future. b) The stock's required return will never be lower than 5%. c) The stock's dividend yield is 5%. d) The expected return on the stock will always be higher than 5% a year. e) The stock's price one year from now is expected to be 5% above the current price. Roussakis Inc.'s stock currently sells for $45 per share. The stock's dividend is projected to increase at a constant rate of 3.75% per year. The required rate of return on the stock, rs, is 15.50%. What is Roussakis' expected price 5 years from now? Sunshine Co.'s stock has a 15% chance of producing a 20% return, a 60% chance of producing a 10% return, and a 25% chance of producing a 15% return. What is the firm's expected rate of return? a) 4.05% b) 3.12% c) 3.55% d) 2.72% e) 5.25%