Question

DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities.

DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost-plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labor hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three-month notice period.

Required :

a) Given the managing director’s concern about DK’s approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing.

b) Calculate the full cost per unit of each product using DK’s current method of

absorption

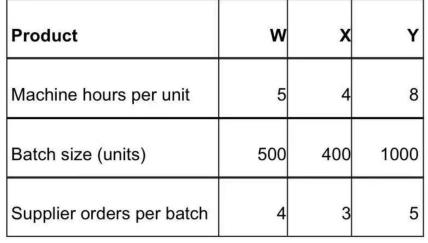

c) Calculate the full cost per unit of each product using activity-based costing and briefly comment on the contrast to your results in part (b).

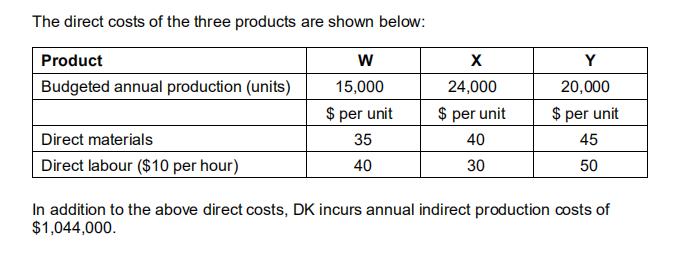

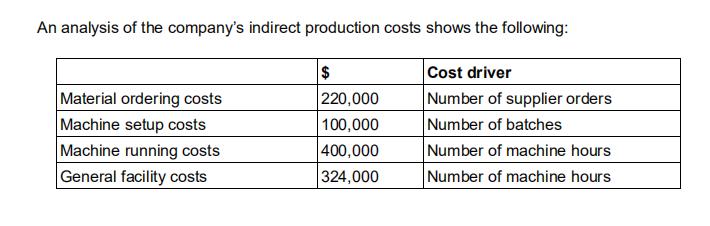

The direct costs of the three products are shown below: Product Budgeted annual production (units) Direct materials Direct labour ($10 per hour) W 15,000 $ per unit 35 40 X 24,000 $ per unit 40 30 Y 20,000 $ per unit 45 50 In addition to the above direct costs, DK incurs annual indirect production costs of $1,044,000.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started