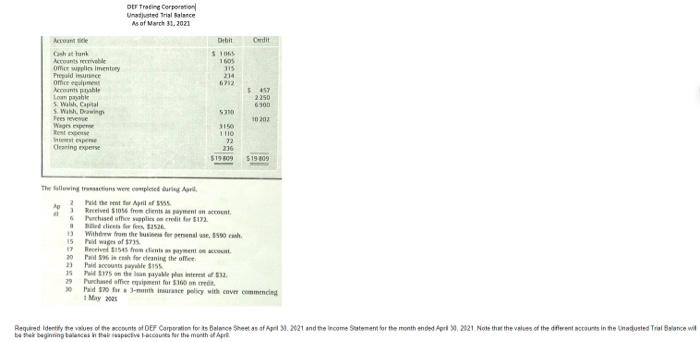

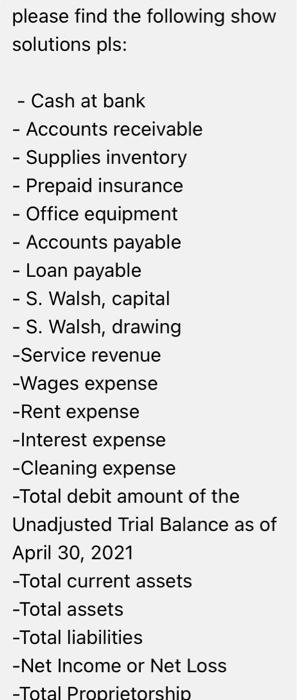

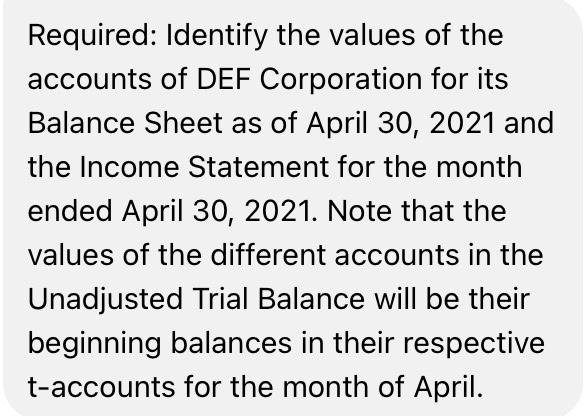

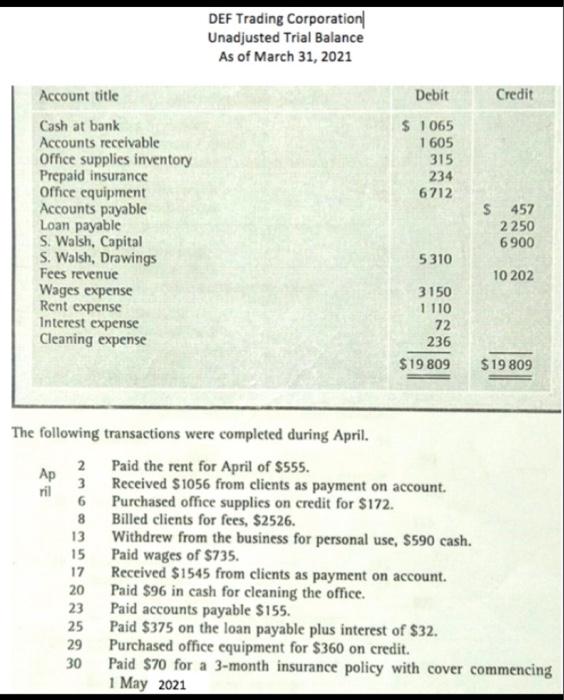

DL Trading Corporation Unahisted Trial Balance As of March 31, 2021 Cedit Debit 565 1605 115 214 6712 Acemile hun Aconserve Om wenty Prepaid omice etable Lomparable IWC With Drawing Perever Wages Best We Cleaning 457 2.250 6300 10202 1156 1110 22 236 $1909 519 109 The followings were complete Art ? Pent 1 Received to free dients sont chiedi sport for 5172 #ce With from the lines for the 13 it on the ban mayable plan interest 832 23 Puchaffent for 100 m finne policy with ever coming 1 May 2008 Required identify the ves of the accounts DEF Corporation for its Balance Sheets of Apr 3.221 and the income Statement for the month ended Apr 2021 Note that the values of the different counts in the industed Trail Blance will te beginning twice that we account for the month of April please find the following show solutions pls: - Cash at bank - Accounts receivable - Supplies inventory - Prepaid insurance - Office equipment - Accounts payable - Loan payable - S. Walsh, capital - S. Walsh, drawing -Service revenue -Wages expense -Rent expense -Interest expense -Cleaning expense -Total debit amount of the Unadjusted Trial Balance as of April 30, 2021 -Total current assets -Total assets -Total liabilities -Net Income or Net Loss -Total Proprietorship Required: Identify the values of the accounts of DEF Corporation for its Balance Sheet as of April 30, 2021 and the Income Statement for the month ended April 30, 2021. Note that the values of the different accounts in the Unadjusted Trial Balance will be their beginning balances in their respective t-accounts for the month of April. DEF Trading Corporation Unadjusted Trial Balance As of March 31, 2021 Credit Debit $ 1065 1605 315 234 6712 Account title Cash at bank Accounts receivable Office supplies inventory Prepaid insurance Office equipment Accounts payable Loan payable S. Walsh, Capital S. Walsh, Drawings Fees revenue Wages expense Rent expense Interest expense Cleaning expense $ 457 2250 6 900 5310 10 202 3150 1 110 72 236 $19 809 $19 809 The following transactions were completed during April. 2 Paid the rent for April of $555. Ap 3 Received $1056 from clients as payment on account. 6 Purchased office supplies on credit for $172. 8 Billed clients for fees, $2526. 13 Withdrew from the business for personal use, $590 cash. 15 Paid wages of $735. 17 Received $1545 from clients as payment on account. 20 Paid $96 in cash for cleaning the office. 23 Paid accounts payable $155. 25 Paid $375 on the loan payable plus interest of $32. 29 Purchased office equipment for $360 on credit. 30 Paid $70 for a 3-month insurance policy with cover commencing 1 May 2021