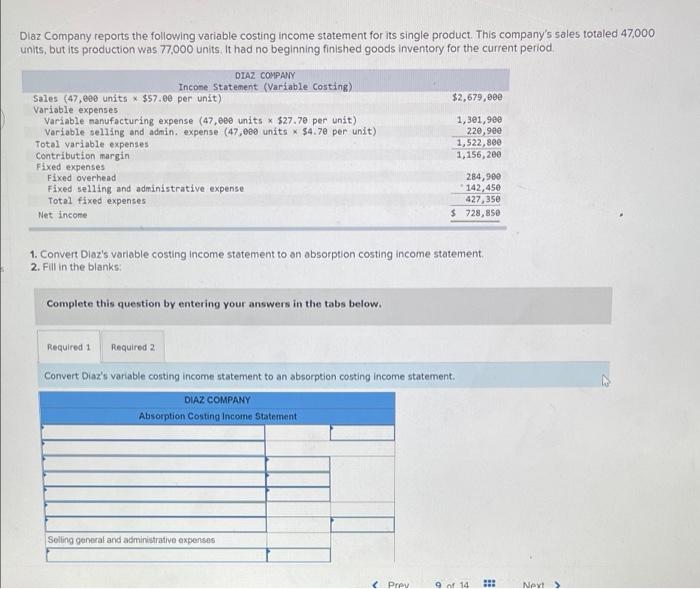

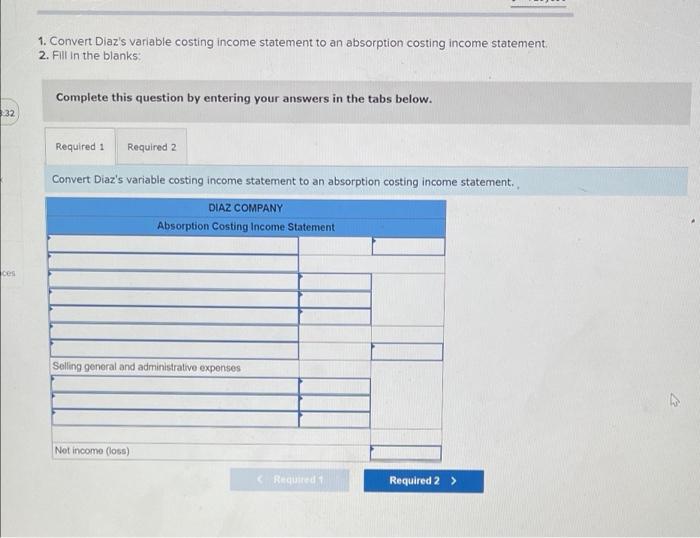

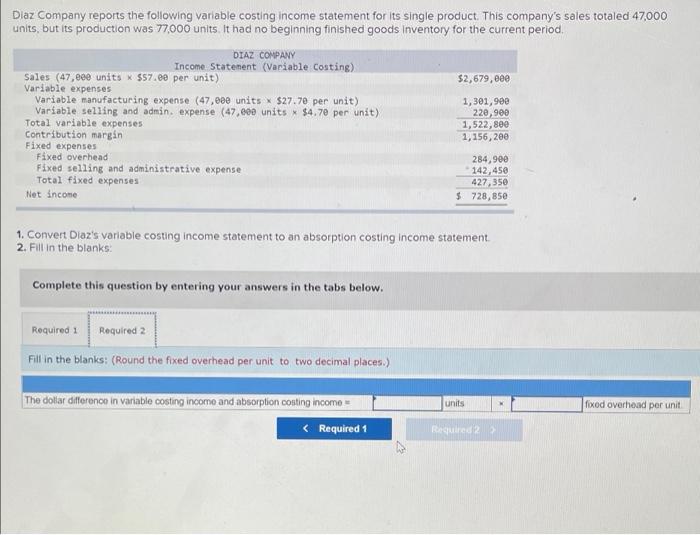

Dlaz Company reports the following variable costing income statement for its single product. This company's sales totaled 47,000 units, but its production was 77,000 units It had no beginning finished goods inventory for the current period DIAZ COMPANY Income Statement (Variable Costing) Sales (47,880 units * $57.ee per unit) $2,679,888 Variable expenses Variable nanufacturing expense (47,800 units * $27.70 per unit) 1,301,900 Variable selling and admin. expense (47,000 units X $4.78 per unit) 220,900 Total variable expenses 1,522,8ee Contribution margin 1,156,200 Fixed expenses Fixed overhead 284,900 Fixed selling and administrative expense 142, 45e Total fixed expenses 427,350 Net income $ 728,850 1. Convert Diaz's variable costing Income statement to an absorption costing income statement 2. Fill in the blanks Complete this question by entering your answers in the tabs below. Required: Required 2 Convert Diaz's variable costing income statement to an absorption costing Income statement. DIAZ COMPANY Absorption Costing Income Statement Selling general and administrative expenses Diaz Company reports the following variable costing income statement for its single product. This company's sales totaled 47,000 units, but its production was 77,000 units. It had no beginning finished goods inventory for the current period. DIAZ COMPANY Income Statement (Variable Costing) Sales (47,000 units * $57.ee per unit) $2,679, eee Variable expenses Variable manufacturing expense (47,eee units $27.70 per unit) 1,301,900 Variable selling and admin. expense (47.600 units $4.70 per unit) 220, 900 Total variable expenses 1,522,800 Contribution margin 1,156,2ee Fixed expenses Fixed overhead 284,900 Fixed selling and administrative expense 142,450 Total fixed expenses 427,350 Net income $728,85e 1. Convert Diaz's variable costing income statement to an absorption costing Income statement 2. Fill in the blanks Complete this question by entering your answers in the tabs below. Required 1 Required 2 Fill in the blanks: (Round the fixed overhead per unit to two decimal places.) units food overhead per unit The dollar difference in variable costing income and absorption costing incomo