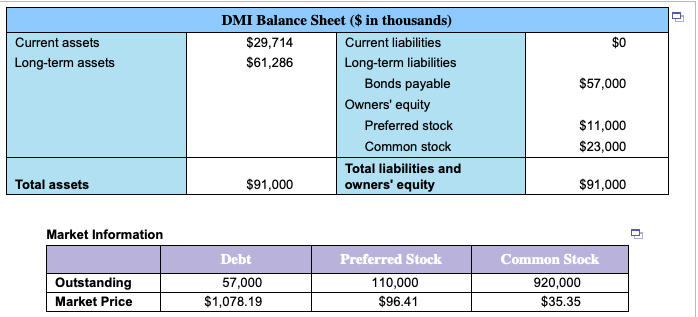

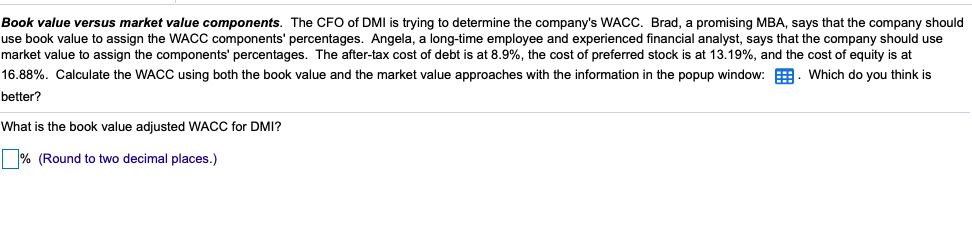

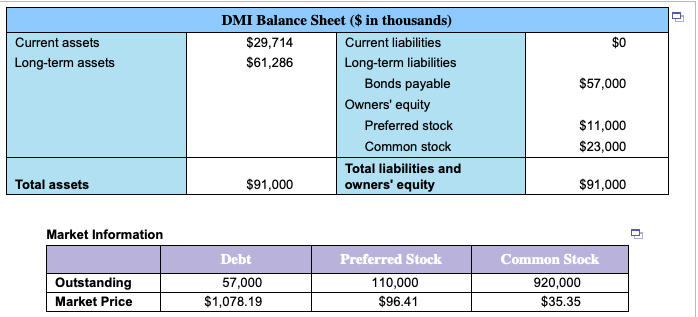

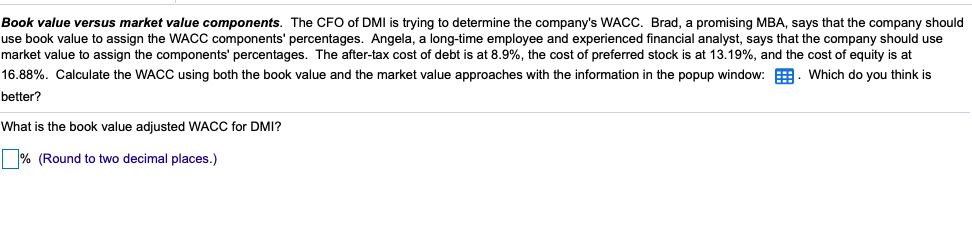

DMI Balance Sheet ($ in thousands) Current assets $29,714 $61,286 Current liabilities $0 Long-term assets Long-term liabiliies Bonds payable Owners' equity $57,000 Preferred stock $11,000 $23,000 Common stock Total liabilities and owners' equity Total assets 91,000 91,000 Market Information Debt Preferred Stock 110,000 $96.41 Common Stock Outstanding Market Price 920,000 $35.35 57,000 $1,078.19 Book value versus market value components. The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 8.9%, the cost of preferred stock is at 13.19%, and the cost of equity is at 16.88%. Calculate the WACC using both the book value and the market value approaches with the information in the popup window:. which do you think is better? WACC using boththok ale ar8.9%, the What is the book value adjusted ACC for DMI? % (Round to two decimal places.) DMI Balance Sheet ($ in thousands) Current assets $29,714 $61,286 Current liabilities $0 Long-term assets Long-term liabiliies Bonds payable Owners' equity $57,000 Preferred stock $11,000 $23,000 Common stock Total liabilities and owners' equity Total assets 91,000 91,000 Market Information Debt Preferred Stock 110,000 $96.41 Common Stock Outstanding Market Price 920,000 $35.35 57,000 $1,078.19 Book value versus market value components. The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 8.9%, the cost of preferred stock is at 13.19%, and the cost of equity is at 16.88%. Calculate the WACC using both the book value and the market value approaches with the information in the popup window:. which do you think is better? WACC using boththok ale ar8.9%, the What is the book value adjusted ACC for DMI? % (Round to two decimal places.)